Fear of overdraft rejection prevents two thirds of consumers from switching their current account

Almost two thirds (63%) of current account holders are in the dark about whether they can switch banks if they’re overdrawn [1]

Over a third (34%) of people are reliant on their overdraft to make it through the month [2] – and one in eight (13%) are never in credit [3]

On average, Brits are overdrawn by £266 every month, and families are even more dependant on their overdrafts, finding themselves nearly £400 in debt every month [4]

Despite overdrafts being essential for many people, 14% of consumers switching accounts are given a smaller overdraft and face a possible financial shortfall [6]

Uswitch is calling on Bacs to change the Current Account Switch Service so customers are told the overdraft they will receive before making the decision to switch account.

Despite a push from the Current Account Switch Service (CASS) to encourage more people to switch, two thirds of current account holders are in the dark about whether they can do so if they are overdrawn[1]. That’s according to research from Uswitch.com, the price comparison site and switching service.

Seven out of ten UK current account customers have access to an arranged overdraft[7] and on average go overdrawn by £266 every month[4]. And a third (35%) of people are heavily reliant on their authorised overdraft to get through the month, including 13% being permanently overdrawn and a further 5% falling back into debt almost immediately after being paid[3].

Families with children face a more challenging financial situation, as they are especially reliant on their overdraft. The research showed that nearly a quarter (23%) say they are permanently overdrawn or almost immediately after payday slip back into their overdraft[5]. On average, families are almost £400 into the red at the end of each month[4] – and with authorised overdrafts fees at the main high street banks reaching up to 20% Equivalent Annual Rate (EAR), on top of any other charges, each family could be paying out nearly £150 every year just for using their authorised overdrafts[8].

Despite many customers being dependent on their overdrafts, when it comes to switching it is not possible to find out if they will be offered an overdraft with their new account before they switch. This lack of clarity has left one in seven (14%) current account holders high and dry with a lower arranged overdraft[6].

This lower limit can have severe consequences for those regularly using their overdrafts – with 30% of people saying they would be unable to pay essential bills or meet unexpected costs and 15% admitting they would turn to credit cards to make up the shortfall[9].

The Competition and Markets Authority (CMA) has already said that overdraft users are less likely to switch account than other customers and that the heaviest overdraft users stand to save up to £260 by switching to a different provider[10]. So ahead of the CMA’s retail banking report next month, Uswitch is calling on Bacs to ensure CASS gives customers clear information about their arranged overdraft before they commit to switching.

Tashema Jackson, money expert at Uswitch.com said, “Millions rely on their overdraft every month just to make ends meet. Yet they’re not only being stung by high charges and fees, but many also feel like they’re not eligible to switch to a better deal. With some accounts charging nearly three times more than others for an arranged overdraft, customers should be able to simply compare all the options so they’re not paying over the odds.

“While the CMA has said it will take a tough stance on capping unarranged overdraft fees, it’s doing little to help overdraft prisoners who feel trapped and unable to switch. We’re calling on the banks to assure people that if they do switch their current account, they won’t be left high and dry by an overdraft that doesn’t meet their needs.”

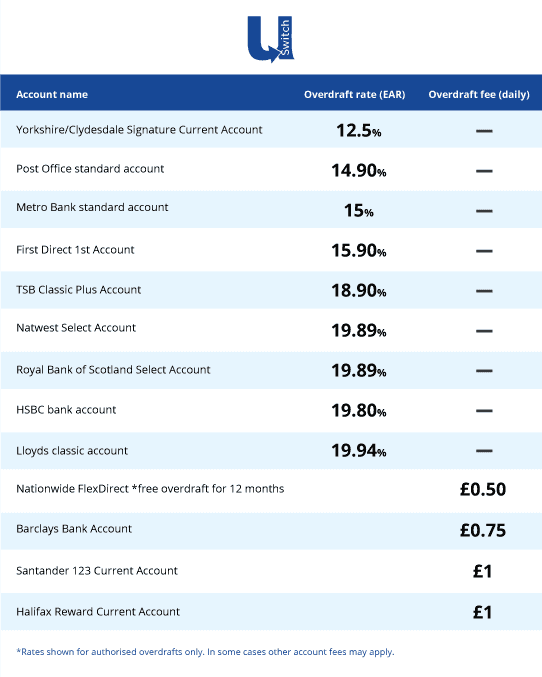

Standard current account overdraft charges for the major high street bank

Find out how you could save over £1,000 a year with Uswitch here.

FOR MORE INFORMATION

Rory Stoves

Phone: 020 3872 5613

Email: rory.stoves@uswitch.com

Twitter: @UswitchPR

Notes to editors

When asked “Do you agree with the following statement ‘It is not possible to switch bank accounts if you are using an authorised overdraft’, 14.8% said ‘yes’ and 48.1% said ‘Don’t know’. 14.8 + 48.1 = 62.9%.

When asked ‘Which of the following statements best describes the way you use your overdraft facility’, 13.1% said ‘I am never out of my overdraft’, 4.5% said ‘I am ‘in the red’ almost immediately after I am paid.’, 7.9% said ‘I dip into my overdraft between one and two weeks after I am paid’ and 9.3% said ‘I dip into my overdraft between two and four weeks after I am paid’ 13.1% + 4.5% + 7.9% + 9.3% = 34.7%.

When asked ‘Which of the following statements best describes the way you use your overdraft facility’, 13.1% said ‘I am never out of my overdraft’

When asked ‘How far into your overdraft do you go every month?’, the average amount was £266.25. For families with children, the average amount was £394.40.

When asked ‘Which of the following statements best describes the way you use your overdraft facility? 16.1% said ‘I am never out of my overdraft’ and 6.9% said ‘I am ‘in the red’ almost immediately after I am paid’. 16.1% + 6.9% = 23%.

When asked ‘Have you switched your bank account in the past three years’, 20.7% said ‘yes’. Those who replied ‘yes’ were asked ‘When you switched current account, did you receive the same authorised overdraft limit as your previous account?’ 14.3% said ‘No, I was given less than my previous account’

When asked ‘Do you have access to an authorised overdraft with any of your current accounts?’, 69.6% said ‘yes’.

Lloyds Classic account charges an Equivalent Annual Rate (EAR) of 19.94% plus a monthly usage fee of £6 on any overdraft over £25. An average overdraft debt of £394.4 at 19.94% = £6.14 + £6 monthly usage fee = £12.14. £12.14 x 12 months of the year = £145.68

When asked ‘What would be the consequences if you lost access to your overdraft?’, 16% said ‘I would be unable to pay essential bills’ and 13.9% said ‘I would not be able to pay for any unexpected costs e.g. broken boiler, new washing machine, car repair’. 16 + 13.9 = 29.9%. 15.2% said ‘I would use a credit card to make up the shortfall.’

https://www.gov.uk/government/news/cma-proposes-better-deal-for-bank-customers

About us

It’s all about “U”!

Thank you for indulging us over the last 20 years by using a small ‘u’ and a big ‘S’ when writing about our brand in your articles.

We are delighted to let you know that you are now off the hook - it’s big U’s all the way (and small s’s) as we undertake our biggest ever rebrand - so let your autocorrect go wild!

About Uswitch

Uswitch is the UK’s top comparison website for home services switching. Launched in September 2000, we help consumers save money on their gas, electricity, broadband, mobile, TV, and financial services products and get more of what matters to them. Last year we saved consumers over £373 million on their energy bills alone.

Uswitch is part of RVU, a new business that also owns Money.co.uk and Bankrate.

If you would no longer like to receive our press releases please email prteam@uswitch.com with 'unsubscribe'.