How does having a conviction affect my car insurance?

If you’ve been convicted of a driving offence this will be reflected in higher car insurance costs. It’s not a pleasant thought, but paying a higher premium may be your only option. After all, driving or even keeping a car on the road without car insurance isn’t an option. If you do, the police could slap you with an on-the-spot £300 fine and six penalty points.

You could face greater fine and be disqualified from driving if the matter’s considered more serious and your case went to court.

For these reasons, it’s best to focus on getting the right type of car insurance for you; an affordable policy that’ll keep you road legal.

Insurance for drivers with a drink-driving conviction

Getting insurance if you have the drink driving conviction DR10 on your licence can be difficult, but it’s not impossible. Some policy providers even offer specialist convicted driver insurance.

You could also take a drink-driving rehabilitation course, which can make it easier to get cover.

Insurance for drivers with a previous driving ban

No insurer will cover you while you’re serving a ban and many won’t even after your ban’s been lifted.

However, you can get specialist convicted driver insurance if you’ve been disqualified for specific offences, including the more common totting-up ban. This appears as conviction code TT99 on your licence, and is issued if you’ve been banned for amassing 12 or more penalty points in three years.

Insurance for drivers with points on their licence

Having penalty points on your licence isn’t the same as being convicted of a motoring or other offence in a court. But penalty points, or endorsements, will affect your insurance price. You’d need tell your insurer about them either straight away or when you come to renew, depending on your policy terms and conditions.

Get a car insurance quote

See a range of car insurance quotes in just a few minutes when you compare with Uswitch

Do I need to declare convictions to my car insurance provider?

You must declare any unspent convictions to your car insurer, if asked. If your insurer doesn’t ask you don’t need to volunteer this information.

Whether you need to declare any conviction or fixed penalty notice imposed during your current insurance term will depend on the policy wording.

What happens if my conviction is spent?

After a certain period of time most convictions will be considered ‘spent’. This means you wouldn’t need to disclose them to your insurer, even if you’re asked.

Note: Some convictions, such as those where the conviction included a prison sentence of four or more year, are never spent.

How can I get cheaper car insurance if I’m a convicted driver?

There’s no magic bullet when it comes to getting convicted driver car insurance. However, some or all of the following could help:

Downsize your car to a cheaper, less powerful model

Consider black box insurance

Pay annually

Select a higher excess

Reduce your mileage.

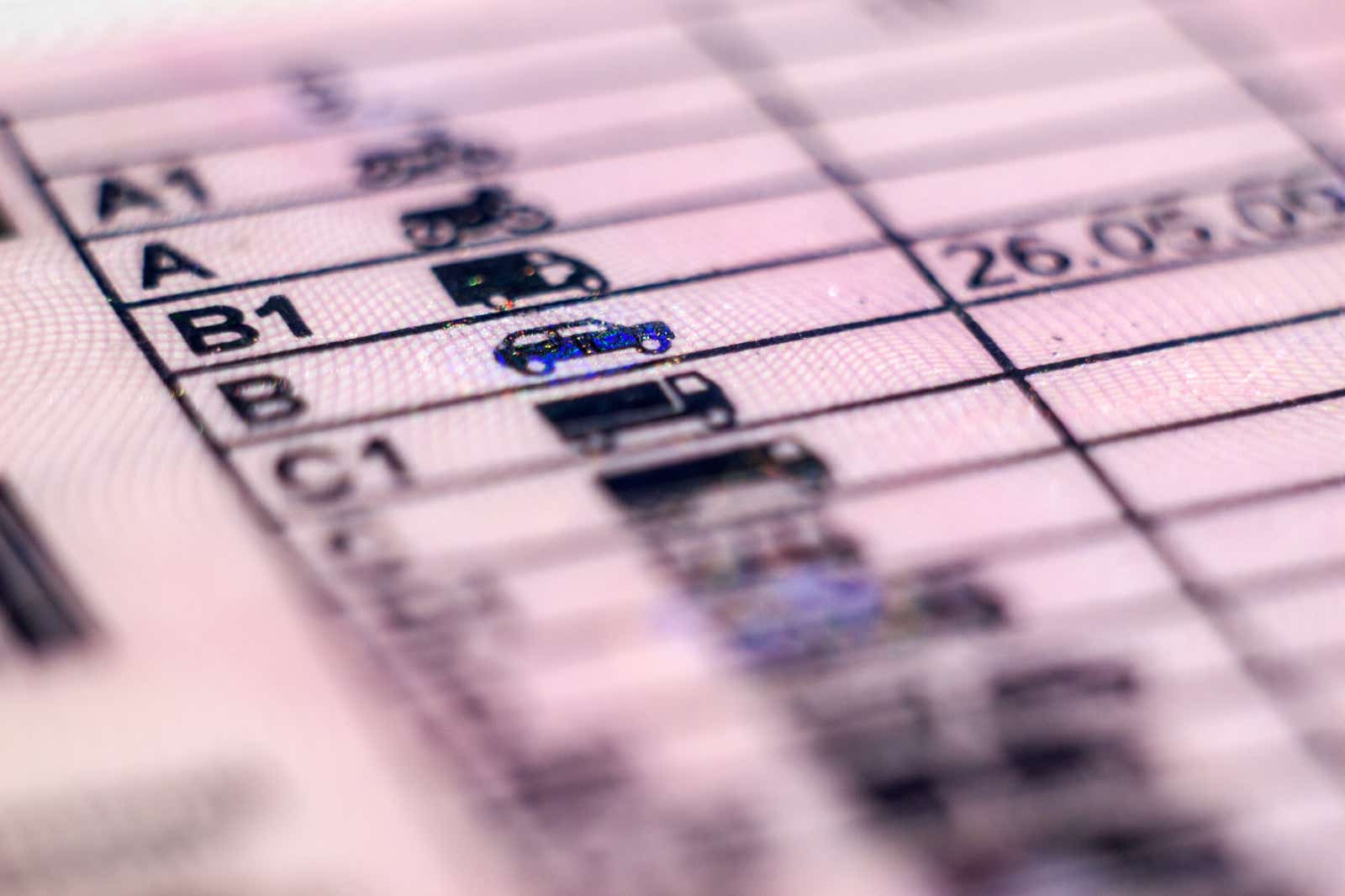

Motoring offences and penalty points explained in detail

There’s a wide range of driving offences, including drink-driving and driving without insurance. If you’re convicted a unique code that identifies the offence is placed on your driving record. For example, codes starting DD refer to dangerous driving, while DR offences refer to alcohol-related ones and DR are drug-related.

Punishments depend on the severity of the offence. Less serious offences result in endorsements; more serious ones could result in bans, criminal convictions and even prison.

Endorsements

Depending on the motoring offence, you could get up to 11 penalty points on your driving licence

The more serious the offence, the more points you’d get. For example, driving a vehicle with defective brakes would attract three penalty points, while dangerous driving could get you 11 points

Any points you get stay on your driving licence for three years

Notice of any offences committed remain on your driving record for between four and 11 years, depending on their severity.

Fines

Any fine you get remains on your record for five years if you were 18 or over at the time of the offence.

If you were under 18, they remain for half this time.

Disqualifications

If you’re convicted of a serious motoring offence you could get a driving ban

Anyone disqualified for more than 56 days must apply for a new licence before driving. You might also be required to retake your driving test

If you collect 12 or more points in a three-year period, you’ll be disqualified for six months, in the first instance

For more serious offences, or if you repeatedly rack up 12 points or more, the ban could last for far longer

Driving bans of up to five years become spent five years after issue. Bans lasting longer than five years are spent when they expire.

Prison

Anyone found guilty of serious motoring offence, such as causing death while under the influence of drink or drugs, could face a prison sentence

The length of your sentence will determine when it becomes spent. For example, a sentence of less than six months would be spent two years after it ends, even if the sentence was suspended or where parole was awarded

A sentence of longer than four years is never spent.

Get a car insurance quote

See a range of car insurance quotes in just a few minutes when you compare with Uswitch

FAQs

How much is car insurance after a drink-driving ban?

Car insurance costs more than double over the five years following a drink-driving ban, as your disqualification will remain on your driving record for five years.

What are my options if I’m refused car insurance because of a conviction?

Given you can’t drive without car insurance, your options are limited. Unless you can get cover as a named driver on someone else’s car, you’ll need to stay off the road.

What if I don’t disclose my conviction to a car insurance provider?

If you’re asked, but don’t declare any unspent conviction or points received during the past three years your policy could be invalid.

What is the most common type of driving conviction in the UK?

Speeding is the most common UK driving offence, accounting for more than 30% of all motoring convictions.

If you’re convicted of speeding, consider taking a speed awareness course. Whatever you pay for one will probably be much less than the effect on your premiums.