Time is money – the simple car insurance errors that could cost motorists up to £114 million a year

Busy Brits risking millions of pounds by forgetting to renew MOT or tax on time (25%) and leaving cars unlocked (24%)[1]

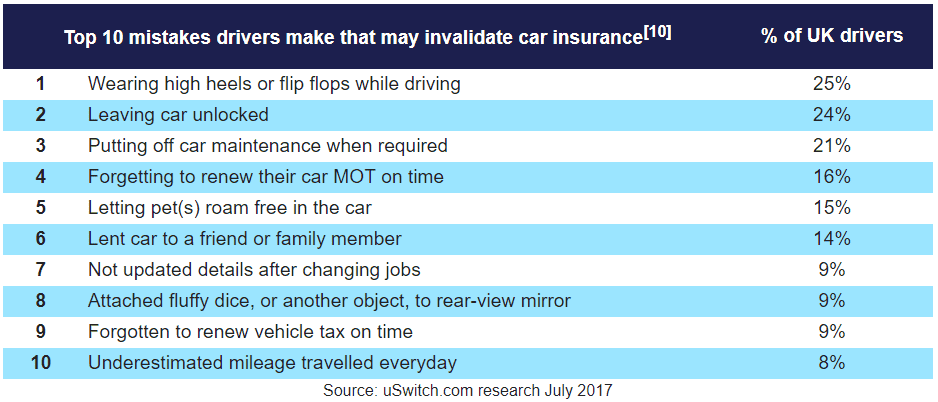

Other habits that could be costing motorists include driving in flip flops (25%), hanging fluffy dice from the rear-view mirror (9%) and underestimating their mileage (8%)[2]

A quarter of drivers (25%) don’t realise these oversights can invalidate their car insurance, while one in eight (13%) said they were in too much of a rush[3]

With average car insurance pay-outs now £2,671, these slips ups could leave a £114 million hole in the nation’s bank balances, as 43,000 claims are rejected each year[4]

A quarter of young drivers underestimate the severity of their actions (25%) while almost half of older drivers (43%) say they simply forgot certain behaviours could impact their insurance policy[5]

Proving time really is money, drivers could be risking up to £114 million[4], in rejected car insurance claims due to slip ups like forgetting to MOT their car or renew their car tax on time, or putting off car maintenance (21%)[1]. According to new research from Uswitch.com, the price comparison and switching service, two thirds (63%)[6] of drivers make simple errors which can leave them out of pocket, should they need to make a claim.

As well as forgetting their key renewal dates, a quarter of time pressed motorists confess to not locking their cars, while almost 10 million drivers (25%) admit to not taking the time to change out of inappropriate driving shoes before jumping behind the wheel[2].

Other faux pas that could lead Brits to invalidate their car insurance include not updating insurers when changing jobs or addresses (16%), hanging fluffy dice from the rear view mirror (9%) and underestimating the mileage travelled each day (8%)[2]

A quarter (25%) of drivers admitted that they didn’t realise these small errors could result in car insurance providers not paying out, with an additional third (37%) of drivers admitting they simply forget that such behaviours might impact on an insurance claim[7].

Around the country one in three (35%) people in Birmingham said they leave their cars unlocked. While motorists from Wales and those living in the South West of England are prone to forgetting to renew their MOT’s on time, with a quarter (26%) admitting to doing so[8].

As young drivers head off to university or move away from home in search of a steady job, they are three times (15%) more likely than their parents (5%) to invalidate their insurance by not updating their address. However, old habits die hard and people over 55 (29%) are almost twice as likely as young drivers (17%) to leave their cars unlocked[9].

The latest data from the Association of British Insurers (ABI) shows that over 43,000 car insurance claims are rejected a year[3]. With the average insurance claim now £2,671, on average, motorists could be losing as much as £114.85 million[3] from claims being rejected each year, showing that these small mistakes can be very costly.

Rod Jones, insurance expert at Uswitch.com, says: “We know the British public are increasingly time poor, so it’s unsurprising that motorists can be forgetful when it comes to locking up their cars or renewing their car MOT and taxes on time.

“With claims now running into the thousands of pounds, people can’t afford to make a careless mistake that could invalidate their cover and leave them out of pocket. It is therefore really important that drivers note down their key renewal dates, and avoid making the easy to forget mistakes to ensure they are covered should they ever need to make a claim.”

Find out how you could save over £1,000 a year with Uswitch here.

FOR MORE INFORMATION

Rory Stoves

Phone: 020 3872 5613

Email: rory.stoves@uswitch.com

Twitter: @UswitchPR

Notes to editors

All research referred to was conducted by Opinium from 11th July to 14th July 2017 among 1,593 UK adults with a driving licence.

When asked, ‘To the best of your knowledge, which of the following have you ever done?’ from a list of behaviours that could invalidate car insurance policies, 16% selected ‘Forgotten to renew your vehicle MOT on time’, 9% selected ‘Forgotten to renew your vehicle tax on time’ and 24% selected ‘Left your car unlocked’

When asked, ‘To the best of your knowledge, which of the following have you ever done?’ from a list of behaviours that could invalidate car insurance policies, 24% of UK drivers selected ‘Left your car unlocked’, 25% selected ‘Worn unsuitable shoes to drive (flip flops, high heels)’. 15% selected are ‘Let your pet(s) roam free in the car, 7% selected ‘Not updated your address on your motor insurance policy if you’ve moved/start spending most nights at a different address’, 9% selected ‘Attached fluffy dice or any other object to your rear-view mirror’, 8% selected ‘Underestimated mileage travelled everyday’ and 9% selected ‘Not updated your motor insurance policy details when you’ve changed jobs (employer or role)’. 8% of UK drivers selected ‘Underestimated mileage travelled everyday’. According to gov.uk, 39,909,550 full UK driving licences are held in the UK.

When asked, ‘You mentioned you may have acted in a way that could invalidate your driving insurance, why was this?’ 25% selected ‘I didn’t think it would have an impact on my car insurance’, 13% selected ‘I was in a rush’

Research from the Association of British Insurers (ABI) released in 2016 states that the overall average claim amount for all types of private car insurance claims was £2,671. The latest research from the ABI released in for 2013/14 showed that 43,000 car insurance claims were rejected. When multiplying this by the overall average claim amount of £2,671, this amounts to a total of £114.85m in claims not paid-out by insurance providers

When asked, ‘You mentioned you may have acted in a way that could invalidate your driving insurance, why was this?’, 25% of 18 – 24-year-old UK drivers selected ‘I didn’t think it was serious’ while 43% of 55+ UK drivers selected ‘I forgot’

When asked, ‘To the best of your knowledge, which of the following have you ever done?’ from a list of behaviours that could invalidate car insurance policies, 63% of UK drivers said they ‘Had done’ one or more of the listed behaviours

When asked, ‘You mentioned you may have acted in a way that could invalidate your driving insurance, why was this?’ 25% selected ‘I didn’t think it would have an impact on my car insurance’ and 37% selected ‘I forgot’

When asked, ‘To the best of your knowledge, which of the following have you ever done?’ from a list of behaviours that could invalidate car insurance policies, 35% of drivers who live in Birmingham selected ‘Left your car unlocked’, and 26% of drivers who live in Wales and the South West selected ‘Forgotten to renew your vehicle MOT on time’

When asked, ‘To the best of your knowledge, which of the following have you ever done?’ from a list of behaviours that could invalidate car insurance policies, 15% of 18-34 year old UK drivers selected ‘Not updated your address on your motor insurance policy if you’ve moved/start spending most nights at a different address’, compared to 5% of those aged 35-54 who selected this option. 29% of UK drivers aged 55+ selected ‘Left your car unlocked’, with 17% of those aged 18-34 selecting this option.

When asked, ‘To the best of your knowledge, which of the following have you ever done?’ from a list of behaviours that could invalidate car insurance policies, 25% of UK drivers said they had ‘Worn unsuitable shoes to drive (flip flops, high heels)’ 24% selected ‘Left your car unlocked, 21% selected ‘Put off car maintenance when required’, 16% selected ‘Forgot to renew your vehicle MOT on time’ and 15% selected Let your pet(s) roam free in the car, 14% selected ‘Lent your car to a friend or family member’, 9 % selected ‘Not updated your motor insurance policy details when you’ve changed jobs (employer or role), 9% selected ‘Attached fluffy dice or any other object to your rear-view mirror’, 9% selected ‘Forgotten to renew your vehicle tax on time’, 8% selected ‘Underestimated mileage travelled everyday’

com offers customers the opportunity to set reminders for a range of services including your MOT, motor insurance and tax renewal dates. You can find out more details here.

About us

It’s all about “U”!

Thank you for indulging us over the last 20 years by using a small ‘u’ and a big ‘S’ when writing about our brand in your articles.

We are delighted to let you know that you are now off the hook - it’s big U’s all the way (and small s’s) as we undertake our biggest ever rebrand - so let your autocorrect go wild!

About Uswitch

Uswitch is the UK’s top comparison website for home services switching. Launched in September 2000, we help consumers save money on their gas, electricity, broadband, mobile, TV, and financial services products and get more of what matters to them. Last year we saved consumers over £373 million on their energy bills alone.

Uswitch is part of RVU, a new business that also owns Money.co.uk and Bankrate.

If you would no longer like to receive our press releases please email prteam@uswitch.com with 'unsubscribe'.