Compare car insurance and save up to £524*

Get a quote in minutes and see what you could save with a cheap car insurance deal

How to compare car insurance

Enter your details

Using our quote form, tell us about the car and driver you want to insure.

Compare quotes

We'll compare over 140 car insurance providers based on the details you provide.

Start saving

Choose from a list of quotes and complete your purchase with your chosen provider.

What information do I need to compare car insurance?

To get accurate quotes you'll need:

To speed up the process, have these things ready before you start comparing.

Find the car insurance provider that suits you

We compare car insurance from over 160 insurance providers across the UK so that you can choose the deal that’s right for you.

Admiral

AA

Churchill

Hastings Direct

Quotemehappy

RAC

Tesco Bank

AXA

Author Ben Gallizzi Last updated April 18th 2024

How much does car insurance cost?

The average car insurance cost in the UK is £941 a year, giving an average monthly car insurance cost of £78. But how much does car insurance cost you?

In reality, your car insurance cost could be a lot more or less than £78 per month. Along with the type of car you drive, car insurance costs can vary depending on things like your age, where you live and even your job title.

Car insurance costs are higher for younger people. The average car insurance cost is £2,176 for a 21-year-old versus £666 for a 55-year-old - that’s over 200% more!

The average car insurance cost in Inner London is £1,393, which is over £173 more than someone living in outer London.

Gender also makes a difference - the average car insurance cost for men is about 19% higher than for women.

For tips to reduce your car insurance cost, see our guide on 20 tips to get cheaper car insurance.

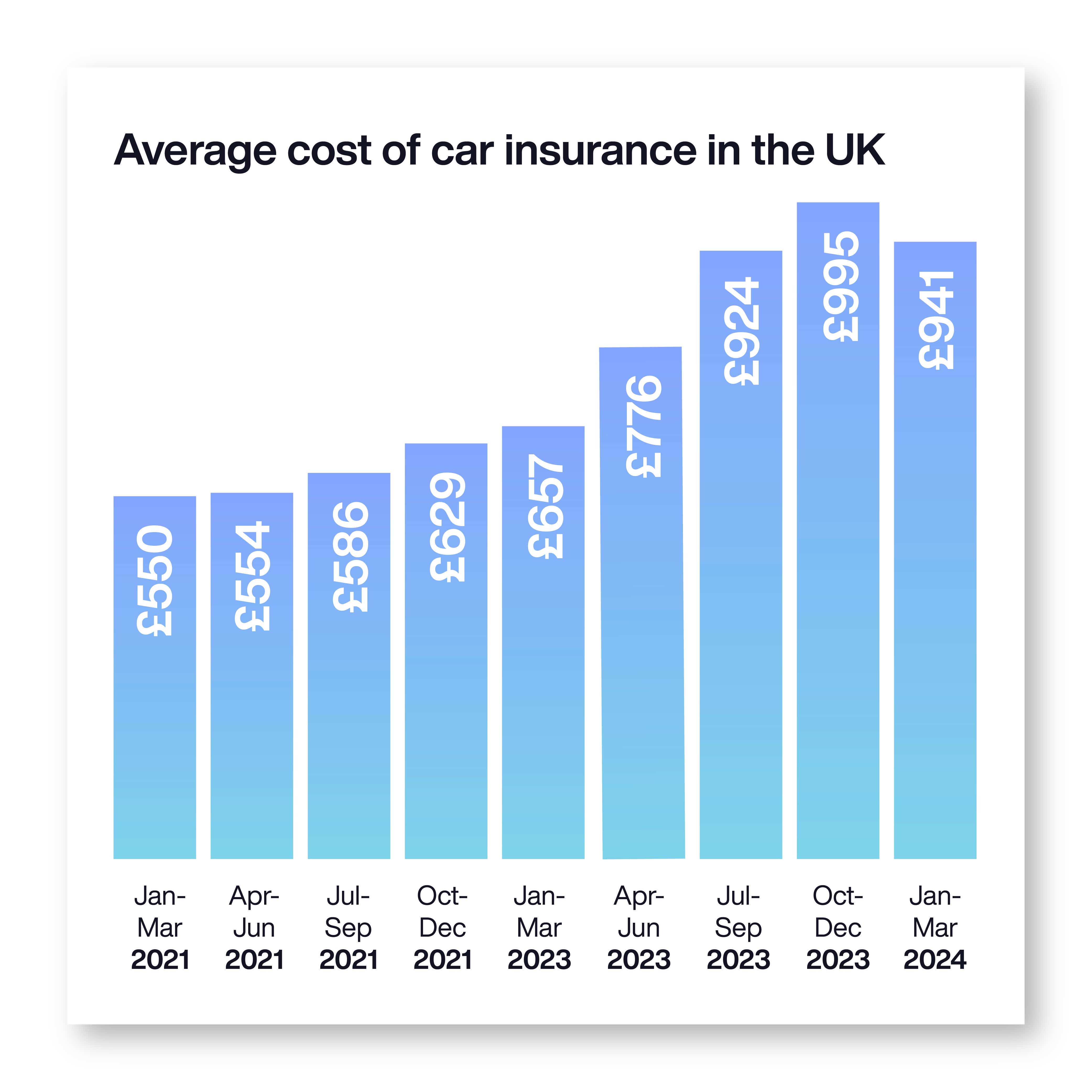

Are car insurance costs increasing?

Car insurance costs have been slowly rising since early 2021, but have gotten bigger since late 2022. These increases put further financial pressure on drivers at a time when the overall cost of living is high. The increased cost of claims paired with higher levels of inflation are just two of the factors contributing to the rises.

It’s still possible to make savings though. According to Confused.com, almost half (45%) of motorists who shopped around at renewal went on to save £90 compared to their price last year.

How do I get cheap car insurance quotes?

Car insurance quotes are calculated using a string of factors - some simple for you to change, some you can’t easily control - including your age, years of driving experience and where you live. But that doesn't mean there aren't ways to get a cheaper car insurance quote and save quite a lot.

The first thing to do is to check what other providers will offer you using our insurance comparison tool - that way you can see if your provider is offering you a competitive deal.

Read the Key Features document for policies you are considering to ensure that it also offers all of the right coverage for you, so it pays out when you need it.

If you are renewing your car insurance, it helps to shop around - about three weeks ahead of time ideally - and go back to your current insurer and ask them to beat the best quote you find.

Other ways to cut car insurance costs

Pay your premiums annually

Paying car insurance in full for the whole year up front, instead of in monthly instalments, can save you money as you won't be charged interest on them.

Make sure you don’t have unnecessary add-ons

Are you paying for add-ons you don’t need or that are covered by other insurance? Could you get separate breakdown or legal cover cheaper elsewhere?

Maximise your no-claims discount

When you compare quotes for car insurance, make sure you can carry with you your no-claims bonus – this is the discount given to drivers who don’t claim on their insurance.

Types of car insurance cover

It’s illegal to drive or park a car on a UK road without adequate car insurance. There are three types to choose from.

Fully comprehensive car insurance

The highest level of cover available protects you, your passengers and your car following an accident regardless of who’s to blame. It also covers anyone else harmed in the incident and pays out if their vehicle or property was damaged or destroyed. Fire damage, theft or attempted theft of your car is also covered.

Third party, fire and theft

Third party, fire and theft (TPFT) won’t cover your injuries or damage to your car following an incident, but it will protect others, including cars or other property, as well as covering for fire and theft losses relating to your car.

Third party

This is the most basic level of cover that’s legally allowed in the UK. It won’t pay out any losses you incur but will pay if other people, including any passengers you’re carrying, are injured. It also covers any damage or loss to another person’s property, as well as any injuries they sustain following an incident involving your car.

Leoni Moninska, Insurances ExpertComparing car insurance policies is the best way to ensure you're not overpaying for your cover - don't assume your current policy is the best or cheapest one for you when your renewal date comes around. You may be able to switch to a cheaper policy depending on your experience and driving record.”

Find the car insurance that’s right for you

While standard car insurance policies work for most drivers, there are also alternative types of cover that might be more suited to your needs.

What car insurance add-ons and upgrades can I get?

Car insurance add-ons allow you to tailor cover to your needs. You can choose from a wide range of car insurance add-ons but remember, you’ll pay extra to get them.

Popular car insurance add-ons include:

Breakdown cover: There are different levels of breakdown cover to choose from, including basic roadside assistance to national recovery and European recovery.

Windscreen cover: Windscreen cover gives you peace of mind as you’ll be covered for any chips and even the replacement of your entire windscreen.

Legal expenses: Motor legal protection helps you claim losses and compensation that aren’t covered by a standard car insurance policy for a car accident that’s not your fault.

Personal accident cover: Personal accident cover pays out if you’re injured or die due to a car accident.

Car insurance add-ons, are they worth it? It’s for you to decide. Car insurance add-ons and their costs vary between insurers and policies, so it’s worth shopping around and reading the policy wording.

Find out more about car insurance

‡Car Insurance comparison is powered by Confused.com which is a trading name of Inspop.com Limited who are authorised and regulated by the Financial Conduct Authority. Registered office; Greyfriars House, Greyfriars Road, Cardiff, CF10 3AL, registered in England and Wales 03857130. Please note, we cannot be held responsible for the content of external websites and by using the links stated to access these separate websites you will be subject to the terms of use applying to those sites. By using this system you are also agreeing to our Terms and Conditions and Privacy Policy. Uswitch is an intermediary and receives a percentage of the commission if you decide to buy through us. If you already hold an account with Confused.com, the information held for you will be available to help you complete your quote more quickly - you should check the information is still accurate and up-to-date.