10 years on from Northern Rock, households continue to struggle as bills rise ten times faster than income

Essential bills soar by 20% in a decade – ten times faster than household income at 2%****

Real household disposable income falls by 33% since 2007****

Increase in gas (59%), electricity (42%) and water (27%) bills fuelling the rise****

Households spend nearly a quarter (23%) more on rent than they did in 2007****

A third (37%) of consumers feel they have less disposable income than they did 10 years ago****

British consumers have an average of £171 left at the end of the month after paying for their essentials – but one in ten (**12%) have nothing at all left**

Uswitch.com is calling on households to make sure they are not paying more than they need to on their essential bills.

A decade on from the financial crisis and the infamous collapse of Northern Rock, consumers are again feeling the effects of a turbulent financial landscape across Britain, with a third (37%) saying they have less disposable income than they did 10 years ago.

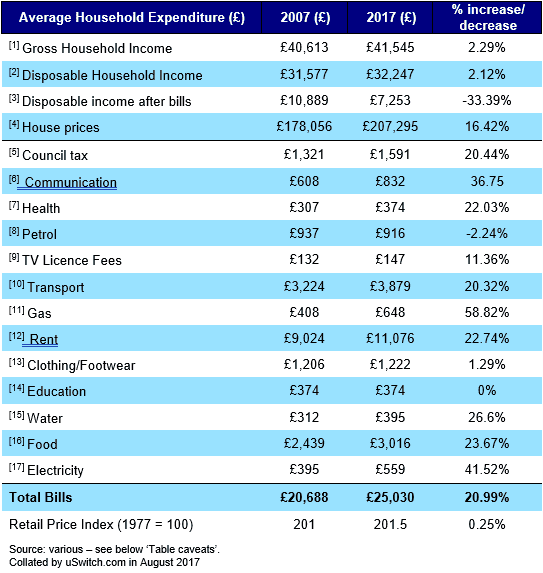

Comparing a range of household expenses from 2007 to today’s figures, research by Uswitch.com, the price comparison and switching service, found that despite household income increasing by over 2% over the ten-year period, disposable income after bills is down by a shocking 33%, from £10,889 in 2007 to £7,253 today.

This dramatic fall in quality of life is mainly due to a 20% rise in all household costs. The key culprits are utility bills, which have seen a staggering increase over the last decade. Gas bills have shot up by 58% over the course of the decade, while electricity and water costs have increased by 42% and 27%, respectively .

With the average utility bill per household totalling £1,602 per year versus £1,115 in 2007, it’s no wonder that 16% of those questioned said these bills are the hardest costs to find money for each month. On top of this, council tax adds more pressure for households too, having shown an average rise of over 20% across the decade for every home.

However, it’s not only bills that are contributing to the mounting crisis: households are spending almost 25% more of their income on rent per year, while the cost of feeding a family or a household has also increased by a quarter (24%). It’s the focus on such essentials that is causing British households to tighten their belts, with recent Office for National Statistics data showing that consumer spending is growing at the weakest rate in almost three years.

This difficulty in keeping up with the cost of living is also reflected in the fact that British consumers are increasingly relying on credit and struggling with debt. Recent data from the Bank of England showed that Britons are accumulating debt at almost five times the growth rate of earnings, with total unsecured borrowing at its highest rate since December 2008 at £201.5bn . Indeed the research shows that almost 16% of Britons’ income after essential costs goes towards paying off credit cards and personal loans.

Tom Lyon, money expert at Uswitch.com, says: “Ten years since the Northern Rock crisis and homes are still feeling the squeeze. The cost of running a household has climbed 20% against a meagre 2% increase in income. With one in ten of us barely breaking even at the end of the month, it’s easy to see how homes are being plunged into debt simply trying to make ends meet.

“An almost 10% reduction in disposable income is life-changing for many families and shows how crucial it is that financial planning is a priority for everyone.

“In spite of the uncertainty, you can take control of your own finances and check whether you’re getting the best value for money on all your bills and any debt you have. Don’t pay more than you need to – switching your supplier could save you over £1,000, which could make a vital contribution to keep your family finances afloat.”

Find out how you could save over £1,000 a year with Uswitch here.

FOR MORE INFORMATION

Rory Stoves

Phone: 020 3872 5613

Email: rory.stoves@uswitch.com

Twitter: @UswitchPR

Notes to editors

Notes to editors Research referred to was conducted by Opinium from 29th August to 31st August 2017 among 2,005 UK adults

According to data from the Office for National Statistics, the national archive, Gov.UK, Hometrack, BBC, TV licensing, Ofwat and Water UK there has been an increase of 20% in total household bills between 2007-2017. Household disposable income increase of 2% calculated by comparing 2007 and 2017 figures, as seen in the table in the body of the release. All sources are listed below in the ‘table caveats’ section.

Calculation based on a comparison of disposable income after bills in 2007 and 2017. In 2007, this was £10,889. In 2017 this had fallen to £7,253. £10,889 - £7,253 = £3,636. £3,636 / £10,889 = 0.334. 0.334 x 100 = 33.4%

According to official data from Government and Water UK gas, water and electricity

According to Hometrack Rental Index and Hometrack House Price Index

When asked, ‘Compared to ten years ago (2007), do you feel that you have more or less disposable income at the end of the month?’ 37% of respondents selected ‘Less’

When asked, ‘On average, how much money do you have left at the end of the month once you have paid all your essential bills and expenditure including rent/mortgage and food?’ the mean figure for all respondents was £170.85. 12% of respondents selected ‘£0 a month’

When asked, ‘Compared to ten years ago (2007), do you feel that you have more or less disposable income at the end of the month?’ 37% of respondents selected ‘Less’

According to ONS data, household bills in 2007 totalled £20,688. In 2017 ONS data showed that this had increased to £25,030. £25,030 - £20,688 = £4,342. £4,342 / £20,688 = 0.209. 0.209 x100 = 20.9%

According to official data from Government and Water UK gas, water and electricity

Utilities bill calculated by adding up the gas, water and electricity bill cost seen in 2007 and in 2017. Please see the table in the main body of the release for the list of these costs, and their sources below. When asked ‘Which of the following household expenditures do you find hardest to find the money for each month?’ 16% of respondents said ‘Essential household bills e.g. electricity/water/gas/council tax/internet’

According to ‘Live tables on Council Tax’ Band D average from gov.uk

Rent increase according to Hometrack Rental Index. Food price increase according to Office for National Statistics data

According to data from the Office for National Statistics

When asked ‘Once you have paid all your essential bills and expenditure including rent/mortgage and food, approximately what percentage of your disposable income do you spend on the following?’ 11.58% of respondents selected ‘I use it to pay off my credit card’ and 4.28% selected ‘I use it to pay off other personal loans’. 11.58 + 4.28 = 15.86%

Table Caveats

According to data from The National Archives fig. 4 and Office for National Statistics fig. 3

According to data from the Office for National Statistics Nowcasting household income in the UK

Disposable income after bills calculated ‘Gross Household Income’ minus ‘Disposable Household Income’

According to Hometrack House Price Index

According to ‘Live tables on Council Tax’ Band D average from gov.uk

2007 figures according to the Office for National Statistics Family Spending Survey 2007 – table 3.2E. 2017 figures according to Office for National Statistics Living Costs and Food Survey technical report March 2017 – table 7.1

2007 figures according to the Office for National Statistics Family Spending Survey 2007 – table 3.2E. 2017 figures according to Office for National Statistics Living Costs and Food Survey technical report March 2017 – table 7.1

According to ‘Vehicle mileage and occupancy’ statistical data from gov.uk and Petrolprices.com taking the average mileage from the government data and multiplying it by the average price of unleaded petrol from the petrolprices.com data

According to BBC Annual Report and Accounts 2006/2007 and tvlicencing.co.uk

2007 figures according to the Office for National Statistics Family Spending Survey 2007 – table 3.2. 2017 figures according to Office for National Statistics Living Costs and Food Survey technical report March 2017 – table 7.1

According to ‘Annual domestic energy bills’ statistics for households paying by direct debit from gov.uk report QEP 2.3.1 and table 2.3.1 (st).

According to Hometrack Rental Index

2007 figures according to the Office for National Statistics Family Spending Survey 2007 – table 3.2E. 2017 figures according to Office for National Statistics Living Costs and Food Survey technical report March 2017 – table 7.1

2007 figures according to the Office for National Statistics Family Spending Survey 2007 – table 3.2E. 2017 figures according to Office for National Statistics Living Costs and Food Survey technical report March 2017 – table 7.1

2007 figure according to Ofwat data. 2017 figure according to Water UK data

2007 figures according to the Office for National Statistics Family Spending Survey 2007 – table 3.2E. 2017 figures according to Office for National Statistics Living Costs and Food Survey technical report March 2017 – table 7.1

According to ‘Annual domestic energy bills’ statistics for consumers paying by direct debit from gov.uk report QEP 2.2.1 and table 2.2.1 (st).

About us

It’s all about “U”!

Thank you for indulging us over the last 20 years by using a small ‘u’ and a big ‘S’ when writing about our brand in your articles.

We are delighted to let you know that you are now off the hook - it’s big U’s all the way (and small s’s) as we undertake our biggest ever rebrand - so let your autocorrect go wild!

About Uswitch

Uswitch is the UK’s top comparison website for home services switching. Launched in September 2000, we help consumers save money on their gas, electricity, broadband, mobile, TV, and financial services products and get more of what matters to them. Last year we saved consumers over £373 million on their energy bills alone.

Uswitch is part of RVU, a new business that also owns Money.co.uk and Bankrate.

If you would no longer like to receive our press releases please email prteam@uswitch.com with 'unsubscribe'.