Cost of running a household rises £500 to £17,000 a year

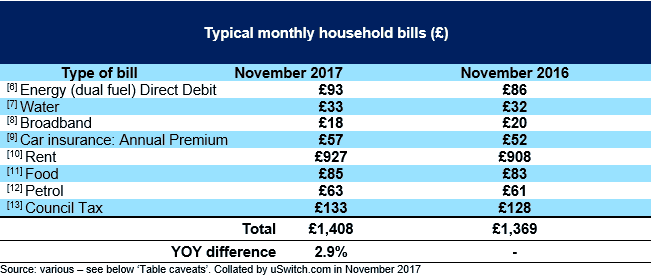

Essential bills cost families £1,408 a month – rising by 2.9% in a year, more than double the rise in household income (1.2%)****

Bills (£16,896) now account for more than half (52%) of household income (£32,247)

Increases in car insurance (10%), energy (8%) and petrol (3%) drive annual bills up by £468 compared to 2016****

One in ten Brits say they have no money left at the end of the month after paying all essential household bills****

With inflation at 3.0% all eyes will be on next week’s budget hoping for some relief to help keep spiralling bills under control.

Running a home today costs £16,896 a year – an increase of £468 since 2016 – according to new research from Uswitch.com, the price comparison and switching service, as essential bills rise by 2.9% in a year, adding to the financial burden of cash strapped consumers.

In the last twelve months, car insurance premiums have shot up by 10%, energy bills have risen by 8% and filling up a car with petrol now costs 3% more. The combined increase in bills across the board leaves consumers having to find an extra £468 per year, further squeezing household finances.

This rise in the cost of running a home comes as wages continue to stagnate. Recent ONS findings revealed that average annual household income has increased by £387 in the last year, which is not enough to cover the additional cost of essential household bills. This increase is leaving consumers searching for the extra cash to make ends meet, and leaving them poorer in real terms going into the traditionally expensive festive season.

With households starting to feel the pinch, our recent research on the cost of living found that one in ten consumers said they had no money left at the end of each month, after paying all of their essential household bills.

Tashema Jackson, money expert at Uswitch.com, says: “The cost of running a household continues to rise and with wages failing to keep pace, cash strapped families are spending over half of their income simply to keep on top of their bills.

“Going into the most expensive part of the year, it is unsurprising that many will be feeling the pinch and with one in ten of us getting to the end of the month broke after paying our essential bills, millions of people really need all the help they can get.

“The country will be desperately looking towards next week’s Autumn Budget, hoping the Chancellor will provide some much-needed relief to counteract this spiralling cost of living, and help give consumers a lift when it comes to managing their household.”

Find out how you could save over £1,000 a year with Uswitch here.

FOR MORE INFORMATION

Rory Stoves

Phone: 020 3872 5613

Email: rory.stoves@uswitch.com

Twitter: @UswitchPR

Notes to editors

Notes to editors

Please refer to table of ‘Typical monthly household bills’ and table caveats below for annual and monthly bill total and the actual cost and % change in the cost of running a household between November 2016 and November 2017. Mean equivalised household disposable income for all household types taken from the 28 July 2017 release of the ONS Nowcasting household income in the UK data tables, comparing the figure of £31,860 in 2015/16 to £32,247 in 2016/17 which results in an increase of 1.2%.

Mean equivalised household disposable income for all household types taken from the 28 July 2017 release of the ONS Nowcasting household income in the UK data tables for 2016/17 is £32,247 in 2016/17. The average cost of running a household in November 2017 is £16,896 which is 52% of £32,2478.

Mean equivalised household disposable income for all household types taken from the 28 July 2017 release of the ONS Nowcasting household income in the UK data tables, comparing the figure of £31,860 in 2015/16 to £32,247 in 2016/17. £32,247-£31,860 = £387

Car insurance increase according to the average premiums from the com quarterly motor insurance report for Q2 2016 and Q3 2017. Energy dual-fuel increase according to data from Uswitch.com based on the on the average price on 8 November 2017 compared to 2016 for a medium user profile on a standard plan, using 3100 KWH electricity and 12000 KWH gas, paying by direct debit. Bill size average of the big eight suppliers, averaged across all regions. Council tax increase according to Gov.uk average Band D council tax set by local authorities in England for 2017-18 compared to the average Band D council tax for 2016-17

Research referred to was conducted by Opinium from 29th August to 31st August 2017 among 2,005 UK adults When asked, ‘On average, how much money do you have left at the end of the month once you have paid all your essential bills and expenditure including rent/mortgage and food?’ the mean figure for all respondents was £170.85. 12% of respondents selected ‘£0 a month’

According to data from Uswitch.com based on the on the average price on 16 October 2017 compared to 2016 for a medium user profile on a standard plan, using 3100 KWH electricity and 12000 KWH gas, paying by direct debit. Bill size average of the big eight suppliers, averaged across all regions.

According to data from Ofwat regarding the average household bills 2016-17, published 1 February 2017

According to data from Uswitch.com about the cheapest broadband packages available through uSwitch.com on 8 November 2017 compared to 2016

According to data from the com quarterly motor insurance report for Q2 2016 and Q3 2017

According to data from the HomeLet Rental Index - UK average figure taken from September 2016 and September 2017

According to data from mySupermarket, average cost of a basket of groceries for October 2017 compared to 2016

According to data from com for a full tank of petrol for a Ford Focus (53 Litres) for October 2017 compared to 2016

According to data from co.uk for the average Band D council tax set by local authorities in England for 2017-18 compared to the average Band council tax for 2016-17

About us

It’s all about “U”!

Thank you for indulging us over the last 20 years by using a small ‘u’ and a big ‘S’ when writing about our brand in your articles.

We are delighted to let you know that you are now off the hook - it’s big U’s all the way (and small s’s) as we undertake our biggest ever rebrand - so let your autocorrect go wild!

About Uswitch

Uswitch is the UK’s top comparison website for home services switching. Launched in September 2000, we help consumers save money on their gas, electricity, broadband, mobile, TV, and financial services products and get more of what matters to them. Last year we saved consumers over £373 million on their energy bills alone.

Uswitch is part of RVU, a new business that also owns Money.co.uk and Bankrate.

If you would no longer like to receive our press releases please email prteam@uswitch.com with 'unsubscribe'.