Motorists purchasing a new vehicle could lose out £4,000 or more should it be written off or stolen with insurers only paying out on the market value of a car – as opposed to how much it cost to buy

With almost one in ten (86%) of motorists buying cars on credit and 2.5 million new cars sold in the UK in last year alone, millions of drivers are liable for the full debt, but are not adequately covered by their insurer

Only four in ten (38%) motorists know what Guaranteed Asset Protection (GAP) is and just one in ten (10%) have taken out the insurance designed to cover this shortfall

Uswitch.com is calling on the insurance industry to offer motorists the option to cover their car at new or trade value, to ensure they aren’t left short, should their car be stolen or written off.

As the new registration plates are launched this month, motorists purchasing new cars are at risk of losing thousands of pounds in the event of theft or their car being written off. According to the latest research from Uswitch.com, the price comparison website and switching service, insurers typically pay out the market value of a vehicle rather than a like-for-like model, potentially leaving drivers who have bought their cars on credit facing a shortfall of thousands of pounds.

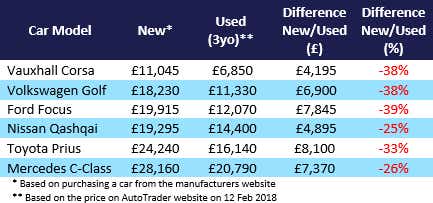

Most car insurance policies will only cover a car’s value at the time of write-off or theft, rather than its value at the time of purchase. Should this happen within the first three years of it being purchased, the average motorist could lose out on £4,000 for the most popular cars but can run up to more than £8,000 for some models. This can be cause for concern for drivers who have purchased a new car as its value falls rapidly immediately after purchase – in some cases up to 60% within the first three years.

The majority (86%) of motorists use a loan or other form of credit agreement when purchasing their vehicles, making them particularly vulnerable to being left significantly out of pocket in the event of theft or a write-off. These drivers will be left with the outstanding loan amount to repay while only being compensated for the market value of the vehicle.

In a bid to address this issue, an additional financial product called Guaranteed Asset Protection (GAP) insurance is offered by the insurance industry to provide motorists with further reassurance. However, only four in ten (38%) UK motorists are aware of GAP insurance and just one in ten have taken out the product to protect themselves.

With over three quarters (78%) of motorists asking to be able to choose the value of their car insurance – whether new or used, in lieu of taking out this extra insurance product – Uswitch.com is calling on insurers to offer drivers a choice of values when taking out their motor insurance, so that should they need to claim, motorists won’t be in for a nasty surprise.

Rod Jones, insurance expert at Uswitch.com, says: “Worryingly, a large number of drivers who purchase a new car are at risk of being left significantly out of pocket if it is written off or stolen. Consumers should have a clear choice of the amount of financial liability they want to protect themselves against when insuring their vehicle.

“With so many of us opting to purchase cars on finance plans, it is vital that insurers make consumers aware of the possible shortfall between the loan value and the current used value of the car, and that they provide the option to cover their vehicle at new or market values.”

FOR MORE INFORMATION

Rory Stoves

Phone: 020 3872 5613

Email: rory.stoves@uswitch.com

Twitter: @UswitchPR

Notes to editors

All research referred to was conducted by Opinium from 26th to 30th January 2018 among 2,003 nationally representative UK adults (aged 18+) of which 1,584 are drivers.

See table in body of release.

Research from the Finance and Leasing Association (FLA) showed that in the 12 months approaching March 2017, 86.5% of new private cars were bought by consumers using finance supplied by members of the Finance and Leasing Association.

When asked ‘Have you ever taken out a GAP Insurance (Guaranteed Asset Protection Insurance) policy?’ 11% answered ‘Yes – I currently have this’.

Data from the AA shows that the average new car will have lost 60% of its value after three years. After the first year the average new car will have lost 40% of its value.

Guaranteed Asset Protection (GAP) is an insurance policy which covers the difference between what your car insurer will pay out in the event of your car being written off or stolen and either the original amount you paid for it or the amount you still owe to a car finance company.

When asked ‘Which of the following do you understand GAP insurance to be?’, 38% answered correctly ‘GAP insurance covers the difference between what your car insurer will pay out in the event of your car being written off or stolen and either the original amount you paid for it or the amount you owe to a car finance company’, 6% answered ‘GAP insurance covers any excess on your insurance policy if your car were to be damaged’, 4% responded with ‘GAP insurance covers you if you are unable to pay monthly finance payments on your car’, and 52% answered ‘N/A – I have never heard of GAP insurance’.

When asked ‘How far do you agree or disagree with the following statement – “it would be better if my car insurance provider offered me the option of whether to cover my vehicle at trade, used or new price, allowing me to choose the value of the policy I take out”’, 30% answered ‘Strongly Agree’ and 49% answered ‘Agree’.

About us

It’s all about “U”!

Thank you for indulging us over the last 20 years by using a small ‘u’ and a big ‘S’ when writing about our brand in your articles.

We are delighted to let you know that you are now off the hook - it’s big U’s all the way (and small s’s) as we undertake our biggest ever rebrand - so let your autocorrect go wild!

About Uswitch

Uswitch is the UK’s top comparison website for home services switching. Launched in September 2000, we help consumers save money on their gas, electricity, broadband, mobile, TV, and financial services products and get more of what matters to them. Last year we saved consumers over £373 million on their energy bills alone.

Uswitch is part of RVU, a new business that also owns Money.co.uk and Bankrate.

If you would no longer like to receive our press releases please email prteam@uswitch.com with 'unsubscribe'.