Can I get car insurance after I’ve been convicted of drink-driving?

Yes, you can get car insurance even after a conviction for drink-driving, although you might find it harder to find a good deal.

The cost of your insurance is almost certainly going to be much more than you used to pay, because your drink-driving record makes you a higher risk in the eyes of insurers.

When you plan to get back behind the wheel once you’ve completed any ban after being disqualified, contact your insurer and tell them you plan to drive again. Make sure you remind them of your drink-driving conviction to avoid any confusion at a later date.

They may offer you a new car insurance quote. If they don’t, it’s time to start looking around for an insurance policy elsewhere.

Again, don’t be tempted to hide your drink-driving conviction when you apply for insurance. If you do, you could be committing fraud and any policy you do manage to take out will almost certainly be cancelled when your insurer finds out.

This would make it even harder for you to get car insurance again later on.

How much is car insurance after a drink-driving ban?

Getting car insurance after a drink-driving conviction can be hard. This is because drink-driving is one of the most serious driving offences in an insurer’s eyes, as claims for drink-drivers are so costly and the potential for damage and injury is huge.

To reflect this, it would be fairly standard to see your premium double after being convicted of a drink-driving offence.

High initial premiums aside, you might also encounter the following obstacles:

Some of the more well-known insurers may not be willing to insure you

You might have to pay a higher compulsory excess in the event of a claim

You must declare your drink-driving conviction for up to five years (depending on your insurer), which will continue to bump up your premiums

Points from more serious drink-driving convictions can stay on your driving licence for up to 11 years.

How can I get cheaper car insurance if I’ve got a drink-driving conviction?

Although your premiums will almost certainly go up, there are several ways to cap their increase after a drink-driving conviction.

Go on a driving course

You might be offered the chance to take part in a drink-driver rehabilitation course. If you are, you should go because some insurers offer discounts for drivers who have taken these courses, and you might get a reduction in your driving ban if you attend an approved course.

You usually have to pay upfront to take a course, but it’s likely to result in savings on your car insurance over the long term.

Talk to insurance experts

Once you’re ready and able to resume driving, search for car insurance quotes.

Many providers won’t offer you a quote if you have a conviction. But you can use a comparison site such as Uswitch to establish which ones would have been cheaper if you didn’t have a conviction, and then you can call them direct.

Some providers might be willing to negotiate a deal once they’ve discussed your driving history and the details of your conviction.

If you are struggling to get affordable car insurance after a conviction, speak to a specialist insurer or broker. The British Insurance Brokers’ Association is a good place to start.

Speak to charities

Charities for people with criminal convictions, such as Unlock, might be able to help you find affordable car insurance. They could recommend brokers and insurers who have insured other people with similar convictions.

Get a black box

Black-box insurance (or telematics) is often recommended for younger drivers, but it might help older drivers following a drink-drive conviction, too.

The ‘black box’ monitors how you are driving and sends the data it collects back to your insurance company. Your insurance premiums are lower if you drive safely, and this could be one way to prove to your insurer that you have learnt from the errors of your past.

Do I need to tell my insurer if I have a drink-driving conviction?

You should never hide a criminal conviction from an insurer when they ask, and you should always tell your insurer immediately whenever your circumstances materially change. This certainly includes getting a drink-drive conviction.

In fact, you should tell them about any driving penalties you're given, including being given points for things such as speeding or not wearing a seatbelt.

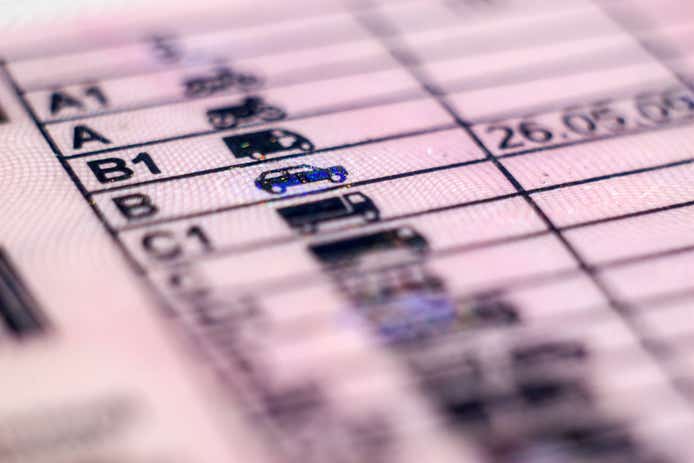

What are the different drink driving codes and penalties?

The table below outlines the different codes and penalty points for each drink driving offence, as recorded on the government’s website:

Drink driving codes and penalty points

| Code | Offence | Penalty points |

|---|---|---|

| DR10 | Driving or attempting to drive with alcohol level above limit | 3 to 11 |

| DR20 | Driving or attempting to drive while unfit through drink | 3 to 11 |

| DR30 | Driving or attempting to drive, then failing to supply a specimen for analysis | 3 to 11 |

| DR31 | Driving or attempting to drive, then refusing to give permission for analysis of a blood sample that was taken without consent due to incapacity | 3 to 11 |

| DR61 | Refusing to give permission for analysis of a blood sample that was taken without consent due to incapacity in circumstances other than driving or attempting to drive | 10 |

| DR40 | In charge of a vehicle while alcohol level above limit | 10 |

| DR50 | In charge of a vehicle while unfit through drink | 10 |

| DR60 | Failure to provide a specimen for analysis in circumstances other than driving or attempting to drive | 10 |

| DR70 | Failing to cooperate with a preliminary breath test | 4 |

Note that codes DR10 to DR61 must stay on your driving record for 11 years from the date of the conviction.

Codes DR40 to DR70 must stay on your driving record for four years from the date of the offence or four years from the date of conviction where a disqualification is imposed.

Source: gov.uk

Get a car insurance quote

See a range of car insurance quotes in just a few minutes when you compare with Uswitch