- Uswitch.com>

- Credit Cards>

- Stoozing - make money with your credit cards

Stoozing - Make money with your credit cards

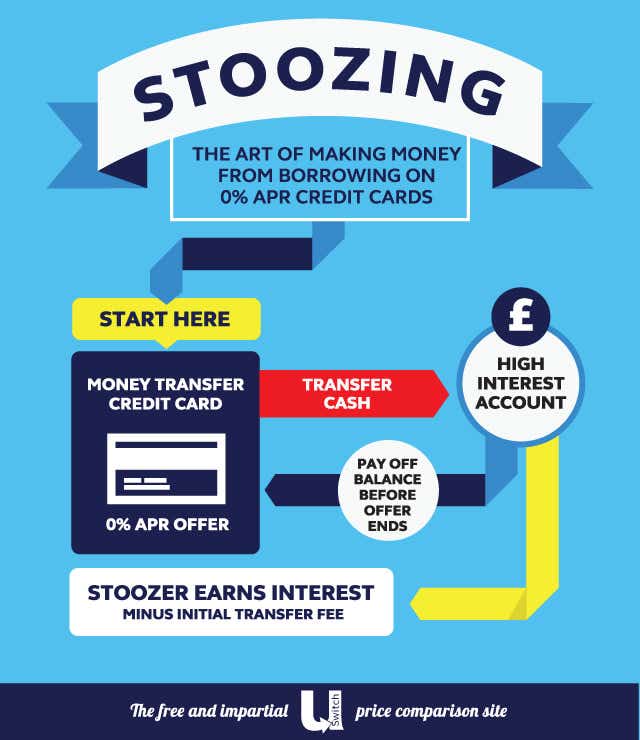

Stoozing is all about how to make money from 0% interest periods, but how does it work?

Could you make money by borrowing interest-free on your credit card and then investing the money in a high interest savings account? We look at the options to borrow money on a credit card to make money, and whether it works.

Can I borrow money to make money on a credit card?

Many credit cards offer an introductory period where you don't have to pay any interest on the money you borrow. This is known as the 0% interest introductory period.

Stoozing credit card

If you want to start stoozing find a credit card with an interest free period for purchases.

There are many methods and terms for borrowing on your credit card to make money, but it is most commonly known as stoozing. Here we explain what 'stoozing' is, how to be a 'stoozer' and use a 'stoozepot' to earn money.

What is stoozing?

Stoozing is treating 0% introductory rates on credit cards as interest free loans. You then invest this 0% interest money into a high-interest savings account. When the 0% introductory period ends, you pay off the credit card loan and you are left with the profit.

Why do people use credit cards to make money?

While it is in theory possible to make money via stoozing on credit cards, you have to find the best savings accounts and the right credit card. It also only really works when you can earn a lot of interest on a savings account, ie when savings interest rates are high.

Stoozing reached its heyday before the 2008 crash when credit was more freely available and the best interest rates on savings were 5.5% . Some people were reported to have stoozed balances well into the tens of thousands.

Stoozing is still relatively uncommon despite the best interest rates on savings accounts now topping the 2008 best rates, having recovered after plummeting to around 2% in recent years.

What are the drawbacks of using your credit card to make money?

It is also worth bearing in the mind that you cannot simply withdraw cash on your credit card and then put it into a savings account in the hope of earning more interest.

This is because cash withdrawals on credit cards attract an interest rate as soon as the money is withdrawn, unlike purchases which benefit from an interest-free period. This interest charge is applied even if you have a 0% interest on purchases credit card. As if this isn’t deterrent enough, you may also be charged a cash handling fee of 2% to 5%.

The interest rate and fee you will be charged for withdrawing cash will amount to more than you would currently receive on a savings account, even with a best-buy savings account. For this reason, you should never simply withdraw cash on your credit card, and it is not a sensible way to raise money for savings or investments.

How can I make money from stoozing?

There are many different techniques to stooze effectively, but for most intents and purposes there are two methods: quick and easy, or advanced.

The simple way - spend and save

This method is reasonably straight-forward - simply build up your cash savings by using a 0% interest credit card to make as many purchases as possible.

Find a savings account that pays you the most AER (annual equivalent rate) and get the best 0% purchase card you can.

Make as many of day-to-day purchases you can afford on your card.

Deposit the cash you save into a high interest account. Remember, your deposits need to match your card spending.

Once the 0% interest period expires use the saved cash to pay off the balance.

Any money left over is your profit.

If you borrowed £1,200 on a 24 month 0% purchase card, matched this with £1,200 in deposits in a 3% interest account, you could make about £72 by the time the 0% period expires. However, the larger the sum of money you 'stooze' the bigger the returns will be.

You will need to be disciplined with your spending and never borrow no more than you deposit - if you don't pay off the card debt before the 0% period expires you'll lose your profits.

Advanced stoozing - card balancing

This is how you can make bigger profits from creatively moving debts around, but it's not for everyone. It requires meticulous planning and calculations to manage. Also, with savings rates relatively low, the potential returns are unlikely to be worth the hassle involved in juggling cards, credit and savings accounts.

First you need a money transfer credit card that will allow you to transfer money directly into your bank account.

Transfer money from the card into a high interest account or other investment (investments typically offer higher returns but are risky, and could leave you worse off).

You can use a money transfer card to put cash into your account and transfer that card debt to a 0% balance transfer card. Balance transfer cards with no, or low, transfer fees can keep costs as minimal as possible.

After the 0% period on the money transfer card expires, pay off the debt with the money from the savings account, there should be extra money left over as profit.

High interest current accounts

To start stoozing you need a high interest current account to save money

This method can be used multiple times with many cards to create very large 'stoozepots'. However, it does require a lot of time and commitment to manage multiple cards and accounts. You will need to make sure you've worked out that everything will add up in your favour and transfer fees won't wipe out your profits.

What to watch out for when it comes to stoozing

Don't get mixed up, make sure to not use your 0% purchase card to make a money transfer, and do not use your money transfer card to make any purchases. These cards will often offer different rates for purchases and money transfers.

You must meet your minimum monthly card repayments or you will lose your 0% interest period. This would make your 'stoozing' pointless. You should pay off your card debts as soon as possible or you will be out-of-pocket.

If you do decide to become a 'stoozer', you will need a good credit score, so regularly check your credit report - read our guide on how to improve your credit score to learn more.

To keep credit scores clean, 'stoozers' should also make sure to close credit cards once they've been paid off.

Lastly, don't forget to carefully read through all the terms and conditions, thoroughly read credit card summary boxes so you're not caught out by any hidden fees. Then work out how much money you can make and decide whether it's worth putting in the effort.

It would be very risky to use the money you have raised to invest in stocks and shares on the stockmarket. This is because, unlike cash, share investments can unexpectedly fall in value and you may not have sufficient capital to pay off your original credit card debt.

0% money transfer credit cards

Find a credit card that lets you transfer cash into your bank account.

How can I avoid interest on my credit card?

Many of us are not committed enough to put in the effort to stooze credit cards but there are simpler ways to exploit 0% periods on credit cards with the savvy use of 0% purchase and 0% balance transfer cards.

Simply make your purchases on with a credit card offering a 0% introductory period. After this expires transfer the debt onto a balance transfer card.

Provided you meet your minimum repayments and keep your credit score in good health you can avoid interest accruing on your debts for many years, until you can afford to pay them back.

In terms of stoozing, while it used to be a potentially lucrative way to make money, with interest rates on savings accounts now so low, the opportunity has passed. For most people, making sure they have the right credit card for their needs, comparing different credit cards to find a low APR credit card or a balance transfer credit card deal, would be time better spent.