Compare young driver car insurance quotes

Get a quote in minutes and see what you could save with a cheap young driver insurance deal.

How to compare young driver car insurance

Enter your details

Get personalised quotes in minutes by providing a few car and young driver details.

Compare quotes

Find the right young driver car insurance for you by exploring our best deals.

Start saving

Start saving money and apply with your chosen provider.

What is young driver insurance?

Young driver insurance is a type of policy which is aimed specifically at younger people aged under 25 to help them with the costs of cover. This type of young person car insurance cover can help these drivers who typically pay the highest sums for insurance. It works in the same way as car insurance for older drivers but often comes with cost-cutting features. These include telematics technology to help drivers lower their costs if they can show their insurer they are driving consistently well and they keep their mileage down.

Author Ben Gallizzi Last updated Feburary 5th 2024

Is young driver insurance right for you?

It’s important to buy the correct car insurance. Young driver insurance might be the best option for you if you:

Leoni Moninska, Insurances ExpertCar insurance for young drivers can be expensive because younger, inexperienced drivers are considered to have a higher risk profile. It can be tempting to go for less comprehensive cover to keep costs down, but it's usually safer and sometimes cheaper to get fully comprehensive insurance. And remember, every year you drive without incident or making a claim, your premiums should come down.”

How can I get a young driver car insurance quote?

It’s quick, easy and straightforward to get a range of young driver insurance quotes. As the insurance market is so competitive, one of the best ways to keep your costs down is to compare prices. That’s because prices can vary considerably between policies and insurers.

To get a quote you’ll need to enter some personal details, such as your job and address, and also some information about your car. You will then be given a list of quotes allowing you to see the overall price and what’s included in each policy before you make a final decision.

See all car insurance providers we work with at Uswitch and compare today.

Is young driver insurance not right for you?

Find alternative types of cover that might be more suited to your needs.

How much is young drivers insurance?

The cost of young drivers insurance can vary depending on a range of factors. The biggest impact will be how long it has been since the driver has passed their test and received their full UK driving license.

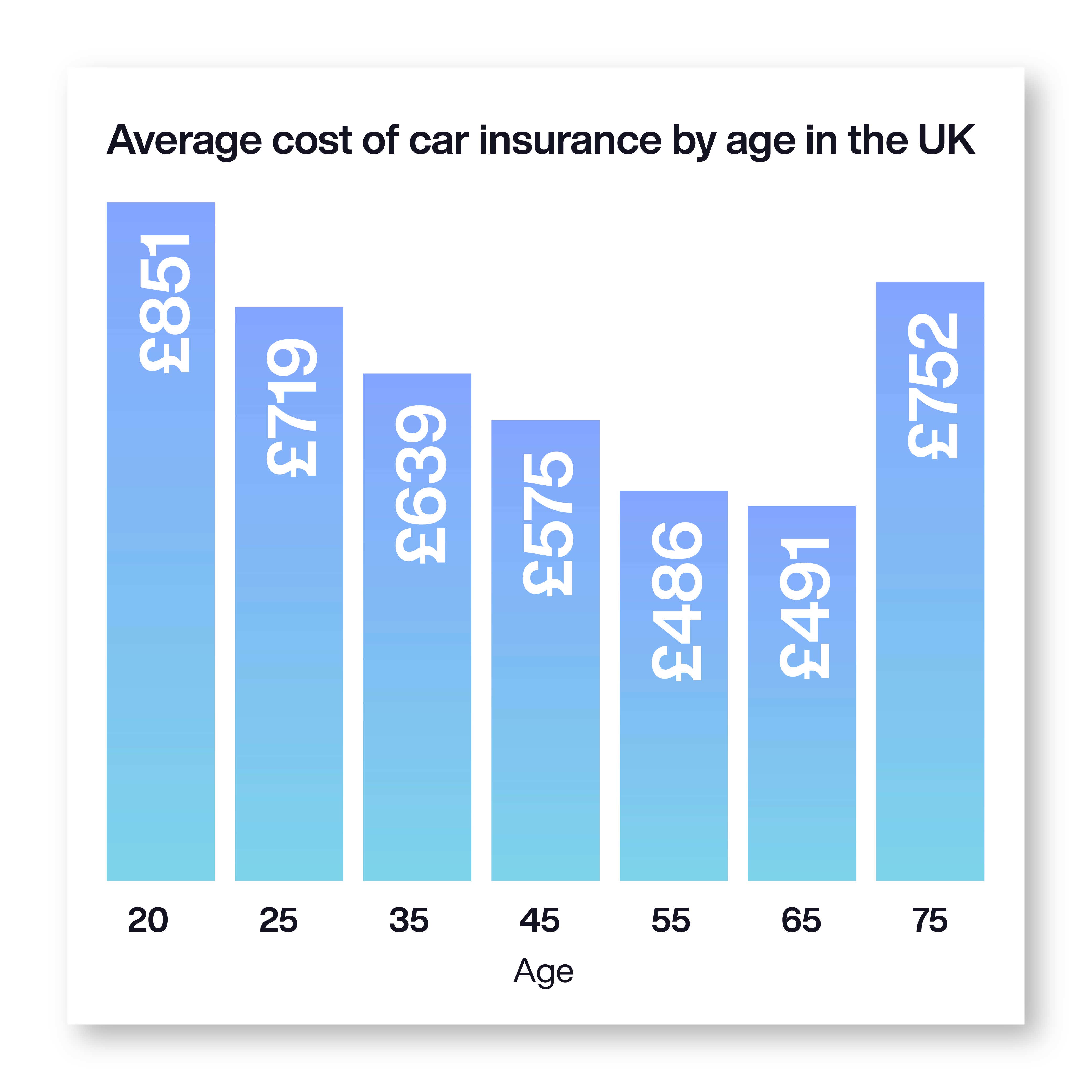

Young drivers between the ages of 17-19 are most affected by high insurance costs, due to the potential inexperience and high risk driving. From the age of 18 the average cost starts coming down year on year as seen in the graph to the left.

Age 17: Average cost of car insurance: £1,612.

Age 18: Average cost of car insurance: £1,845.

Age 19: Average cost of car insurance: £1,709.

How can I get cheaper car insurance as a young driver?

Cheap car insurance for young drivers may seem impossible yet there are ways to lower your costs. Despite young drivers paying the highest fees, there are many simple tips and tricks to make car insurance cheaper.

These include:

Lowering your annual mileage

Keeping your car in a safe and secure spot overnight

Increasing the amount you pay for an excess if you need to make a claim

Adding a second driver to your policy

The type of car you drive also matters, picking a small, cheap, car could be far less to insure than an expensive top-of-the-range model.

Cars are rated on how quickly the car accelerates and its top speed.

They are also rated depending on the value of the car as new, the security features it has, how long it will take to fix if it is damaged in a standard accident and how much the individual parts cost.

Check out our guide on the cheapest cars to insure to learn more.

Data from Confused.com 31/05/23

What are the cheapest cars to insure in 2023 - Uswitch

The type of car you drive affects the cost of your car insurance. Find the cheapest car insurance groups and the cheapest cars to insure in 2023 here.

Learn more

Adding a named driver: secondary car insurance - Uswitch

Are there any advantages to adding another driver to your car insurance policy? How easy is it? Could it help bring down the cost of your car insurance premiums? Find out in our guide.

Learn more

Car Insurance Excess Explained | Voluntary and Compulsory

Everything you need to know about car insurance excess. What are the differences between voluntary and compulsory excess, and which is right for you.

Learn more

How to add a learner driver to car insurance - Uswitch

Find out how to add a learner driver to your existing car insurance policy, what it might cost and more in our guide.

Learn more

What are the cheapest and best first cars for new drivers? - Uswitch

Once you've passed your driving test, you'll need a car - but what are the cheapest and best first cars for new drivers? Find out how to make your decision here.

Learn more

Pay-as-you-go car insurance - Uswitch

If you drive only a few miles during the year annual car insurance can seem unfairly expensive. Pay-by-the-mile car insurance can be a cheaper alternative.

Learn more‡Car Insurance comparison is powered by Confused.com which is a trading name of Inspop.com Limited who are authorised and regulated by the Financial Conduct Authority. Registered office; Greyfriars House, Greyfriars Road, Cardiff, CF10 3AL, registered in England and Wales 03857130. Please note, we cannot be held responsible for the content of external websites and by using the links stated to access these separate websites you will be subject to the terms of use applying to those sites. By using this system you are also agreeing to our Terms and Conditions and Privacy Policy. Uswitch is an intermediary and receives a percentage of the commission if you decide to buy through us. If you already hold an account with Confused.com, the information held for you will be available to help you complete your quote more quickly - you should check the information is still accurate and up-to-date.