Britain’s 12 million overdraft users could be wasting £640 million a year on fees and interest by not switching from expensive traditional high street banks

The average overdraft user is £285 in the red for nine days a month – with one in five (18%) using their overdraft 20 days or more each month

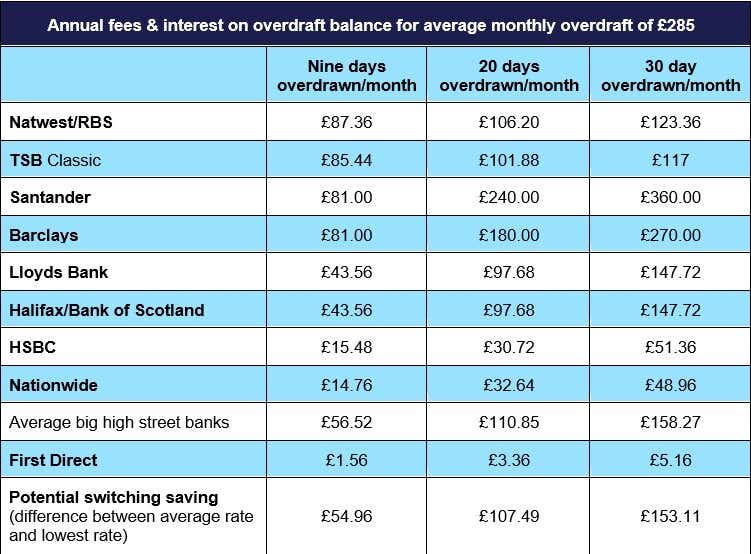

High street bank customers could cut payments from £56.52 to just £1.56 annually by switching provider

Nearly three in ten (29%) rely on their overdraft to cover everyday spending such as groceries, while a quarter (23%) use it to pay their household bills

A fifth (21%) of those overdrawn don’t know what it costs them and most (59%) are unaware they can switch while in the red

Uswitch.com calls on banks to make it clear to customers that they can save money by switching even when they are overdrawn.

Twelve million current account holders at the biggest high street banks could be paying more than £640 million too much on their overdrafts, according to Uswitch.com, the price comparison and switching service. With the big banks charging over 50 times more than the cheapest in fees and interest on the typical overdraft, consumers are missing out by not switching to cheaper providers.

On average overdraft users are £285 in the red each month and use the credit facility for nine days. A further fifth (18%) of borrowers say that they are stuck in their overdraft for nearly three weeks every month – racking up more than £110 in fees and interest each year.

On average, consumers are paying £56.52 every year to their high street bank in overdraft fees and interest rates. By comparison, customers of the cheapest provider – First Direct, which charges no interest on overdrafts of up to £250 and no fees – pay as little as £1.56 a year on the average overdraft.

The most common reason consumers use their overdraft for each month is to cover their everyday expenses, with three in ten (29%) relying on it to put food on the table and a further quarter (23%) using the credit to pay their household bills. Just one in seven (15%) use it for emergency expenses.

Despite millions of consumers using their overdraft every month, one in five (21%) don’t know what it costs them. Nearly six in ten (59%) don’t realise that they could switch current account provider while being overdrawn, potentially reducing how much they paid to service their debt.

Table 1: Comparing average annual cost of high street banks overdrafts

Source: Uswitch.com correct as of 15 October 2018

Tashema Jackson, money expert at Uswitch.com, says: “Overdrafts are an absolutely essential part of consumers’ everyday finances, but the associated charges seem to be accepted as a necessary cost, when they do not need to be at all.

”Banks that offer incentives on positive balances often make the headlines, but for the 12 million of us who rely on our overdraft to make ends meet every month, getting the cheapest deal on borrowing is what will really save you the most money.

“If you know you are going to be a few hundred pounds overdrawn each month, it really pays to do your research. Some banks offer interest free overdrafts, while others charge no fees for using one. Even when you have to pay, some will cost you significantly less than others.

“Crucially, banks could and should be doing more to help their customers ensure they are getting the best deal possible. Far too many aren’t aware what their overdrafts are actually costing them or that they can to a cheaper provider while overdrawn.

“There are options around to help cover household spending while you wait for payday, or provide you with a safety net in case of emergency, but it is always important to check the terms and conditions of any credit agreement you sign up to. Knowing what the penalties are should you miss a repayment and understanding the impact on your credit rating are essential before taking out any form of borrowing.”

Find out how you could save over £1,000 a year with Uswitch here.

FOR MORE INFORMATION

Rory Stoves

Phone: 020 3872 5613

Email: rory.stoves@uswitch.com

Twitter: @UswitchPR

Notes to editors

All research referred to was conducted by Opinium between 10th and 13th September amongst 1,004 respondents who have fallen into an overdraft in the last 12 months. All overdraft fees and charges calculated via provider websites and/or Candid Money overdraft calculator assuming £285 overdrawn nine consecutive days per month, twelve times a year

When asked have you gone into an authorised overdraft, 22% of people said yes (representing 11,662,579 people nationally). When asked how many days in an average month was the balance of your current account in an authorised overdraft, the average amount was nine days. When asked ‘during the periods of time when you have been overdrawn, what is the average amount you are overdrawn in your authorised overdraft each month?’ The average response was £285. For customers of the big high street banks the difference in fees and interest between having this average overdraft with the average amount paid across the ten biggest high street banks £56.52 in fees and interest and the cheapest provider £1.56 (First Direct - 0% under £250 then 15.9% EAR) is £54.96. Therefore this means a total potential national saving of £640,975341.84 ( £54.96 x 11,662,579)

When asked how many days in an average month was the balance of your current account in an authorised overdraft, the average amount was nine days. When asked ‘during the periods of time when you have been overdrawn, what is the average amount you are overdrawn in your authorised overdraft each month?’ The average response was £285.

When asked how many days in an average month was the balance of your current account in an authorised overdraft, the average 18% said 20 days or more

The average overdraft user (£285 for nine days) with a Natwest Reward current account will pay £87.36 annually in fees and interest; the average overdraft user with a First Direct current account will pay £1.56 annually

When asked ‘Was there a specific reason why your current account balance goes / went into your overdraft?’, 23% of respondents answered ‘everyday spending i.e. grocery shopping’, 29% answered ‘regular bills e.g. energy, broadband’, and 15% answered ‘emergency spending e.g. car repairs, boiler’.

When asked ‘what is the charging and interest structure of your bank when you go into your overdraft?’. 21% of respondents answered ‘I don’t know’.

When asked ‘Do you know whether you are able to switch your current account provider whilst overdrawn?’, 10% of respondents answered ‘Yes, for either authorised, or unauthorised overdraft’; 59% of respondents answered ‘Don’t know’.

See table 1 for average cost of overdrafts for consumers using their overdraft for 9, 20 and 30 days.

Information on each provider’s overdraft arrangements available at: Natwest – reward account / Royal Bank of Scotland – reward account – arranged overdraft usage fee of £6, interest at 19.89% EAR (variable) TSB Classic account - arranged overdraft usage fee of £6, interest at 19.84% EAR Santander – 123 current account - for overdraft balances below £2,000, £1 a day Barclays – Bank account – 75p per day Lloyds Bank – classic account – daily overdraft fee of 1p per £7 borrowed Halifax / Bank of Scotland classic account - daily overdraft fee of 1p per £7 borrowed HSBC - Bank Account - 19.9% EAR variable Nationwide - FlexAccount - 18.9% EAR (First 3 months free for new customers, switching to Nationwide) First Direct – current account - 0% EAR variable on the first £250. 15.9% EAR variable on anything above £250

About us

It’s all about “U”!

Thank you for indulging us over the last 20 years by using a small ‘u’ and a big ‘S’ when writing about our brand in your articles.

We are delighted to let you know that you are now off the hook - it’s big U’s all the way (and small s’s) as we undertake our biggest ever rebrand - so let your autocorrect go wild!

About Uswitch

Uswitch is the UK’s top comparison website for home services switching. Launched in September 2000, we help consumers save money on their gas, electricity, broadband, mobile, TV, and financial services products and get more of what matters to them. Last year we saved consumers over £373 million on their energy bills alone.

Uswitch is part of RVU, a new business that also owns Money.co.uk and Bankrate.

If you would no longer like to receive our press releases please email prteam@uswitch.com with 'unsubscribe'.