Brits wasting £495 each year on unused subscription services

Consumers are wasting £495 million every year on inactive subscriptions, such as TV streaming services and gym memberships****

Most of these services use a reoccurring payment system known as a continuous payment authority (CPA) to collect the monthly fee

Despite a third (33%) of consumers using these services and signing up to a CPA, nine out of ten (88%) don’t understand what one actually is****

Three in ten (29%) consumers with a CPA say money was taken out of their account when it wasn’t due and one in eight (13%) have been unfairly charged for an inactive subscription****

Uswitch.com calls on firms using continuous payment authorities to notify customers who stop using their subscription and give them the option to cancel.

More than £495 million is being wasted each year by Brits who are still paying for subscription services like online streaming services and gym memberships that they no longer use, new research from Uswitch.com, the price comparison and switching service, reveals.

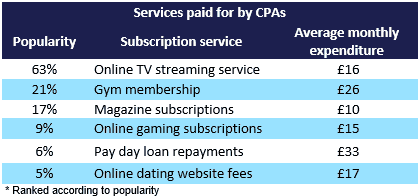

Continuous Payment Authorities (CPAs) used to pay for services such as online TV subscriptions, gym memberships, online dating websites and payday loan repayments are leaving one in eight Brits (13%) out of pocket.

Despite a third (33%) of consumers paying an average of £240 a year through a CPA, nine out of ten (88%) are unaware of what one is. Commonly used as a method of payment for subscription services on rolling contracts, a CPA differs from a direct debit as it gives a company permission to change the date and amount charged without consulting a customer beforehand.

The research found more than a quarter (29%) of consumers who paid for a service with a CPA were charged when they were not expecting to be.

One in eight (13%) current subscribers no longer use a service but are still paying for it. Of those no longer using a service paid for by a CPA, a quarter (26%) want to cancel their subscription but one in five (17%) are unsure how to do so.

Given the confusion around CPAs and with more than nine in ten consumers (92%) believing they should be notified when they stop using a subscription service, Uswitch.com is calling on providers to proactively contact their customers after a pre-defined period of inactivity and give them the option to cancel it.

Tashema Jackson, money expert at Uswitch.com, says: “It is a real concern that millions of consumers don’t know what a continuous payment authority is, despite having signed up to one. Given it is effectively the equivalent of handing over your debit or credit card to a company to use as it wishes, consumers need to be aware of what their rights are. If you are looking to cancel a continuous payment authority, notify your bank and it should do it for you immediately.

“Many companies rely on customer inertia as a source of revenue. For example, people may have been encouraged to sign up to a subscription service on a free or cheap introductory offer, which kicks in to a full subscription upon expiry. If you no longer use the service, make sure you cancel your subscription, so you aren’t stung by fees which although relatively small on their own, can total hundreds of pounds over the course of a year.

“It’s not right unfair that businesses are continuing to charge consumers when they are no longer using that service. Most subscription services, especially the online ones, can easily access usage data and if they find a user is no longer signing in, they should notify the customer and give them the option to cancel.”

Find out how you could save over £1,000 a year with Uswitch here.

FOR MORE INFORMATION

Rory Stoves

Phone: 020 3872 5613

Email: rory.stoves@uswitch.com

Twitter: @UswitchPR

Notes to editors

Research carried out online with the Uswitch.com Consumer Opinion Panel in March 2018 amongst a sample of 2,005 UK adults.

Calculation based on number of adults in the UK over 20yrs which, according to ONS, is 50 million. Subtract 2 million UK adults who don’t have bank accounts from the Financial Inclusion Commission and that leaves 48 million. When asked, ‘Do you currently have a Continuous Payment Authority (CPA)?’ 18% selected ‘Yes – I have one CPA’, 15% ‘Yes – I have more than one CPA’, totalling to 33%. This calculates to a third of adults having a CPA, totalling to 16 million British adults. When asked, ‘Thinking back to the services you have and pay for using a CPA, do you still use all of these services?’, 13% selected ‘No’. 13% of 16 million British adult totals 2,080,000. When asked, ‘How much on average are you being charged for Continuous Payment Authorities each month?’ the average across all CPAs total £20 per person per month. The calculation of 2,080,000 multiplied by £240 (average CPA cost per person per year) totals £499,200,000. This has been rounded down to £495million.

A Continuous Payment Authority (CPA) is an authorisation provided by the customer that permits a merchant to take payments from them by either debit or credit card. These payments will remain in force until the customer cancels the arrangement. To set up a CPA a customer provides their card details to the merchant – in effect handing over their card. A CPA enables the merchant to take payments from a customer’s account on dates of the merchant’s choosing, and for different amounts, without seeking any further authorisation from their customer.

When asked, ‘Out of the following payments, which of them could you explain to a friend or family member, if any?’, 11% selected ‘Continuous Payment Authorities CPA’ and When asked, ‘Do you currently have a Continuous Payment Authority (CPA)?’ 18% selected ‘Yes – I have one CPA’, 15% ‘Yes – I have more than one CPA’, totalling to 33%.

When asked, ‘Have you ever had money taken out by a firm when you didn’t think it was due?’, 29% responded ‘Yes’ and When asked, ‘Thinking back to the services you have and pay for using a CPA, do you still use all of these services?’, 13% selected ‘No’.

When asked, ‘Out of the following payments, which of them could you explain to a friend or family member, if any?’, 11% selected ‘Continuous Payment Authorities CPA’ and When asked, ‘How much on average are you being charged for Continuous Payment Authorities each month?’ the average across all CPAs total £20 per person per month.

When asked, ‘As you are no longer using the service, why have you not cancelled your CPA?’, 26% selected ‘I’ve been meaning to cancel but haven’t got around to it’ and 17% selected ‘I don’t know how to cancel it’.

When asked, ‘Do you think companies should have to notify their customers if their use of its services has lapsed, but they still have an active CPA?’, 92% selected ‘Yes’.

About us

It’s all about “U”!

Thank you for indulging us over the last 20 years by using a small ‘u’ and a big ‘S’ when writing about our brand in your articles.

We are delighted to let you know that you are now off the hook - it’s big U’s all the way (and small s’s) as we undertake our biggest ever rebrand - so let your autocorrect go wild!

About Uswitch

Uswitch is the UK’s top comparison website for home services switching. Launched in September 2000, we help consumers save money on their gas, electricity, broadband, mobile, TV, and financial services products and get more of what matters to them. Last year we saved consumers over £373 million on their energy bills alone.

Uswitch is part of RVU, a new business that also owns Money.co.uk and Bankrate.

If you would no longer like to receive our press releases please email prteam@uswitch.com with 'unsubscribe'.