Loyal Brits missing out on car insurance savings of £1.7 billion a year

Motorists could save over £1.7 billion a year by switching to a black box car insurance policy, but only 5% of UK drivers currently have one

The top barriers to installing a black box are concerns about an insurer tracking their movements (49%), loyalty to their current insurance provider (43%) and not wanting to pay to have a black box fitted (28%)

Although over half (54%) of drivers recognise that they could save money by switching to a black box policy, 47% say they wouldn’t consider it

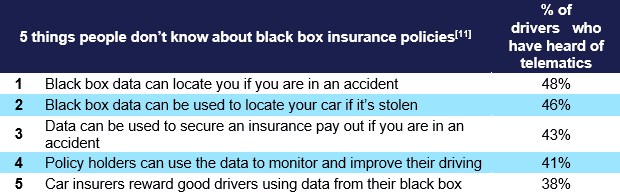

Almost half of drivers don’t know that black box data can track your car if it’s stolen (46%)

Young drivers are the trailblazers with almost a quarter (23%) already using black box technology

Uswitch.com is calling on drivers to consider using new technology to help drive down the cost of their premiums.

British drivers could save up to £1.7 billion a year by switching to a telematics ‘black box’ insurance policy, according to new research from Uswitch.com, the price comparison and switching service. With the average car insurance policy now at an all-time high of £690 a year, careful drivers could save up to £145, and young drivers could save even more – up to £372 a year .

Car insurance premiums are currently increasing at five times the rate of inflation and savvy British motorists are always on the lookout for better deals, with 93% comparing car insurance policies before renewing or switching. Yet, despite over half of policy holders (54%) believing telematics options are cheaper, only 5% have taken out a black box policy.

A third (36%) of drivers who have switched to a black box policy found that the cost of their car insurance has decreased, with careful drivers able to save up to 21% by using a black box. But despite this, almost half (47%) of British motorists who don’t have a black box say they wouldn’t consider taking out a telematics policy.

The top barriers to switching are concerns about being tracked when driving (49%), loyalty to their current insurance provider (43%) and not wanting to pay to have a black box fitted (28%).

Indeed, the research shows that motorists who aren’t currently using a black box or telematics policy say they would have to save over £85 to consider installing a black box. However, with policy cost reductions of up to £145 possible with black box technology, many drivers seem unaware of the actual savings available to them.

As well as the potential savings on offer, UK motorists are also often overlooking the additional benefits of such policies. Almost half of UK drivers (46%) don’t know that black box data can track your car if it’s stolen, 48% aren’t aware that it can locate you if you are in an accident, and 38% don’t know that black box insurers offer rewards to good drivers. Astonishingly, over a quarter (27%) wrongly think that everyone who has a black box policy is subject to a curfew and can only drive at certain times.

Source: Uswitch.com research August 2017

Young drivers are the most likely to feel comfortable with black box insurance, with almost a quarter (23%) having already switched compared to only 2% of over 55s.

Rod Jones, insurance expert at Uswitch.com, says: “The savvy British public are always looking for ways to save a few extra pounds on their bills. This is especially in car insurance where costs have soared by a fifth in the last year.

“With savings of up to £145 on offer when installing a black box and the added benefits that this technology brings when it comes to safety and theft, we’re encouraging drivers to take time to research black box policies and see if the new technology could help drive down the cost of their policy. The money saved could instead be put towards essential car maintenance or paying off other household debts.”

Find out how you could save over £1,000 a year with Uswitch here.

FOR MORE INFORMATION

Rory Stoves

Phone: 020 3872 5613

Email: rory.stoves@uswitch.com

Twitter: @UswitchPR

Notes to editors

Notes to editors All research referred to was conducted by Opinium from 10th August to 14th August 2017 among 2,010 UK adults.

Calculated because, according to the latest AA British Insurance Premium Report, the average motor insurance policy in the UK costs £690. Ingenie found that careful drivers can save up to 21% on their car insurance using a black box policy. 21% of £690 equals £144.90 (average saving that could be made on a safe driver’s policy). When asked ‘How long have you had a car / vehicle insurance policy?’ 7% of respondents with a driving license selected ‘less than 1 year’, 6% selected ‘up to 2 years’, 9% selected ‘up to 4 years’, 4% selected ‘up to 7 years’, 61% selected ‘more than 7 years’. This means that 87% of UK drivers have a car insurance policy in their name. There are 39,974,283 full driving licences in the UK according to DVLA. That means that there are 34,777,626 car insurance policies. If there are 34,777,626 policies in the UK, and 95% (When asked: ‘Before today, had you heard of black box / telematic insurance policies before?’ 5% of respondents with a driving license selected ‘I have a telematics or black box car insurance policy; meaning that 95% of respondents with a driving license do not.) 95% of 34,777,626 car insurance policies is 33,038,744, meaning this is the number of non-telematic car insurance policies in the UK. When those who selected that they have a telematic policy were asked: ‘Which of the following is most accurate regarding you having a black box and the effect it’s had on your renewal premium?’ 36% selected ‘The cost of my car insurance has decreased since using a black box’. These are the ‘safe’ drivers. 36% of 33,038,744 is 11,893,947. If 36% of all drivers could save money on their policy, this means approximately £144.90 could be saved on 11,893,947 policies, equalling = £1.723bn overall

When respondents who would not consider telematics / black box were asked ‘You said you would not take out a telematics or black box car insurance policies. Is this for any of the following reasons?’ 49% selected ‘I don’t want my car insurer tracking my movements’, 43% selected ‘I am happy with my current car insurance policy’, 28% selected ‘I don’t want to have to pay to get a black box fitted in my car’.

When asked to select whether they thought that the statement: ‘Telematics or black box car policies are cheaper than normal car insurance premiums’ was true or false, 54% of respondents with a driving license selected true. When asked: ‘Before today, had you heard of black box / telematic insurance policies before?’ 37% of respondents with a driving license selected ‘I HAD heard of telematics / black box car insurance policies before today and WOULD NOT consider taking one out in future’ and 10% selected ‘I HAD NOT heard of telematics / black box car insurance policies before today and WOULD NOT consider taking one out in future’.

When respondents who have heard of telematics / black box were asked whether ‘The data can be used to track your car if it is stolen’ was true or false, 20% selected ‘Could be true or false’, 8% selected ‘probably false’, 3% selected ‘definitely false’, 15% selected ‘don’t know,’

When asked ‘Before today, had you heard of black box / telematic insurance policies before?’ 23% of respondents aged 18-24 who have a driving license selected ‘I have a telematics or black box car insurance policy’.

See caveat 1 for £144.90 saving for average UK driver. According to the latest AA British Insurance Premium Report, the average motor insurance policy for a young driver costs £1,771. Ingenie found that careful drivers can save up to 21% on their car insurance using a black box policy. A 21% (saving for careful driver) of £1,771 is £371.91.

According to the latest AA British Insurance Premium Report, the average motor insurance policy has increased in cost by 19.6% in the last year. When asked, ‘Do you shop around for a new car insurance policy every time it comes up for renewal?’ 93% of respondents with a car insurance policy in their name selected ‘Yes’.

When asked to select whether they thought that the statement: ‘Telematics or black box car policies are cheaper than normal car insurance premiums’ was true or false, 54% of respondents with a driving license selected true. When asked: ‘Before today, had you heard of black box / telematic insurance policies before?’ 5% of respondents with a driving license selected ‘I have a telematics or black box car insurance policy’

When respondents who have a black box car insurance policy were asked: ‘Which of the following is most accurate regarding you having a black box and the effect it’s had on your renewal premium?’ 36% selected ‘The cost of my car insurance has decreased since using a black box.’ Ingenie found that careful drivers can save up to 21% on their car insurance using a black box policy.

When respondents who don't have black box car insurance policy were asked, ‘How much would you have to save per year on car insurance to consider switching to a telematics / black box insurance policy?’ 12% of selected ‘up to £50 a year’, 27% selected ‘Up to £100 a year’, 15% selected ‘Up to £150 a year’, 10% selected ‘Up to £200 a year’, 12% selected ‘More than £200 a year.’ The mean result of this is: £85.09.

When respondents who have heard of telematics / black box were asked whether the statement ‘A black box can locate where you are, should you be involved in an accident’ was true or false: 25% selected ‘could be true or false’, 6% selected ‘probably false’, 2% selected ‘definitely false’, 15% selected ‘don’t know’. When respondents who have heard of telematics / black box were asked whether the statement ‘The data can be used to track your car if it is stolen’ was true or false, 20% selected ‘could be true or false’, 8% selected ‘probably false’, 3% selected ‘definitely false’, 15% selected ‘don’t know’. When respondents who have heard of telematics / black box were asked whether the statement ‘A black box policy will allow me to monitor and improve my driving’ was true or false, 23% selected ‘could be true or false’, 7% selected ‘probably false’, 2% selected ‘definitely false’, 9% selected ‘don’t know’. When respondents who have heard of telematics / black box were asked whether the statement ‘Black box insurers offer rewards for good driving’ was true or false: 20% selected ‘could be true or false’, 5% selected ‘probably false’, 3% selected ‘definitely false’, 10% selected ‘don’t know’. When respondents who have heard of telematics / black box were asked whether the statement ‘, The data can be used to help secure an insurance pay out if you have a car accident’ was true or false: 21% selected ‘could be true or false’, 6% selected ‘probably false’, 2% selected ‘definitely false’, 14% selected ‘don’t know’.

When respondents who have heard of telematics / black box were asked whether the statement ‘You are subject to a curfew if you have a telematics policy and are penalised if you drive at certain times’ was true or false, 9% selected ‘definitely true’, 18% ‘probably true’.

When asked ‘Before today, had you heard of black box / telematic insurance policies before?’ 23% of respondents aged 18-24 who have a driving license selected ‘I have a telematics or black box car insurance policy’. When asked ‘Before today, had you heard of black box / telematic insurance policies before?’ 2% of respondents with a driving license aged 55-64 selected ‘I have a telematics or black box car insurance policy’

About us

It’s all about “U”!

Thank you for indulging us over the last 20 years by using a small ‘u’ and a big ‘S’ when writing about our brand in your articles.

We are delighted to let you know that you are now off the hook - it’s big U’s all the way (and small s’s) as we undertake our biggest ever rebrand - so let your autocorrect go wild!

About Uswitch

Uswitch is the UK’s top comparison website for home services switching. Launched in September 2000, we help consumers save money on their gas, electricity, broadband, mobile, TV, and financial services products and get more of what matters to them. Last year we saved consumers over £373 million on their energy bills alone.

Uswitch is part of RVU, a new business that also owns Money.co.uk and Bankrate.

If you would no longer like to receive our press releases please email prteam@uswitch.com with 'unsubscribe'.