Compare car insurance quotes

Get a quote in minutes and save up to £462*

*Based on data provided by Consumer Intelligence Ltd, www.consumerintelligence.com (April '25). 51% of car insurance customers could save £462.49

Compare car insurance quotes

Comparing quotes only takes a few minutes

Tell us some information about yourself

We’ll need details about the drivers you want to cover, where you live, and your occupation.

Decide what cover you need

Choose from 3 different levels of cover. We’ll also need details of your car, mileage and modifications.

Compare and choose a policy

We compare over 160 car insurance providers to help you find a deal.

Car insurance companies we compare

Find the car insurance company that fits you best. We compare car insurance from up to 160 UK companies to help you choose the right deal.

AXA

AXA Tesco Insurance

Tesco Insurance Admiral

Admiral AA

AA RAC

RAC Churchill

Churchill

How much can I expect to pay for my car insurance?

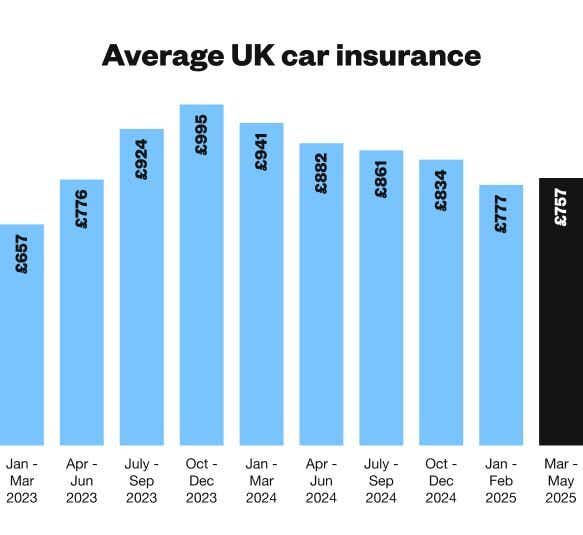

The average car insurance cost in the UK is £757** a year, or £63 per month. But, your actual cost can be higher or lower based on factors like your car type, age, location, and job title.

- Age: Younger drivers generally pay more. A 21-year-old averages £1,704 while a 55-year-old pays around £543 for annual car insurance.

- Location: Inner London residents pay about £1,185, compared to £677 in northern England.

- Driving history: Those with a clean driving record pay less for car insurance than those with previous claims or traffic violations.

The latest report shows that car insurance is at it's lowest recorded price in 2 years.

For tips to reduce your car insurance costs, see our guide on 20 tips to get cheaper car insurance.

** Confused.com price index data, March - May 2025.

Types of car insurance cover

There are 3 car insurance policy types, each offering different levels of cover. Here's a brief overview of the main types to help you choose the best one for your needs and budget.

Fully comprehensive car insurance

The highest level of cover available protects you, your passengers and your car following an accident regardless of who’s to blame. It also covers anyone else harmed in the incident and pays out if their vehicle or property was damaged or destroyed. Fire damage, theft or attempted theft of your car is also covered.

Third party, fire and theft

Third party, fire and theft (TPFT) won’t cover your injuries or damage to your car following an incident. But it does provide protection for others by covering any damage or injury you cause to other vehicles, property, or individuals. Additionally, TPFT insurance covers losses related to fire damage and theft of your car. It offers a balance between basic third-party cover and more comprehensive options.

Third party

This is the most basic level of cover that’s legally allowed in the UK. It won’t pay out any losses you incur but will pay if other people, including any passengers you’re carrying, are injured. It also covers any damage or loss to another person’s property, as well as any injuries they sustain following an incident involving your car.

"Comparing car insurance policies at renewal time is crucial to avoid overpaying. Don't assume your current policy is the best deal when renewal comes around. Depending on your driving record and experience, you might find a more affordable option that offers the cover you need."

What car insurance add-ons can I get?

Car insurance add-ons allow you to tailor cover to your needs. You can choose from a wide range of car insurance add-ons, but remember, you’ll pay extra to get them.

Their costs vary between insurers and policies, so it’s worth shopping around and reading the policy wording.

Breakdown cover

There are different levels of breakdown cover to choose from, including basic roadside assistance, national recovery and European recovery.

Windscreen cover

Windscreen cover gives you peace of mind as you’ll be covered for any chips and even the replacement of your entire windscreen.

Legal expenses

Motor legal protection helps you claim losses and compensation that aren’t covered by a standard car insurance policy for a car accident that isn’t your fault.

Personal accident

Personal accident cover pays out if you’re injured or die due to a car accident.

Car insurance tailored for different needs

We don't just compare standard car insurance, we also offer cover for different situations.

Temporary car insurance

Temporary car insurance provides flexibility and convenience for short-term needs. It's ideal for situations like borrowing a friend's car, driving a new car home from the dealership, or taking a test drive.

Black box car insurance

Black box policies use a telematics device or app to monitor driving behaviour, offering lower prices for safe drivers. Suited to young or inexperienced drivers.

Multicar insurance

Covers multiple cars under one policy, making it easier if you have more than one car in a household. Multicar providers offer discounts for each car added to the policy.

Classic car insurance

Specialised cover for vintage or classic cars, based on their unique value and usage, instead of standard market value.

Car insurance for younger drivers

Finding affordable car insurance as a young driver can be hard, but it’s not impossible. With insurers often rating new drivers as high-risk due to their limited experience, quotes can be steep. But, understanding the factors that influence these costs and knowing where to look can help you get the cover you need without breaking the bank.

Student car insurance

Student car insurance compares prices and flexible cover options for students with limited driving experience or who use their cars intermittently.

New driver car insurance

Look at options for new drivers, emphasising safety and affordability for those just starting on the road.

Young drivers car insurance

Find out more about policies for young drivers, which offer competitive rates. This type of cover is designed to address the higher risks associated with less driving experience.

Why choose Uswitch?

Exclusive deals

We work hard to find insurers who can offer deals and discounts to help you save more.

Saves time

Compare up to 160 insurers in just 5 minutes, saving you time and money.

You're in safe hands

We're regulated by the Financial Conduct Authority (FCA), which means we fully support customer's financial interests first.

Insurance for other vehicles

Electric car insurance

Electric car insurance is tailored to cover things like batteries and cables that wouldn’t need cover on a standard car insurance policy.

Hybrid car insurance

Hybrid car insurance covers cars in the same way as standard car insurance. But, providers often include discounts due to the eco-friendly nature of hybrids.

Van insurance

Van insurance provides cover for commercial or personal use. It protects against risks such as accidents, theft, and damage. It often includes options for business-related needs.

Motorbike insurance

Motorbike insurance offers protection tailored to the unique needs of bikes and riders. It covers various risks, from accidents to theft and damage.

Compare car insurance quotes

Comparing quotes is faster and easier with Uswitch

FAQs

How can I find out who my car is insured with?

With most people holding more than one type of insurance policy, such as car, home and travel, it's easy to forget who your car is insured with.

If you can’t remember your car insurance company there are ways to find out:

Check your bank statements: Look for any payments to an insurance company around the due date.

Check your emails: Search for 'car insurance' to find any correspondence from your insurer. Don't forget to check your spam and trash folders as well.

Retrieve a quote: If you used a comparison site to get a quote, try logging back in to see if you can access it.

Is my car insured?

The easiest way to find out if a car is insured is to run an insurance check online.

The Motor Insurance Database (MID) lets you check if your car is insured. All you need to do is enter the vehicle’s number plate and declare that you're the owner or registered keeper of the car.

See our guide for how to check if your car is insured for more information.

Does my car have a valid MOT?

You can check your MOT status on GOV.UK, and you can set MOT renewal reminders with us to help you remember when it’s due for renewal.

How does car insurance work?

Car insurance protects you financially if you have an accident and cause damage to your car or someone else’s car. All cars and drivers have to be insured as a legal requirement in the UK. People who drive without the proper insurance can be fined, get points on their licence and even be banned from driving.

How does my job affect my car insurance?

When insurers offer policies for car insurance, job titles make a difference because they offer insight into the level of risk that might be associated with the policyholder. For example, a postman may have a higher price because they travel more miles to get to different work locations, compared with a teacher who has a set place of work.

How can I cancel my car insurance?

Car insurance can be cancelled at any time, but you might incur fees and charges depending on your policy and when you decide to cancel it. If you cancel it within the standard 14-day cooling-off period, you won’t be charged extra but admin fees may apply depending on your insurer. But, any time outside that could cost more than you expect, so it’s important to check your contract.

When is the best time to renew car insurance?

The best time to renew car insurance is about 18 days before your current policy expires. Most policies auto-renew, but you won’t necessarily pay the same price, especially if your circumstances have changed. It’s important to shop around for a better deal, so you should be looking at your options in plenty of time before your current deal expires.

How can I make a claim on my car insurance?

You're required to tell your insurance company about any accidents, even if you decide against making a claim.

The first thing you should do is gather information from any drivers involved in the accident. Take pictures and make notes, too. Then contact your insurer and the police. Your insurer will provide you with the next steps to carry out your claim.

See our guide on how to make a car insurance claim.

Car Insurance comparison is powered by Confused.com which is a trading name of Inspop.com Limited who are authorised and regulated by the Financial Conduct Authority. Registered office; Greyfriars House, Greyfriars Road, Cardiff, CF10 3AL, registered in England and Wales 03857130. Please note, we cannot be held responsible for the content of external websites and by using the links stated to access these separate websites you will be subject to the terms of use applying to those sites. By using this system you are also agreeing to our Terms and Conditions and Privacy Policy. Uswitch is an intermediary and receives a percentage of the commission if you decide to buy through us. If you already hold an account with Confused.com, the information held for you will be available to help you complete your quote more quickly - you should check the information is still accurate and up-to-date.