Please note that as of July 2015, the government has stopped funding the Green Deal. The info on this page is for reference purposes only.

The Green Deal scheme was one of the most hotly discussed topics of 2012, with many claiming it would greatly improve the UK’s energy efficiency.

In June 2014, the Green Deal Home Improvement Fund was launched. The latter was designed to encourage more people to install energy efficient measures and provides up to £7,600 cashback for those who abide by certain criteria. But how does it work?

Green Deal latest news

- Green Deal Home Improvement Fund closes

The scheme ended on 25 July 2014 when DECCannounced that the £120m fund set aside for the initiative was depleted.

- Green Deal Home Improvement Fund launches

The new scheme will provide participating households with up to £7,600 to put towards energy efficient installations.

- Greg Barker speaks

Speaking on the launch of the refreshed Green Deal, Energy and Climate Change Minister, Greg Barker said: "The brand new Green Deal Home Improvement Fund [offers] people up to £7600 to help pay for an exciting range of energy efficiency improvements. People should apply now for this unmissable offer and cut their bills before next winter."

- New, simpler Green Deal announced.

Following disappointing uptake figures, in March 2013 Energy Minister Ed Davey announced that a number of changes would be implemented to the Green Deal. He said the objective was to simplify the Green Deal and stop it being "too clunky and too complex".

Amongst the features supported by the new Green Deal are terms aimed at making it easier for landlords to adopt the scheme. The system will now see tenants paying for the installation of energy efficient measures using the savings achieved as a result of lower energy bills. The online process of applying for the Green Deal will also be improved, as many have complained the current system is too complicated.

It is worth noting that despite disappointing figures (only 1,612 homes had Green Deal plans in progress as of December 2013), the Government has been keen to point out that more than 150,000 assessments have been carried out since January 2013.

- Green Deal myths debunked.

Heard a lot of rumours about the Green Deal? We examine which are true and which aren't.

- Four out of five haven’t heard of the Green Deal.

Looks like the government has some work to do!

- Green Deal Cashback Scheme up and running

The Green Deal Cashback Scheme is launched, offering up to 50% back on your home improvements.

- Green Deal launch in 7 major cities

The Green Deal is going to be launched in 7 major UK cities as the government kick starts the scheme with a £12 million investment.

- How renters could benefit from Green Deal

Renters could see their homes made warmer as landlords are encouraged to take up the Green Deal.

- We explain how to make the most out of the Green Deal

Following the government's publication of 'the next steps of the Green Deal' we explain how you’ll be able to get money to make your home more energy efficient - Monday, 11th June 2012

Green Deal Home Improvement Fund

What is the Green Deal Home Improvement Fund?

The Green Deal Home Improvement Fund (GDHIF) is a Government incentive aimed at encouraging home energy efficiency improvements.

Launched in June 2014, the scheme allows home owners, tenants and landlords to claim back up to £7,600 for improvements carried out. These can include the addition of solid wall insulation and glazing, or energy efficiency improvements to a heating system.

You can apply for the GDHIF via the official website, or call the Energy Saving Advice Service on 0300 123 1234.

How does the GDHIF work?

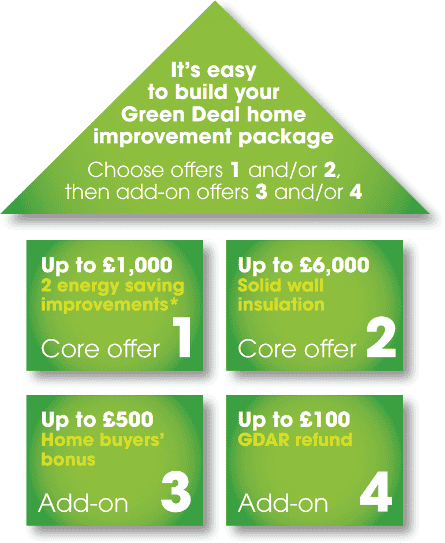

The GDHIF is made up of four different offers (see diagram).

Anyone looking to join the scheme must first select which sections are relevant to their home. This means consumers must select either one or both of offers 1 and 2 and then decide whether to add on offers 3 and 4.

Core offer 1: up to £1,000 for installing two of the eligible*, energy saving products.

Core offer 2: up to 75% of the total price for internal or external solid wall insulation (up to £6,000).

Add-on 3: an additional £500 if the home was purchased in the past 12 months.

Add-on 4: a refund for carrying out a Green Deal Assessment Report (GDAR), up to £100.

*Condensing mains gas boiler, Fan-assisted storage heaters, Flue gas heat recovery, Replacement warm-air unit, Waste water heat recovery, Cavity wall insulation, Flat roof insulation, Floor insulation, Room-in-roof insulation, Double/triple glazing (replacing single glazing), Secondary glazing, Replacement doors.

How do I qualify for the Green Deal Home Improvement Fund?

There are a number of criteria you must meet in order to be eligible.

First of all the home you are improving must be in either England or Wales. Your proposed improvements must be based on recommendations from an Energy Performance Certificate (EPC) or a Green Deal Advice Report (GDAR),that is from less than two years ago.

You must also use an authorised Green Deal Installer or Provider who is registered with the GDHIF scheme. Don’t forget to make sure your improvements are eligible under the GDHIF.

What if I’m a landlord/ tenant?

Landlords are eligible for the Green Deal Home Improvement Fund, but must abide by a slightly different set of rules, which you can find under the Green Deal Home Improvement Fund Terms and Conditions. Tenants are also welcome, but are also subject to a slightly different set of rules.

Green Deal fast facts

- The Green Deal is essentially a very cheap loan scheme to pay for energy-saving measures which will make the UK more energy-efficient.

- Why is this being done? Firstly, our homes suffer from a shocking amount of heat loss. Secondly, Britain has ambitious targets for cutting carbon emissions, and the Green Deal is an important part of meeting these targets.

- The golden rule of the Green Deal is that the amount you save on your bills will always be greater than the cost of the energy-saving measures.

- The cost is absorbed into your future energy bills and consequently paid back over time.

- An estimated 26,000,000 homes could be eligible for Green Deal financing.

What is the Green Deal?

The Green Deal aims to fund energy-saving upgrades for your home without any upfront costs. Instead, the costs are added to your energy bills and staggered over time, like a loan.

So if you want to replace your boiler with a more energy-efficient model, or want to install draught-proofing or loft and wall insulation you can do so using a Green Deal loan.

You’ll still be charged for the improvements, but the cost will be repaid over time as an additional charge on your energy bill. However, the ‘golden rule’ of the Green Deal is that your repayments will have to be less than the money you will save on your energy bills.

The Green Deal is essentially a loan from the private companies installing these energy efficiency measures. There’s a maximum amount of £6,500 per household and, crucially, this is tied to the home rather than the owner, so if you move house the debt is passed on to whoever lives there next.

The loan is then paid back through the electricity bill over a 25-year period.

Unlike many other home improvement initiatives, the Green Deal is not dependent on people’s income and the loans are available to everyone.

How will it work?

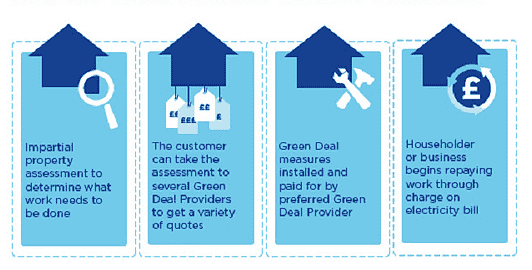

From a customer's perspective there are a few key steps you will have to take:

First, you need to decide what needs to be done to your home. You’ll have to get a property assessment, which will be done by specially accredited advisers who will visit your property and assess its current energy performance and what measures are suitable for you.

Next, shop around. Once you have the results of your Green Deal assessment you can start collecting some quotes from Green Deal providers who will give you a range of quotes for the work.

Then all you have to do is choose which provider you prefer. The work can take place no upfront costs, and you’ll only start paying it back as an additional charge on your energy bills. However, you also have the option of paying for some of the work upfront if you want.

It’s worth bearing in mind that while your ‘deal’ won’t technically be a loan; the government has indicated your contract will be entitled to the protection given under the Consumer Credit Act, so they will have to adhere to the guidelines.

What energy efficiency measures are available to me now?

Lots! The cost of energy efficiency measures has tumbled in recent years, with products such as solar panels and insulation becoming far more affordable and commonplace.

Some energy efficiency measures are already subsidised by energy suppliers, while some customers on certain benefits may be entitled to theirs entirely free. Take a look at our insulation, boiler and solar pages for more information.

Will the Green Deal save me money?

Yes. Energy-efficiency upgrades such as insulation can save you up to £310 a year, while upgrading your boiler to a more energy efficient boiler can save you up to £310 a year.

While cost is often the main reason not to take up these offers, the Green Deal will offer you an upfront loan to be repaid with energy savings. Once the Green Deal energy loan is repaid, you keep any future savings.

Can I still switch energy providers with the Green Deal?

Yes, but only to energy suppliers that participate in the Green Deal programme. Your Green Deal is transferable between those suppliers as it is a fixed amount.

What happens when I move house?

Your Green Deal will be tied to your property, not to you, so if you sell your property the debt will pass on to the next occupier.

The owner must therefore disclose any details of Green Deal payments when selling or letting their property.

What if I can’t pay anymore?

If you default on Green Deal payments you will be treated in the same way as customers who default on their energy bills. You could be disconnected.

However there are some safeguards in place to avoid this scenario. Energy suppliers will have to go through a number of steps to help you to keep up with your payments, including prepayment meters, and no disconnection for certain households in winter months.

If you do feel like you are struggling to pay your energy bills, contact your supplier and see what options are available to you as soon as possible.

When did the Green Deal launch?

The scheme officially launched in January 2013.

What safeguards are in place?

The Green Deal has generated a huge amount of discussion, with a lot of concern centering around protection for customers.

However, there are some protection measures already in place, including:

- an assessment from an authorised Green Deal assessor to determine what is suitable for you;

- authorised installers meeting high standards;

- existing legislation governing mis-selling, unfair trading practices and consumer credit agreements, so you should be;

- clear obligations on Green Deal participants to work within a robust Code of Practice;

- clear confirmation procedures before the Green Deal charge can start to be collected;

- collection of the charge through the electricity bill, which is regulated by Ofgem;

- clear processes to follow when a property changes hands, to ensure people know about the Green Deal before they move in; and

- making it clear when a customer may be required to pay the Plan off early before a they enter into a Green Deal plan.

You can find out more about Green Deal energy on the Department of Energy and Climate Change website.