Providers charge per-transaction fees, often including fixed costs and percentages of each transaction. Consider setup and monthly fees when choosing a provider based on your business size and transaction volume.

Find the right card machine for your business

Save up to £5,400* a year on your business card payments

*The National Federation of Retail Newsagents estimated that when its members switched acquirers, they saved between £100 and £450 per month on the cost of card acceptance services. This means a NFRA member (largely single sites) could potentially save up to £5,400 a year. Larger businesses could save more. Savings are indicative and will vary based on the information provided by the merchant to Tuza.

How it works

It's quick and easy to find a card payment provider

Why Tuza?

We're making payments simple for small business

What are payment providers?

Payment providers enable businesses to accept payments from customers, both online and in-person. They typically process credit and debit card transactions but may also offer alternative payment options like open banking or buy now, pay later.

Examples of payment providers on Tuza include Barclaycard, Worldpay, Tyl by Natwest and Teya.

Why is it important to compare card payment providers?

Comparing card payment providers helps you find the best deal for your business. Fees, features, and technology can vary widely between providers, so reviewing your options ensures you’re not overpaying and that you're using the most efficient, up-to-date system for processing payments.

What payment methods can I accept?

Card-based payments

This category includes credit cards, debit cards, and prepaid cards. These types of payments are often processed via networks such as Visa, MasterCard, American Express, Discover, and others. They are widely used for both online and in-person transactions.

Bank payments

This method includes payments made directly from one bank account to another. This method is often used for recurring payments like bills or subscriptions.

Digital payments

This is a broad category that includes all payments made using digital or mobile technology. This can include app-based services like PayPal, Google Pay, and Apple Pay. It can also include mobile payments made using contactless technology or QR codes.

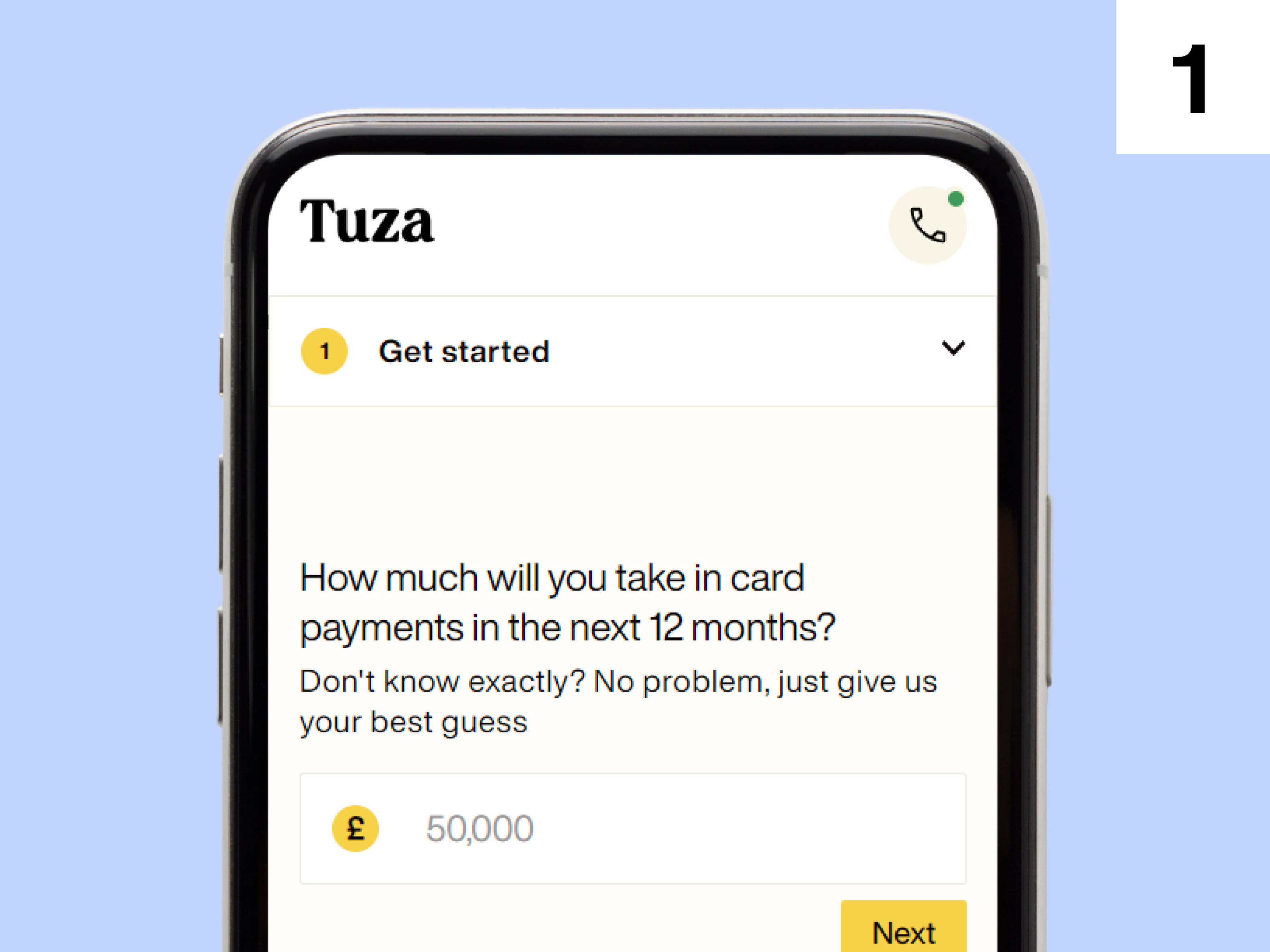

What information does Tuza need about my business?

To give you an accurate quote, Tuza just needs a few key details – and it only takes a couple of minutes.

You’ll be asked about your annual card turnover, average transaction value, and the nature of your business. Tuza will also want to know how and where you take payments (online, in-person, or both), which payment methods you accept, who your customers are, and what types of cards they typically use (debit, credit, or business).

Key things to remember when searching for a payment provider

Fees

Providers charge per-transaction fees, often including fixed costs and percentages of each transaction. Consider setup and monthly fees when choosing a provider based on your business size and transaction volume.

Acceptance of different cards

Ensure the provider can process a variety of cards, including Visa, MasterCard, and American Express.

Speed of processing

Find out how quickly the payment provider can process transactions and deposit funds into your bank account. While some providers offer same-day or next-day deposits, others might take longer.

Security

The payment provider should comply with all relevant security standards, including the Payment Card Industry Data Security Standard (PCI DSS). This helps ensure the security of your customers' card information.

Integration

How well does the provider's system integrate with your existing infrastructure, such as your POS system, online store, or accounting software? Smooth integration can help reduce administrative burdens and ensure a better experience for your customers.

Customer support

Reliable and responsive customer service is crucial. Check if the provider offers support 24/7, and consider looking at reviews to see how well they handle customer issues.

Fraud protection

Some payment providers offer tools and services to help you detect and prevent fraudulent transactions. This can help protect your business and your customers.

Flexibility and scalability

Ideally, the payment provider should be able to support your business as it grows and evolves. This could include the ability to handle increased transaction volumes, support for multi-currency transactions if you expand internationally, or additional services like invoicing or recurring billing.

Contract terms

Be sure to understand the length of the contract and any penalties for early termination.

Key things to remember when searching for a payment provider

Fees

Acceptance of different cards

Ensure the provider can process a variety of cards, including Visa, MasterCard, and American Express.

Speed of processing

Find out how quickly the payment provider can process transactions and deposit funds into your bank account. While some providers offer same-day or next-day deposits, others might take longer.

Security

The payment provider should comply with all relevant security standards, including the Payment Card Industry Data Security Standard (PCI DSS). This helps ensure the security of your customers' card information.

Integration

How well does the provider's system integrate with your existing infrastructure, such as your POS system, online store, or accounting software? Smooth integration can help reduce administrative burdens and ensure a better experience for your customers.

Customer support

Reliable and responsive customer service is crucial. Check if the provider offers support 24/7, and consider looking at reviews to see how well they handle customer issues.

Fraud protection

Some payment providers offer tools and services to help you detect and prevent fraudulent transactions. This can help protect your business and your customers.

Flexibility and scalability

Ideally, the payment provider should be able to support your business as it grows and evolves. This could include the ability to handle increased transaction volumes, support for multi-currency transactions if you expand internationally, or additional services like invoicing or recurring billing.

Contract terms

Be sure to understand the length of the contract and any penalties for early termination.

Statements that make happy reading

Helping small businesses like yours to find and switch to the right payments provider.

Join the millions who have already switched.

More people switch their broadband and mobile with us than any other switching site.

Here's what some of our customers have to say:

Resolution

Simple and quick

Best Site for Energy deals