Mortgage providers pushing up rates ahead of predicted base rate rise in May

Average mortgage rate has increased 0.25% since mid-March****

Rise equates to nearly £5,000 of extra interest over lifetime of the average mortgage****

Popular mortgages have seen the largest rises – first-time buyer and remortgaging rates up 0.3% and 0.2% respectively during this period****

Barclays, NatWest and TSB among those announcing rate increases in recent weeks****

Bank of England base rate is expected to rise on 10 May at the next Monetary Policy Committee meeting****.

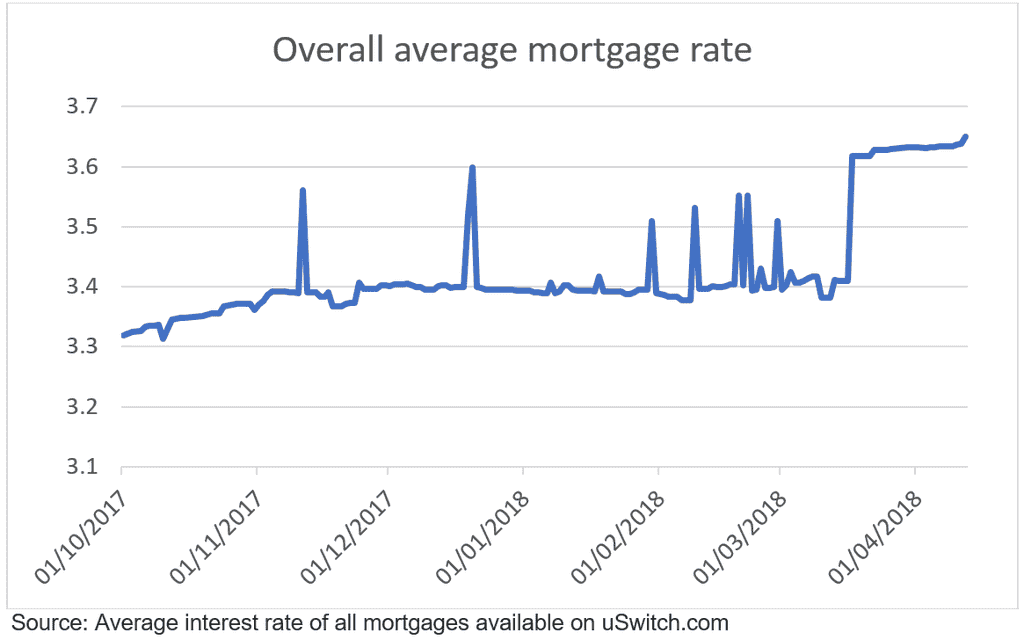

Mortgage rates have increased by an average of 0.25% since March, according to data from Uswitch.com, the price comparison and switching service. The rise equates to an extra £4,971 of interest payments on an average mortgage debt and comes well before any decision has been made by the Bank of England.

The average annual mortgage interest rate leapt to 3.65% in mid-March and has remained at this level since, going against the trend of recent years where any rate hikes reverted within a few days to their previous level.

Major lenders have been increasing their rates in March and April, including Barclays changing over 60 products in its range, including residential and help to buy, and NatWest upping their two-year fixed rates.

First time buyer mortgages have increased by 0.3% to 3.9% and average remortgaging rates are up 0.2% to 3.65%. For first time buyers this rise is equivalent to an extra £13,587 in interest payments over the lifetime of the mortgage.

With average two-year and three-year fixed rate deals increasing at a slower rate in recent weeks, it is not all bad news for those looking to fix for a short period.

Tashema Jackson, money expert at Uswitch.com, says: “Average mortgage rates have spiked at various points in the past few years, but this recent jump could be just the beginning as providers prepare for the expected base rate rise in May. Banks are saying that ‘market conditions’ are driving these rises, so we can expect others to follow suit in the coming weeks and months.

“Consumers should use this as a prompt to assess their mortgage options before interest rates increase any further. Fixed rate mortgages can offer some protection against this trend, but for first time buyers or those looking to remortgage, it is important that you shop around now and find a deal that suits your circumstances.”

Find out how you could save over £1,000 a year with Uswitch here.

FOR MORE INFORMATION

Rory Stoves

Phone: 020 3872 5613

Email: rory.stoves@uswitch.com

Twitter: @UswitchPR

Notes to editors

All data provided accurate as of 12th April 2018, collated by Uswitch since 1 October 2015.

Average outstanding mortgage debt is £122,554 as of November 2017, according to the Money Charity. Applying an annual interest rate of 3.4% on this value debt over 25 years equates to a total repayment of £182,028. The same criteria with an annual rate of 3.65% equates to £186,999, producing a difference of £4,971.

Latest UK Finance mortgage lending data for February 2018 shows 35,400 homeowners taking remortgaging loans, and 25,200 first-time buyers loans. Mortgages for home movers totalled 38,500 loans.

The average house price is £319,507 less the average first-time buyer deposit of £41,712 means the average mortgage is £277,795. A rate of 3.6% on that borrowing means your repayments are £1,416. An increase to 3.9% means your repayments are £1,461. Over the course of 25 years that works out at £13,857 in additional interest.

Barclays, NatWest, Santander, TSB are the major providers to have increased mortgage rates across their respective product lines in March/April 2018.

Economic analysts are widely predicting a rate rise at the next Bank of England Monetary Policy Committee meeting on 10th May, including PWC, 8th February.

About us

It’s all about “U”!

Thank you for indulging us over the last 20 years by using a small ‘u’ and a big ‘S’ when writing about our brand in your articles.

We are delighted to let you know that you are now off the hook - it’s big U’s all the way (and small s’s) as we undertake our biggest ever rebrand - so let your autocorrect go wild!

About Uswitch

Uswitch is the UK’s top comparison website for home services switching. Launched in September 2000, we help consumers save money on their gas, electricity, broadband, mobile, TV, and financial services products and get more of what matters to them. Last year we saved consumers over £373 million on their energy bills alone.

Uswitch is part of RVU, a new business that also owns Money.co.uk and Bankrate.

If you would no longer like to receive our press releases please email prteam@uswitch.com with 'unsubscribe'.