Mobile Phone Deals

Looking for a new phone contract? We can help you find your ideal handset on a pay monthly plan that suits your needs.

Happy with your current phone? Compare SIM only deals instead.

Brands

- Black

- Blue

- Pink

- Green

- Yellow

Apple

iPhone 15

5GB of data

No upfront cost

- Midnight

- Blue

- Pink

- Starlight

- Red

- Green

Apple

iPhone 13

5GB of data

No upfront cost

- Onyx Black

- Marble Grey

- Cobalt Violet

- Amber Yellow

Samsung

Galaxy S24

500GB of data

No upfront cost

- Midnight

- Blue

- Purple

- Starlight

- Yellow

Apple

iPhone 14

5GB of data

No upfront cost

- Black Titanium

- White Titanium

- Blue Titanium

- Natural Titanium

Apple

iPhone 15 Pro

5GB of data

No upfront cost

- Black Titanium

- White Titanium

- Blue Titanium

- Natural Titanium

Apple

iPhone 15 Pro Max

5GB of data

No upfront cost

Apple iPhone 13

£30.00 per month

300GB of 5G data

No upfront

- Titanium Black

- Titanium Grey

- Titanium Violet

- Titanium Yellow

Samsung

Galaxy S24 Ultra

5GB of data

No upfront cost

- Obsidian

- Hazel

- Rose

Pixel 8

100GB of data

No upfront cost

- Black

- Blue

- Green

- Red

- White

- Purple

Apple

iPhone 12

5GB of data

No upfront cost

- Phantom Black

- Cream

- Phantom Green

- Lavender

Samsung

Galaxy S23

500GB of data

No upfront cost

- Black

- Green

- Silver

- Dark Red

Samsung

Galaxy A14

300GB of data

No upfront cost

- Black

- Blue

- Green

- Yellow

- Pink

Apple

iPhone 15 Plus

5GB of data

No upfront cost

- Phantom Black

- Phantom White

- Green

- Pink Gold

- Bora Purple

Samsung

Galaxy S22

Unlimited data

No upfront cost

- Graphite

- Cream

- Mint

Samsung

Galaxy S23 FE

300GB of data

No upfront cost

- Obsidian

- Bay

- Porcelain

Pixel 8 Pro

Unlimited data

No upfront cost

- Graphite

- Cream

- Mint

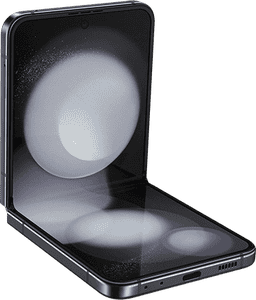

Samsung

Galaxy Z Flip5

100GB of data

No upfront cost

- Phantom Black

- Cream

- Green

Samsung

Galaxy S23 Ultra

300GB of data

No upfront cost

- Charcoal

- Snow

Pixel 7a

Unlimited data

No upfront cost

- Black

- White

- Green

- Purple

- Yellow

- Red

Apple

iPhone 11

300GB of data

No upfront cost

- Onyx Black

- Cobalt Violet

- Marble Grey

- Amber Yellow

Samsung

Galaxy S24+

300GB of data

No upfront cost

- Phantom Black

- Cream

Samsung

Galaxy Z Fold5

Unlimited data

£29.00 upfront cost

- Graphite

- Lime

- Violet

- White

Samsung

Galaxy A54

300GB of data

No upfront cost

- Midnight

- Blue

- Purple

- Starlight

- Red

Apple

iPhone 14 Plus

5GB of data

No upfront cost

Uswitch services are provided at no cost to you, but we may receive a commission from the companies we refer you to. If a deal is "promoted" on Uswitch's tables, then it has been lent additional visibility as a result of us securing exclusivity on a great deal, or a commercial agreement to showcase what we believe to be market-leading value to consumers. Learn more about how our site works.

Please note: Mobile networks may increase monthly prices in line with the retail or consumer price index each year during the length of your contract. Please refer to individual network's terms and conditions before signing up.

Our guides

Choosing the right mobile phone deal

Whether you're looking for the latest iPhone, Samsung Galaxy or any other popular smartphone, we can help you choose a new pay monthly phone contract.

Find out more about data packages, benefits, coverage, and which network could be best for you.

Depending on your needs and budget, there’s a range of options out there - and we’ve got plenty of deals to choose from. Uswitch’s most popular mobile phone deals currently revolve around a selection of top-tier smartphones.

The iPhone 15 tops the list with its cutting-edge features and technology. Followed closely by the iPhone 14 and iPhone 13 which both continue to capture attention, offering users a range of capabilities and sleek designs.

The Google Pixel 8 is popular among users, particularly for its impressive camera abilities and integration with the latest Android features.

The Samsung Galaxy 24, part of Samsung's flagship Galaxy series, is another favourite, offering a powerful performance and design that appeals to a range of users.

How can I find the best phone contract?

When picking the right plan, check how you use your phone so you don’t get tied into a contract that doesn’t suit your needs.

Here are some things to consider:

1. Select the correct phone model

Finding the best mobile phone contract deal starts with the right phone for you. Whether it is the iPhone 15 or Samsung S24, choose a model with all your favourite features.

2. Calculate your call, text and data usage

Consider how much you’ll use your phone for texting, calling, streaming, or browsing websites, and pick an allowance to match.

Most phone contracts now include unlimited call and text allowances, but unlimited data contracts can be more challenging to find. However, you can get unlimited SIM only data deals from networks such as Vodafone and Three.

Not sure how much data you need? Use our mobile data calculator to get a helpful estimate.

3. Check your network coverage

Some areas don't have great mobile phone coverage, so check the coverage for your chosen provider before signing up for a pay monthly contract that could tie you in for as long as two years.

4. Budget for upfront and monthly costs

When you get a contract phone, you pay for the handset and allowances in monthly installments over the length of your contract.

You may have to pay something upfront to help cover the handset cost. If you can afford to pay more upfront, your monthly costs will be lower as you’ll pay less over your contract length.

If not, there are lots of mobile contracts available without upfront costs - you'll likely have to settle for higher monthly prices in turn.

5. Choose your contract length

Usually, phone contracts last from 12 to 36 months. A longer contract allows you to spread the cost over a longer term, so you won’t have to pay as much every month for your phone - but you'll usually pay more in the long run than shorter contracts.

And it's also worth noting that on shorter contracts, you may have to pay quite a bit upfront to help cover the cost of the phone.

What are the main benefits of a pay monthly phone contract?

Here are some benefits you can look forward to when you sign up for a pay-monthly phone contract (and a few potential cons to be aware of).

Pros of a pay monthly contract

Lower upfront costs - Pay monthly packages are a great way of getting the latest phones without paying loads upfront.

Larger allowances - You usually get larger text, call and data allowances than pay-as-you-go deals. Perfect if you’re always on the phone.

Convenience - There’s no need to fuss with top-ups. You can set up your Direct Debit, and your payments will automatically come from your account.

Freebies - Your pay monthly plan may come with a reward or gift like a subscription to a streaming service. However, consider whether this is a good value before signing up.

Cons of a pay monthly contract

Locked in for longer - Pay monthly contracts typically last 12, 24, or 36 months, so you’re making a long-term financial commitment.

Credit checks - Most networks require you to pass a credit check before you can sign up for a pay monthly contract.

Pay more in the long run - Since you’re not covering the phone's total cost upfront, you’ll usually pay a little more than if you bought the device outright.

How do pay monthly phone contracts work?

When you find a handset and deal you like, you’ll be sent to the retailer’s website to secure that deal. Here’s what happens next:

Sign up for your new contract - First, check your contract terms. Then, provide personal details for your credit check.

Pay any upfront costs - If you’re getting one of the latest handsets, you might have to pay a fee upfront.

Get your phone - Hooray! Now you can start using your new mobile phone.

Plan for the end of your contract - Make a note of your contract end date so you can shop for the best deals when it’s time to upgrade.

Can I keep my old phone number?

Switching to a new mobile phone plan? Are you keen to keep your current number? The good news is you can port over your number with a few simple steps. All you need is your PAC code. Here's how to get it:

-- Text 'PAC' to 65075, and you'll get a message back with your PAC code

-- Give your new network your PAC code when you sign up for a new deal

-- You’ll get a message confirming your transfer, which tends to take a few days to complete

-- You'll now be able to use the same number on your new plan

How to compare mobile contract deals with Uswitch

From pay monthly smartphone contracts to SIM only deals, Uswitch can help you compare thousands of offers and find the best package for your needs.

Our mobile phone deals include phone contracts starting from under £20, Android phone deals, 5G mobile phone deals, refurbished iPhones, business mobile deals and SIM-free phone leasing.

Compare deals by brand

Each brand is unique in what it can offer. For example, Apple phones are renowned for their design, featuring easy access to apps from the home screen and streamlined settings in a single menu.

Apple

Apple's App Store is the preferred launch platform for top-tier developers, meaning early access to high-quality apps. This makes the iPhone the go-to choice for running apps.

Your iPhone can also connect with other Apple products and services, such as Macbooks, iPads, Apple Watches, and iCloud, which is excellent if you want to link up to your devices for a more cohesive experience.

Samsung

Samsung is renowned for high-quality AMOLED displays, offering vibrant colours, deep blacks, and excellent contrast ratios.

For a long time, Samsung has been a strong competitor in the smartphone camera space, introducing advanced camera systems with features like multiple lenses, high megapixel counts, and innovative shooting modes.

The Samsung Galaxy S24 Ultra's most eye-catching feature is its 200-megapixel camera.

Google Pixel phones run on a pure version of Android, free from manufacturer-specific customisations. Android software is clean and straightforward to use and updates directly from Google.

Google Pixel phones work closely with Google Assistant, a voice assistant experience. Features like the Pixel Stand improve the integration by turning the phone into a smart display when docked.

Whether you want an iPhone, Samsung Galaxy, Google Pixel, or a smartphone from another brand, check out our phone comparison table for all the top brands.

Compare deals by network

We make finding a new mobile phone pay monthly deal easy by putting offers from all the major networks, including O2, Vodafone, Sky, Three, giffgaff, iD Mobile, Lebara, Tesco Mobile, Talkmobile, VOXI, SMARTY, Lyca Mobile and Asda Mobile on easy-to-compare deals tables.

Each provider is different, and there are factors to consider when choosing one.

O2

O2 was among the pioneering UK networks to initiate the deployment of 5G.

The range of mobile plans available includes pay-as-you-go, SIM only, and contract phone deals. O2's 'Priority' benefits stand out as some of the most comprehensive perks in the phone network industry.

O2 customers enjoy complimentary trials to various services, discounts, competition invitations, and priority access to tickets for concerts and events held at O2 venues.

Furthermore, O2 offers customers special offers on qualifying new plans, for example, six months of free access to either the Disney Plus streaming service or an Amazon service like Prime.

Three

Three is one of the UK's 'big four' mobile networks and has the fastest 5G network in the UK, according to the Ookla Speedtest Awards.

Three offers diverse plans, including pay-as-you-go, SIM only, and contract phone deals. With Three's Go Roam feature, customers can utilise their call, text, and data allowances in 71 destinations worldwide by paying a £2 daily roaming charge.

Three rewards its users through the Three+ app, offering exclusive deals at brands such as Uber Eats and Cineworld and early access to presale festival tickets.

Select or search for the handset you want above, and you can filter by the network you want.

Vodafone

Vodafone has extensive coverage, reaching 99% of the UK. The company has 5G in various locations nationwide, delivering 5G speeds to customers without an additional cost.

Vodafone provides various mobile plans, including pay-as-you-go, SIM only, and contract phone deals.

Vodafone's 'VeryMe' rewards scheme offers a broad spectrum of weekly treats and giveaways. These rewards range from small delights like complimentary coffee or snacks to exclusive event ticket access.

Sky Mobile

Sky Mobile provides a range of SIM only and phone contract deals for its customers.

Distinctive advantages for Sky Mobile users include data rollover, permitting the accumulation of unused data for up to three years, and ensuring flexibility for future use. Additionally, Sky TV customers enjoy unlimited streaming through Sky Apps, exempt from data usage.

Operating on O2's network infrastructure, Sky Mobile extends coverage to nearly the entire UK, leveraging the reach and reliability of O2.

Just select or search for the handset you want above, and you’ll be able to filter by the network you want.

Compare contract deals by cost

If you prefer to filter deals by monthly cost, you can. You can apply filters for call minutes, upfront cost and contact length.

You can also sort by data allowance or cost; just click the filter you’re most interested in to see your ideal deals.

What our experts say

Our Mobile and Broadband expert, Ernest Doku, says switching can save you money in several ways.

“Find out when your current mobile contract is coming to an end - then plan ahead and shop around. Those upgrade offers on shiny new handsets can be incredibly tempting, however there’s often great value elsewhere.

“Switching from an ending 24-month handset contract to a SIM-only contract (and keeping your existing handset) could save you £321 per year, while switching to a new handset contract with a top smartphone could save you £84 per year.

“Even if you’re happy with your current provider, it’s still worth knowing what else is out there. To avoid overpaying - the key is to take action.”

Why compare with Uswitch?

Uswitch makes comparing mobile prices quick and easy by offering exclusive deals and tariffs you won’t find elsewhere. Our comprehensive database will give you access to top brands and networks like Apple, Samsung, Google, Huawei, Sony, O2, Vodafone, and Tesco.

You will find great offers on mobile phone contracts and information on the latest devices, helping you decide when to upgrade.

With a Trustpilot score of 4.7 from over 23,000 reviews, you can trust Uswitch to help you find the best deal. Our commitment to customer satisfaction and industry expertise ensures you’ll receive accurate, reliable advice when comparing mobile phone contracts.

Mobile phone deal and phone contract FAQs

What’s the difference between a contract plan and a SIM only deal?

A SIM only deal gives you data, call and text packages without purchasing a handset, making it ideal if you have a phone you're content with. Without the handset cost, these plans are significantly cheaper than monthly contracts.

Unlike contracts, SIM only plans don't require a long-term commitment, often allowing changes or cancellations after 30 days. The lack of a lengthy commitment also means simplified credit checks, making it an efficient and fuss-free option.

Switching to a SIM only plan can reduce costs, especially compared to a pay monthly plan, as you can keep your handset without continuing the same rate after your contract ends.

Pros of SIM only:

- Usually much cheaper

- No credit check is often required

- More sustainable (less waste)

While SIM only plans are also billed monthly, "pay monthly" typically refers to a mobile phone and SIM contract.

With SIM only, there's no handset charge. Pay monthly plans, on the other hand, involve paying off your handset monthly over a 12 or 24-month commitment.

The monthly fee for pay monthly plans varies based on your chosen phone and includes a set amount of calls, texts, and data. For example, the iPhone 15 Pro costs £999 outright, but you can access it for less through a pay monthly plan.

Opting for a less expensive phone, like the iPhone SE at £429, results in a lower monthly cost, potentially as little as £20.

Pros of a mobile contract:

- You can choose a new and improved phone

- Good for your credit score

Do I have to pass a credit check for a monthly phone contract?

Obtaining a new phone contract might not appear as significant as a mortgage or credit card, but it still involves a credit check.

Providers conduct these checks to ensure your ability to meet payment obligations. If they deem your credit check insufficient, they prohibit you from purchasing a contract, which can be a big shock.

Can I get a phone contract with poor or no credit?

Yes. Networks like Smarty and Voxi frequently offer SIM only deals or pay-as-you-go plans, catering to individuals with poor credit.

On the other hand, networks like TalkMobile conduct a 'soft search' on your credit file for identity confirmation without performing a full credit check.

Handset choices may be restricted, but these options provide flexibility and an opportunity to improve your credit score by responsibly managing your phone usage.

For more information, check out our guide on how to get a mobile phone deal with poor credit history.

What happens if I fail my credit check?

Getting a phone contract with poor or no credit can be tricky. If any credit check is declined, a mark is created on your credit file, temporarily complicating future credit applications or contract approvals.

Applying indiscriminately for contracts in the hopes of acceptance can further reduce your chances.

However, there's no need to panic. Take the opportunity to improve your credit score and demonstrate trustworthiness through a SIM only deal, and in due course, you'll likely regain the ability to apply for a contract successfully.

Do I have to pay an upfront cost for a contract phone?

The upfront cost for a phone contract varies based on the device you opt for. High-end brands often require an upfront payment of at least £50, in addition to the pay monthly contract.

If the initial payment is a concern, alternatives, including contracts with no upfront fees, are available on selected phones.

Do I own my phone after the contract?

If you have a contract phone and the contract ends, you've fully paid for the handset and now own it. If you’re happy to keep your handset, you can reduce your monthly bills by opting for a SIM only or pay-as-you-go deal.

What happens if my phone breaks on contract?

Pay monthly customers typically benefit from a standard warranty for their phones. If your phone experiences malfunctions, verify if it's covered under warranty. If not, most networks provide repair services at a potentially high cost.

For handset faults, consider reaching out directly to the manufacturers. Apple, renowned for its exceptional customer service, allows appointments at local Apple Stores.

Regarding water damage, refer to our guide on how to fix a water-damaged phone.

How can I check when my phone contract ends?

Text INFO to 85075 to find out the information about your contract.

If you’re not sure whether you’re still in contract with your provider and if you would have to pay charges to end your contract early, you can find this out without requesting a switching code.

How our site works

Our website operates on a no-cost basis for users. And while we do not charge you for our services, we may earn a commission from the companies we recommend to you.

This commission structure enables us to maintain our site as a free resource for your use.

Occasionally, we establish commercial agreements with providers to showcase deals we believe are noteworthy, and these deals are marked as 'sponsored’.