Three quarters of drivers mistakenly think third party insurance is always cheaper

Three quarters (72%) of drivers mistakenly believe third party cover is always cheaper than fully comprehensive policies

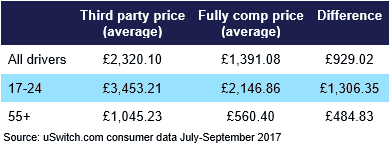

Motorists who only search for third party policies potentially over pay by £929

A third (37%) of those searching for third party cover do not search the whole market

Uswitch.com introduces new search function which allows drivers to select all types of cover, ensuring customers who search for third party policies will not miss out if a fully comprehensive policy is cheaper.

Motorists could be overpaying for their car insurance by as much as £929 by only searching for third party policies, according to the latest research from Uswitch.com, the price comparison and switching service.

Nearly three quarters (72%) of drivers mistakenly believe third party motor insurance is always cheaper than fully comprehensive cover, meaning thousands could be overpaying on their insurance policies.

Overall, a third (37%) of drivers who search for third party policies are potentially losing out because they do not search all policy types and may be paying higher premiums for less cover.

To ensure that motorists don’t lose out any longer, Uswitch.com has set up a new search function which gives drivers the option to list all car insurance cover options when running a search. By allowing drivers to view all the fully comprehensive and third party policies available in one list, they will see the cheapest cover available to them irrespective of policy type.

So far, more than half (54%) of customers who have used the new search function were able to find a cheaper policy, and on average saved £860 compared to the price they would have paid if they had only searched for a third party policy.

This saving is even more pronounced for younger drivers. Traditionally they have favoured third party policies, with the data revealing that motorists aged 17-24 are nearly five times more likely to search for third party cover only when compared to the over 55s.

However, the average third party quote for younger drivers is a staggering £3,529. The average fully comprehensive policy for those searching both policy types was over £1,400 cheaper, at £2,125.

In addition, older drivers can save nearly 50% on their premiums, by opting for fully comprehensive cover, rather than third party.

Sabrina Webb, car insurance expert at Uswitch.com, says, “Every year, drivers could be missing out on huge savings when they insure their cars, as three quarters mistakenly believe that third party cover is always cheaper than a fully comprehensive policy.

“To help motorists get the best deal on their car insurance, all customers looking for third party cover who use our new online search function will be able to see the full range of options available. This means no one needs to overpay on their car insurance.”

Find out how you could save over £1,000 a year with Uswitch here.

FOR MORE INFORMATION

Rory Stoves

Phone: 020 3872 5613

Email: rory.stoves@uswitch.com

Twitter: @UswitchPR

Notes to editors

In a survey of 10,038 consumers conducted in 2016, when asked “Which of the following motor insurance policies do you think would be most expensive?”, 72% said ‘Fully comprehensive’.

Average saving of Uswitch.com consumers who searched for both a third party and fully comprehensive policy.

com consumer data based on number of drivers searching for a third party and fully comprehensive policy in August 2017.

com customers who used the new searched function saved on average £860.

com consumer data based on number of drivers aged 17-24 and 55+ searching for a third party and fully comprehensive policy in August 2017.

com consumer data based on drivers searching for a third party and fully comprehensive policy in August 2017. Motorists aged 17-24 who searched for fully comprehensive cover received an average quote of £2,125.54. If subtracted from £3,529.30, the average quote for third party cover for this age group, this equals a saving of £1,403.76.

com consumer data based on number of drivers searching for a third party and fully comprehensive policy in August 2017. Consumers aged 55+ searching for third party only cover received an average quote of £1,087.08. When the same age group’s search included fully comprehensive cover, the average quote was £566.83.

About us

It’s all about “U”!

Thank you for indulging us over the last 20 years by using a small ‘u’ and a big ‘S’ when writing about our brand in your articles.

We are delighted to let you know that you are now off the hook - it’s big U’s all the way (and small s’s) as we undertake our biggest ever rebrand - so let your autocorrect go wild!

About Uswitch

Uswitch is the UK’s top comparison website for home services switching. Launched in September 2000, we help consumers save money on their gas, electricity, broadband, mobile, TV, and financial services products and get more of what matters to them. Last year we saved consumers over £373 million on their energy bills alone.

Uswitch is part of RVU, a new business that also owns Money.co.uk and Bankrate.

If you would no longer like to receive our press releases please email prteam@uswitch.com with 'unsubscribe'.