Motorists are risking £9.1bn should their cars be broken into, as drivers leave valuables worth an average of £840 in their cars while on holiday in the UK

Over half (58%) of Brits have left valuables in an unattended car while on holiday, with the average family car containing two mobile phones, two tablets, two wallets and three packed suitcases

One in six (16%) consider their car a safe place to store valuable items despite two thirds (64%) of drivers being uncertain of the maximum amount of coverage they’d be entitled to on their insurance policy

Despite the vast majority (80%) of thefts from cars occurring at night, two fifths of drivers (43%) are comfortable leaving their valuables in a car overnight

Nearly a quarter of a million cars are broken into each year

Uswitch.com is calling on all drivers to avoid leaving their valuables in cars and to check their car insurance cover before hitting the road.

With the summer holidays fast approaching and millions of Brits getting ready to go on a driving staycation, millions of drivers risk losing a combined £9.1billion by leaving valuables in their unattended cars. According to research from Uswitch.com, the price comparison and switching service, the total value of items left in cars amounts to £840 per person – but the average car insurance policy typically only covers £250 worth of possessions.

Shockingly, more than half (58%) of Brits have admitted to leaving valuables in their car while travelling either in the UK or abroad. Mobile phones top the list as the most likely item to be left behind with the average family car including at least two mobile phones, two tablets, two wallets and three packed suitcases.

One in six (16%) believe that their car is a safe place to store their valuables, however nearly two thirds (64%) are unsure of what the maximum amount is that they can claim on their insurance should their possessions be stolen.

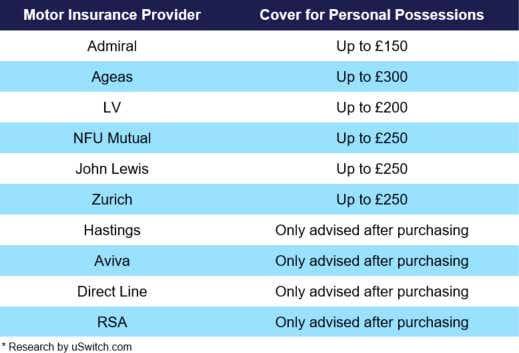

The typical cover for personal possessions is £250, but with two in five drivers (43%) opting for an excess of at least £250, drivers could end up not getting a penny to cover any items that are stolen. This is further compounded by some policies not informing consumers of the level of cover for personal possessions until after purchase, preventing motorists from making informed decisions about the policies they are taking out.

The most recent crime data reveals that 80% of theft from cars is conducted at night, yet, despite this, two fifths of drivers (43%) are comfortable leaving their valuables in a car overnight.

Rod Jones, insurance expert at Uswitch.com, says: “Given the rise in thefts from cars it’s surprising to see how much money drivers are prepared to lose by making it easier for thieves to steal their possessions during their summer holidays. This is particularly true as for many drivers their insurance policy is only likely to cover a fraction of the cost of those possessions.

“It’s vital to insure your luggage and personal items when driving in the UK. This is particularly true if you are going to be taking lots of expensive gadgets with you – so it pays to know how exactly much you are covered for and ensure you aren’t caught out should you need to claim.

“Some insurance policies won’t tell you the level of cover you’ll receive for your personal possessions upfront. This will leave you in the dark to how much cover you are actually entitled to until after you’ve taken out your policy. Furthermore, most policies cap the level of cover to around £250 – which in some cases is less than the excess consumers will have taken out.”

“If you can avoid it, don’t leave your valuables in your car overnight, especially when you’re away on holiday, and make sure that particularly expensive items are covered by separate home, travel or gadget insurance policies.”

Find out how you could save almost £1,000 a year with Uswitch here.

FOR MORE INFORMATION

Rory Stoves

Phone: 020 3872 5613

Email: rory.stoves@uswitch.com

Twitter: @UswitchPR

Notes to editors

Notes to editors Research carried out online with the Uswitch.com Consumer Opinion Panel from 12 – 19 June 2018 amongst a sample of 2,004 UK adults.

Calculation based on number of drivers with full licences in the UK which, according to GOV.uk is 40,331,643. When asked ‘Have you used your car for any of the following trips or holidays in the past 3 years?’, 66% of respondents selected ‘Yes’. 66% of 40,331,643 is 26,618,884. When asked ‘When using your car on holiday (in the UK or abroad), have you ever left any items locked in your car?’ and were given options of a mobile phone, full suitcases, house keys, cash, laptops, tablets, jewellery and wallets, 58% of respondents selected ‘Yes’. 58% of 26,618,884 is 15,438,952. When asked, ‘What is the value of the following items you left in your car?’, the average amount totalled £840. The average car policy cover for personal possessions amounts to £250 (see table within release). £840 minus £250 equals £590. 15,438,952 people multiplied by £590 equals £9.1 billion.

When asked ‘When using your car on holiday (in the UK or abroad), have you ever left any items locked in your car?’ and were given options of a mobile phone, full suitcases, house keys, cash, laptops, tablets, jewellery and wallets. 58% of respondents selected yes. When asked ‘Thinking about the last holiday that you took with passengers in your car, how many items of each of the following were left in the car when parked?’, the average responses totalled 2 mobile phones, 2 tablets, 2 laptops, 3 suitcases and two wallets.

When asked ‘How safe do you consider the following places for storing your valuables?’, 16% of respondents selected ‘Locked in a car’. The average car policy cover for personal possessions amounts to £250 (see table within release).

ONS Crime Survey data, - 80% of thefts from cars occur at night

When asked, ‘Which of the following areas of your car would you be comfortable leaving your valuables if you were parked overnight?’, 57% of respondents selected ‘I wouldn’t leave valuables anywhere in my car’. 100% minus 57% equals 43% of respondents who would be comfortable leaving their valuables in their car when parked overnight.

Figures from RAC.

When asked ‘If your car was broken into and valuable items were stolen, what would be the maximum amount you would be entitled to claim from your insurance provider before you reached the coverage cap?’, 64% of respondents selected ‘Not Sure’.

About us

It’s all about “U”!

Thank you for indulging us over the last 20 years by using a small ‘u’ and a big ‘S’ when writing about our brand in your articles.

We are delighted to let you know that you are now off the hook - it’s big U’s all the way (and small s’s) as we undertake our biggest ever rebrand - so let your autocorrect go wild!

About Uswitch

Uswitch is the UK’s top comparison website for home services switching. Launched in September 2000, we help consumers save money on their gas, electricity, broadband, mobile, TV, and financial services products and get more of what matters to them. Last year we saved consumers over £373 million on their energy bills alone.

Uswitch is part of RVU, a new business that also owns Money.co.uk and Bankrate.

If you would no longer like to receive our press releases please email prteam@uswitch.com with 'unsubscribe'.