So many ways to save

See what you could save by comparing deals today

Looking for something else?

Your shortcut to smarter switching

Choosing your next broadband and mobile provider just got easier. Make sense of the market fast with our Uswitch Telecoms Awards winners for 2024.

Don't settle for less with your switch

You want a supplier to cover all your needs. We'll help you find the best fit.

Join the millions who have already switched.

More people come to us to find their energy, broadband and mobile than any other site.

Why Choose Uswitch?

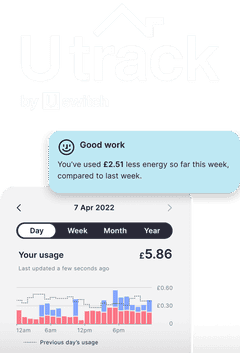

Easy switching

You want a hassle-free switch. Our simple process takes minutes to complete.

Expert guidance

You want to make the right decision. Our customer care team is here to help.

Exclusive deals

You want the perfect deal. We offer deals you can't get anywhere else.