UK business energy statistics show that the energy market is worth a combined £106 million for gas and electricity, as of 2024. This is a 72.3% increase from the 2012 value of just over £61 million.

Average business electricity and gas consumption figures also show industries used 7,318 thousand tonnes of oil equivalent in electricity and 8,462 in gas during 2022.

Oil equivalent is a standardised unit of energy consumption used to compare energies of different sources and defines the amount of energy released by burning one tonne of crude oil.

Our research has collated various commercial energy statistics for 2024 to analyse trends, judge how business energy usage has evolved, and find the most energy-intensive industries in the UK.

Top 10 UK business energy statistics

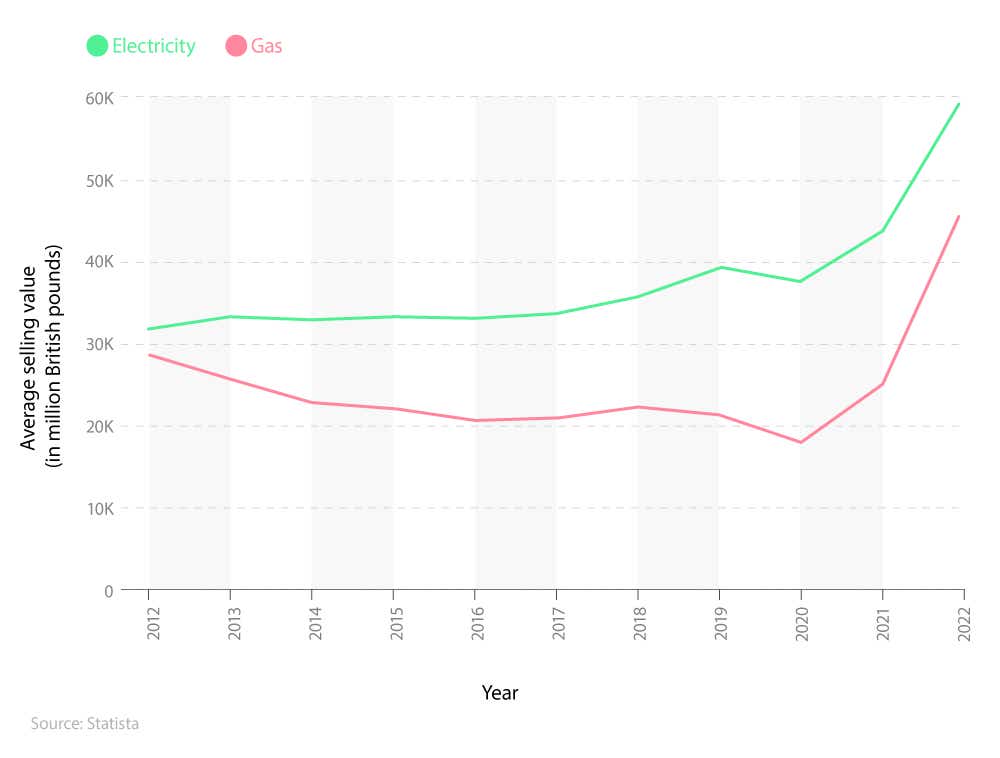

The net selling value (i.e. the actual charged to the customer, minus any value added or taxes included in the price) of the UK business energy industry increased by over four-fifths (84.7%) from 2012 to 2022.

Business electricity unit prices range between 27.3p/kWh in London to 30.8p/kWh in North Wales, Merseyside, and Cheshire in 2024.

Chemicals businesses used the most business electricity in 2022, at 1.2 million tonnes of oil equivalent.

The food and beverage industry used the most business gas in 2022, at 1,603 thousand tonnes of oil equivalent.

When combined, commercial and miscellaneous services have an average annual energy usage of 169,972,450 MWh.

The most expensive region for gas is the South West, with businesses paying £2,720 annually on average.

The region with the lowest average annual electricity cost is London at £7,027.

In Q1 2023, 14,605 premises held a ‘C’ EPC rating – almost a fifth (18%) more than the 12,142 buildings that had a ‘B’ rating.

Six in 10 UK developers (64%) think they will hit net zero emissions across all commercial buildings in their portfolios between 2031-2040.

The same UK developers reported the biggest difficulty with hitting this net zero goal is the high cost of constructing net zero buildings, with an average difficulty score of 3.9 out of five.

UK business energy market statistics

Overall, the average net selling value of the UK business energy market increased by almost three quarters (74%) between 2021 and 2022.

The net selling value is how much customers are actually charged for their energy once any added value and taxes are taken away.

How much is the UK business energy market worth?

Commercial energy statistics show both the value of electricity and gas reached peaks in 2022, with the selling value of electricity outpacing gas.

A breakdown of the average selling value of the electricity and gas industries from 2012 to 2022

The business electricity market saw fluctuations in selling value over the decade from 2012, such as:

The average selling value increased from £32.4 billion in 2012 to £59.8 billion in 2022 – an +84.7% increase over the 10 years.

From 2012-2015, the average value remained relatively stable in the £33 billion to £34 billion range.

There was a slight dip of -1.8% in 2016 from £33.4 billion to £33.3 billion before rebounding.

The highest growth occurred between 2021 (£43.7 billion) and 2022 (£59.8 billion) when by more than a third (36.8%).

According to business energy market statistics, the UK business gas market saw similar levels of change.

The average selling value decreased from £28.9 billion in 2012 to a low of £18.5 billion in 2020. However, there was a rebound of +80.6% between 2021 and 2022 – going from £25.9 billion to £46.8 billion.

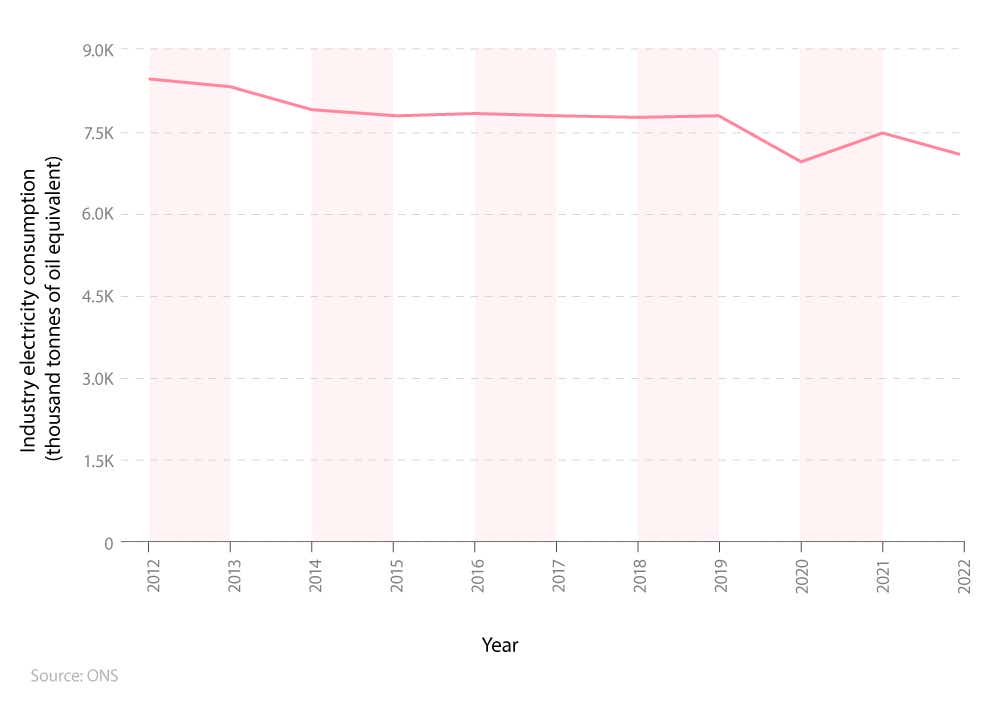

What is the average business electricity consumption in the UK?

ONS business energy statistics show there was a decreasing trend in business electricity usage between 2012 and 2022, with the exception of small rebounds in 2016, 2019, and 2021.

Average business electricity consumption by year

UK business electricity consumption was at its highest in 2012 at 8.5 million tonnes of oil equivalent). It declined year-on-year until reaching a low of 7.3 million tonnes in 2020 – a -14.2% drop from 2012.

A breakdown of the average business electricity usage between 2012 and 2022

There was a small rebound of +3.5% in 2021 to 7.5 million tonnes before dropping again slightly in 2022 to 7.3 million tonnes.

Comparing beginning to end, industry electricity consumption in the UK dropped by -13.6% in a decade, from almost 8.5 million tonnes in 2012 to approximately 7.3 million tonnes in 2022.

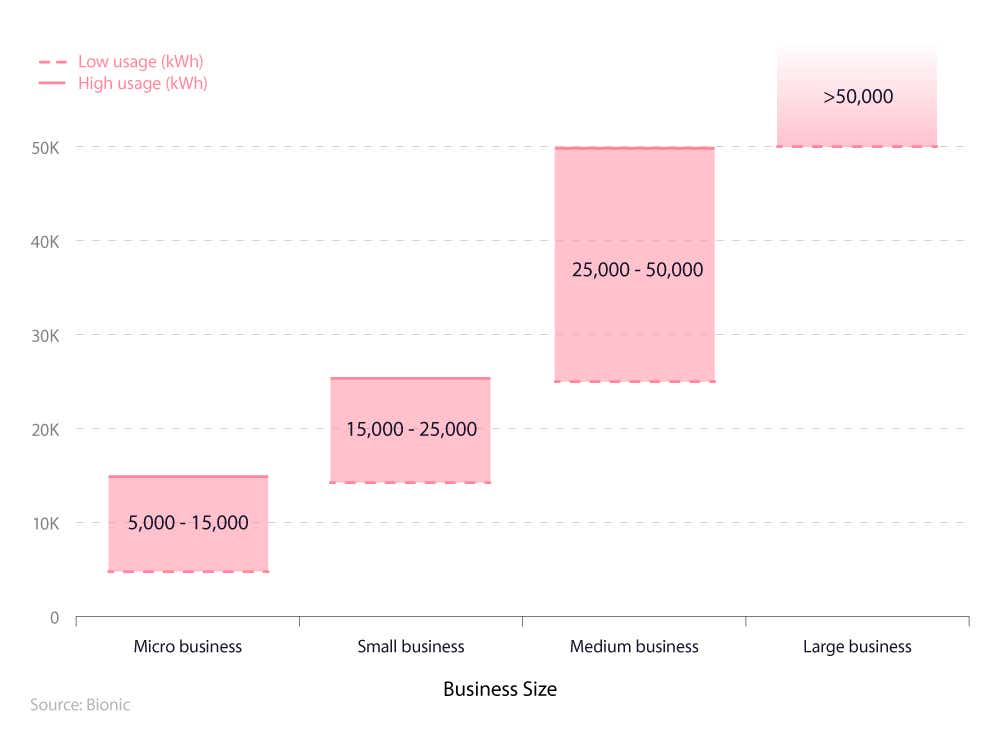

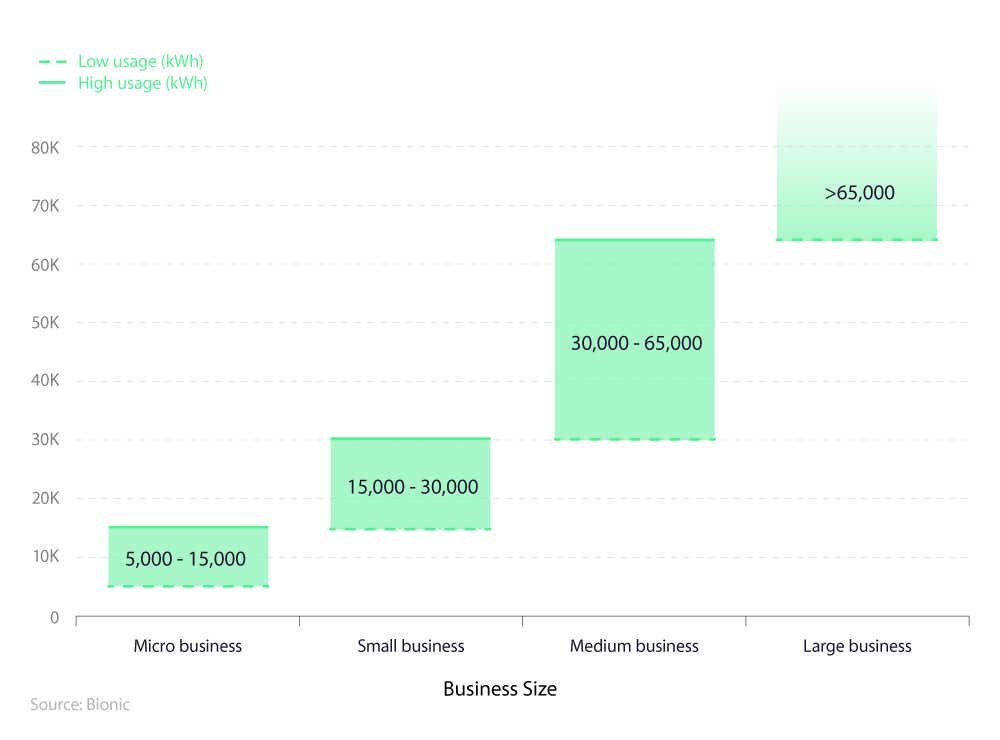

Average electricity consumption by business size

Micro businesses are companies with fewer than 10 employees and a turnover or balance sheet of less than £1.7 million. Because of their small size, they tend to use an average of 10,000 kWh of electricity per year.

A breakdown of average business electricity usage for micro, small, medium, and large businesses

Doubling the figure for micro-businesses, small businesses have an average electricity consumption of 20,000 kWh per year – ranging from 15,000 kWh to 25,000 kWh of yearly usage.

UK commercial energy statistics show that medium-sized businesses operate at a much greater energy demand, often requiring larger facilities. Their electricity consumption ranges between 25,000 and 50,000 kWh per annum, with an average of 37,500 kWh – over triple that of the smallest class of businesses.

Large businesses, which often employ 250 or more people, typically use over 55,000 kWh of electricity every year.

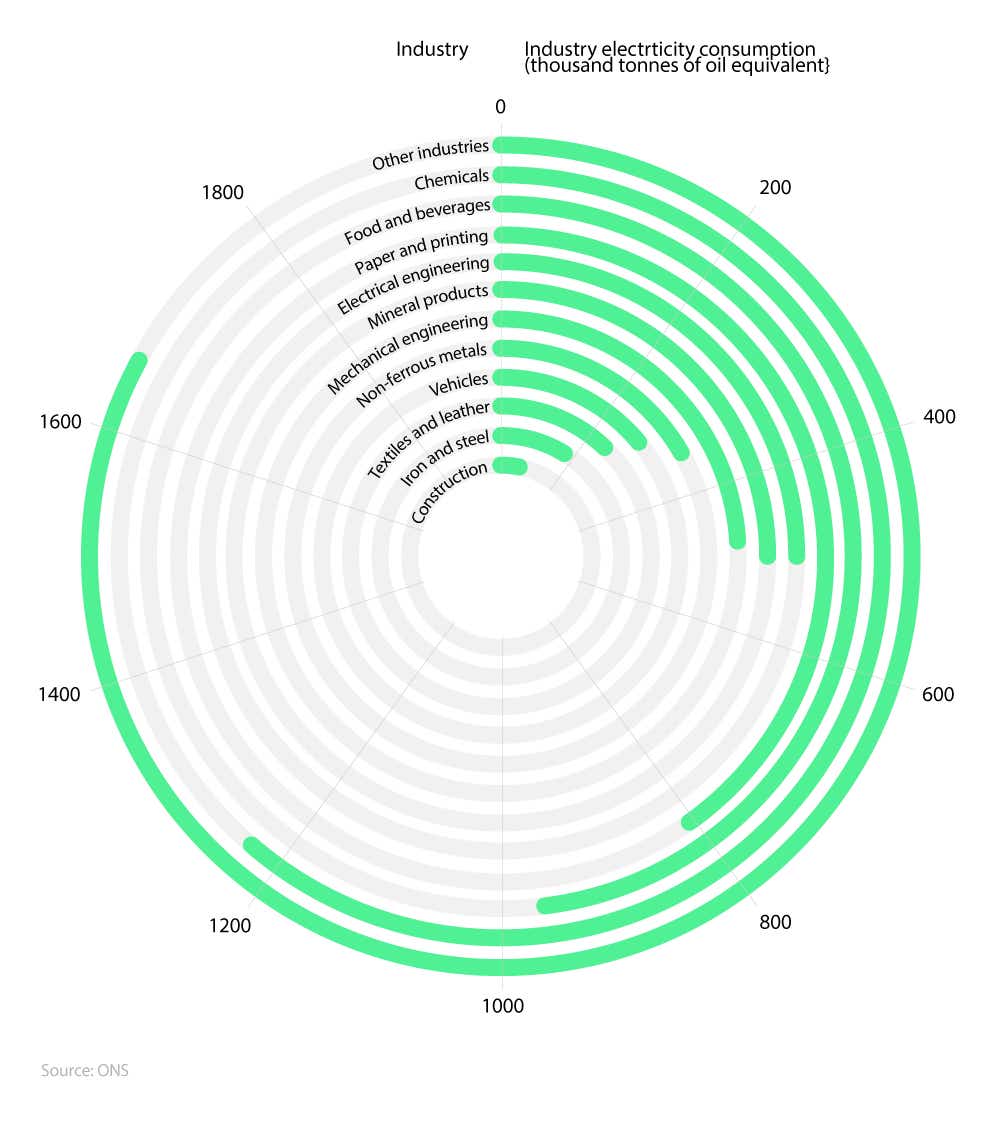

Average business electricity consumption by industry

UK business energy statistics show the top consumer of business electricity by a significant margin is the chemical industry, using 1,224 thousand tonnes of oil equivalent in a year.

A breakdown of average business electricity usage by industry in the UK

In contrast to the figures seen for the chemical industry, construction uses almost a tenth of that amount, at 119 thousand tonnes per year. This 820-thousand-tonne annual difference amounts to 164.6% more electricity being used by companies dealing with chemicals.

A similar imbalance exists with the second highest user, food and beverages (959 thousand tonnes), and the second lowest, iron and steel (192 thousand tonnes). Here, there is a 67.1% difference.

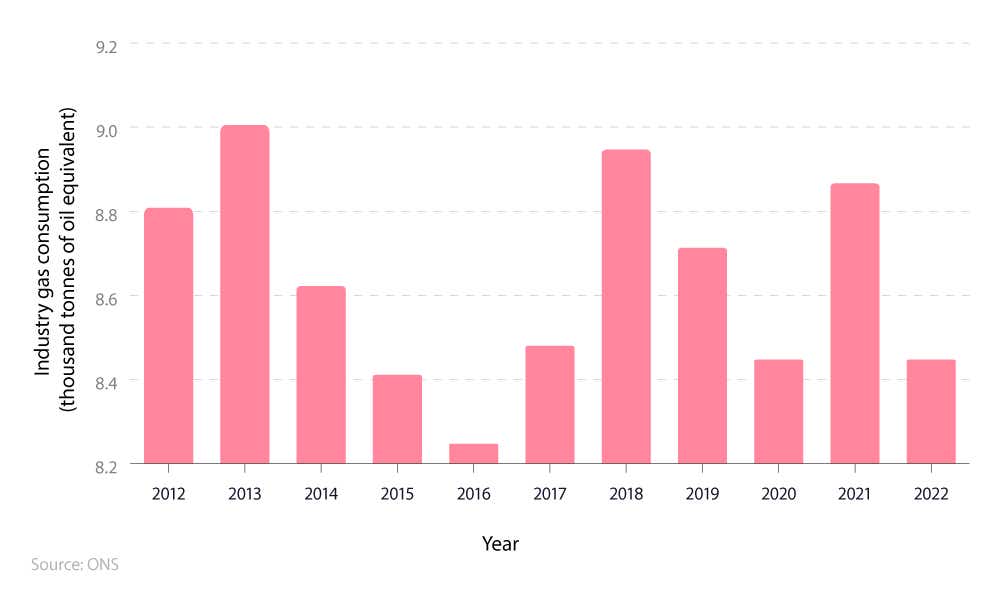

What is the average business gas consumption in the UK?

Business gas consumption levels fluctuated between 2012 and 2022. Usage started at 8,821 (thousand tonnes of oil equivalent) in 2012 and then climbed by +2.4% to hit the period high point of 9,030 thousand tonnes in 2013.

UK average business gas consumption by year

From 2014 to 2016, average business gas consumption figures steadily declined, reaching a low of 8,269 thousand tonnes in 2016.

A breakdown of the UK average business gas consumption between 2012 and 2022

The decline seen between 2014 and 2016 reversed course in 2017 with a year-on-year increase of +2.7% to 8,496 thousand tonnes.

There was another increase in 2018 to 8,972 thousand tonnes – the second-highest total over the timeframe. The average business gas consumption in 2022 was -4.1% (or 359 thousand tonnes) lower than it was back in 2012.

UK average gas consumption by business size

The average business gas consumption for micro businesses is the same as electricity, with a low usage of 5,000 kWh per year to as much as 15,000 kWh.

A breakdown of average business gas usage for micro, small, medium, and large businesses in the UK

UK business gas usage tends to be slightly higher for the three other business sizes. Small business energy usage can be anywhere between 15,000 and 30,000 kWh – an increase of 2,500 kWh when compared to average electricity usage across businesses.

Large business energy statistics show that these bigger companies will often use 10,000 kWh more in gas than they will in electricity throughout the UK.

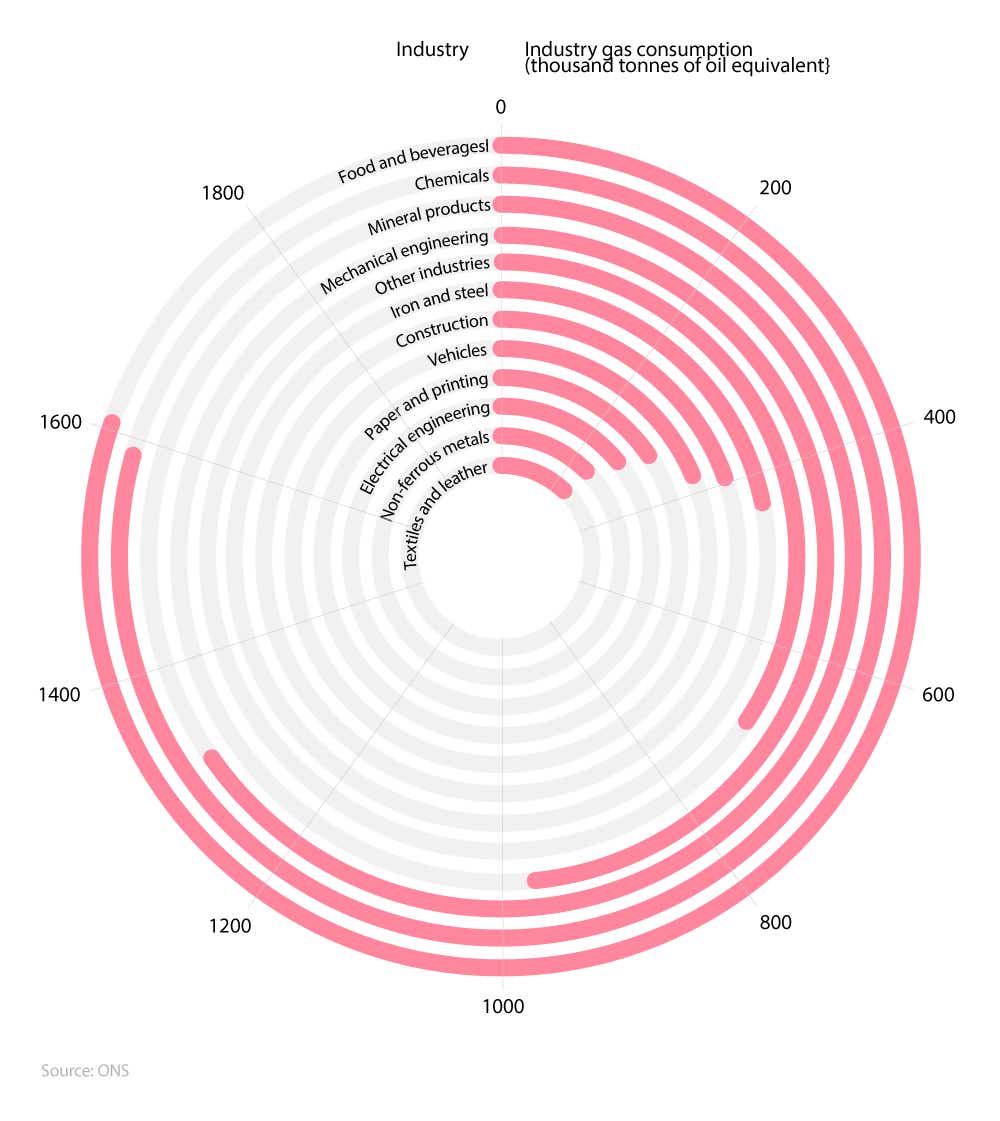

UK average business gas consumption by industry

The UK industry with the highest gas consumption in 2023 was the food and beverages industry, which burned through 1,603 thousand tonnes of oil equivalent. This is a 1.1% difference from the chemicals industry in second place, which consumes 1,585 thousand tonnes a year, UK business energy statistics reveal.

A breakdown of average business gas consumption by industry in the UK

After these leading energy consumers, the industry with the next highest usage of gas is the mineral products industry (1,309 thousand tonnes), followed by mechanical engineering (972).

On the lower end of the consumption scale, textiles and leather had the smallest gas demand in 2023, at 231 thousand tonnes annually – almost seven times lower than the food and beverages industry which takes the top spot.

Learn more about the Energy Bills Discount Scheme and find out how much your business could save.

Which are the most energy-intensive industries?

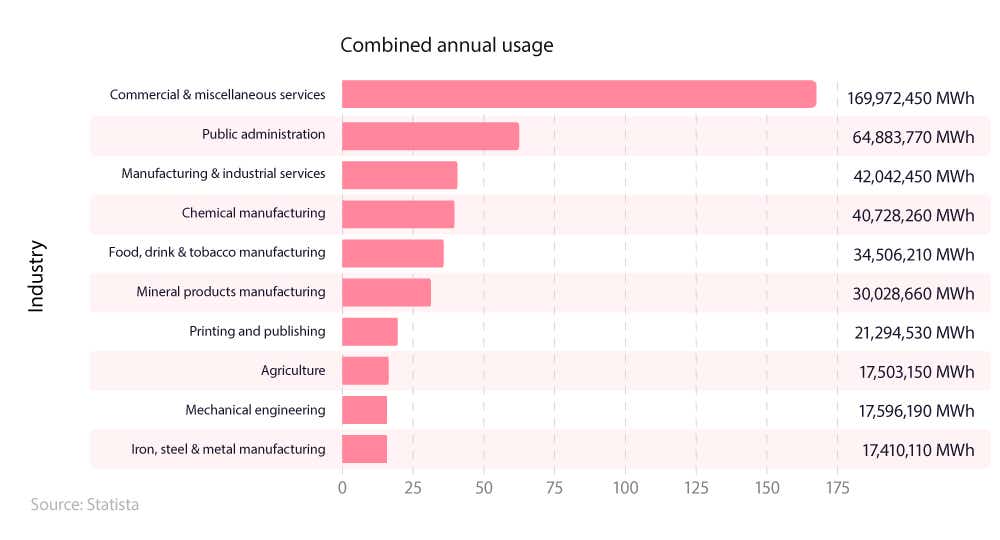

Research by Bionic analysed the UK industries that used the most business energy – electricity and gas combined – in 2023.

The industries using the most business energy

In 2023, the commercial and miscellaneous services sector was the most energy-intensive industry, consuming 169,972,450 MWh of power annually. This is more than double the next highest industry of public administration at 64,883,770 MWh per year.

A breakdown of the most energy-intensive industries in the UK by combined annual usage

Outside of public administration, every other industry consumes less than half that of commercial enterprises. Manufacturing and industrial services had a combined energy usage of over 42 million MWh yearly, still dwarfing sectors like agriculture, which required around 17.5 million MWh.

Iron, steel, and metal manufacturing was the least energy-intensive industry in the UK in 2023, with a combined annual usage of 17,410,110 MWh. This was over nine times, or 162.8%, less than the usage of commercial and miscellaneous services.

What is the average business electricity bill in the UK?

Average business electricity bills can be anywhere from £242 to £1,231 a month depending on the size of the premises, number of employees, and location.

UK average business electricity cost by business size

The average cost of electricity per month for a UK small business works out at just over £505, amounting to £6,062 a year. This is more than double the amount of the average bill of a micro business at £2,895.

A breakdown of the average cost of electricity for a micro, small, medium, and large business

Medium and large UK businesses can expect to pay over £10,000 for electricity each year. There is a 15.6% difference between the two, with large businesses (£14,770) paying an average of £2,134 more than medium businesses (£12,636).

Are you paying more than you should for your business electricity? Compare electricity deals now.

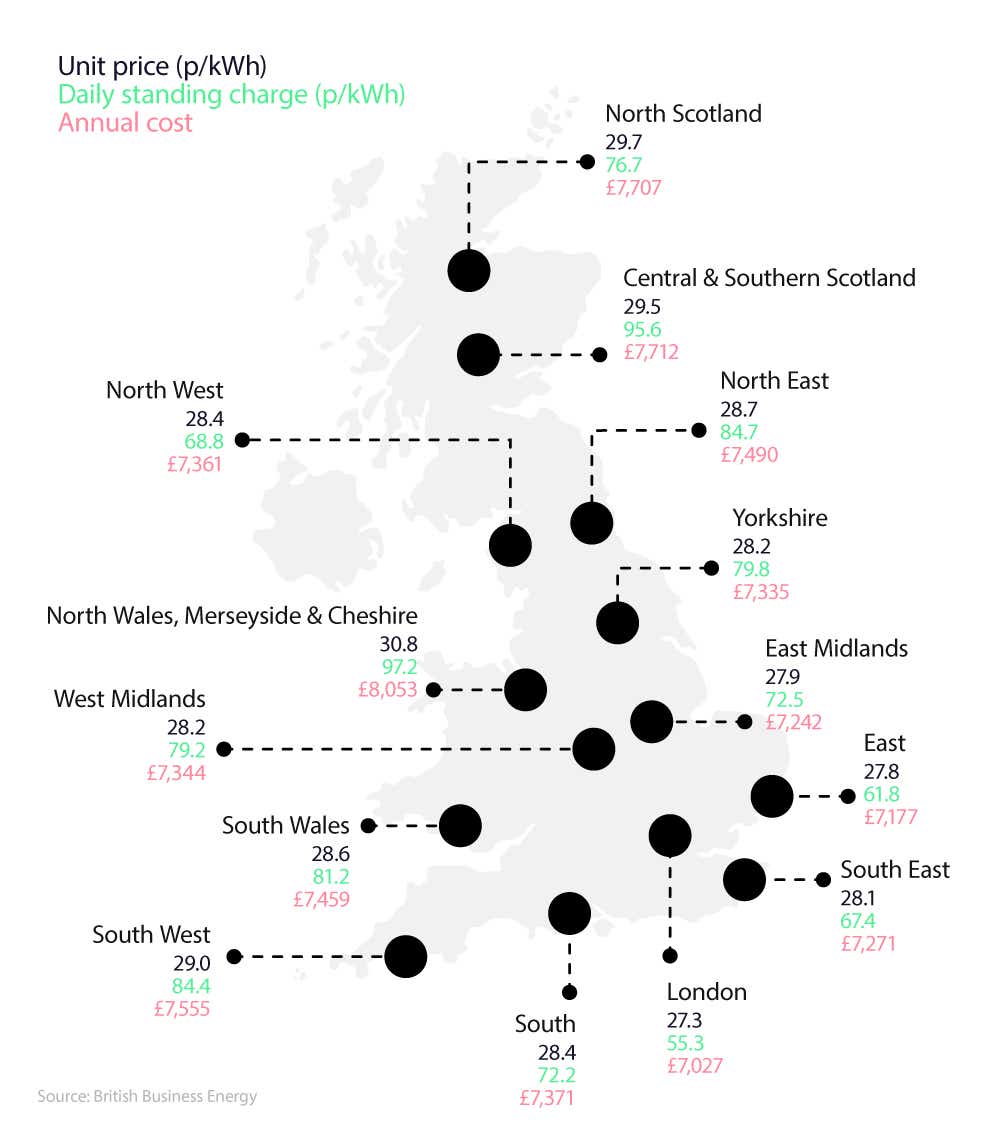

UK average business electricity cost by region in 2024

The UK region with the lowest average annual electricity cost is London at £7,027. This contrasts with the highest cost regions – North Wales, Merseyside, and Cheshire – where businesses pay £8,053 per year on average, 13.6% more than London.

A breakdown of the average annual business electricity cost, unit price, and daily standing charge by region

The South East (£7,271) and East regions (£7,177) mirror the lower costs seen in London. Whereas businesses in Scottish zones, like Central and Southern (£7,712) or North Scotland (£7,707), pay over £436 more each year by comparison.

The average business electricity cost per kWh varies throughout the UK. Unit prices typically range between 27-29 p/kWh, with the highest (30.8p/kWh) seen in North Wales, Merseyside, and Cheshire.

There are noticeable differences in the average standing charge for business electricity too across the UK. From a low of 55.3p/kWh in London up to 97.2p/kWh in North Wales, Merseyside, and Cheshire – a difference of almost 55%.

What is the average business gas bill in the UK?

UK business energy statistics from Bionic reveal the average cost of business gas ranges from £84 to £472 a month. Factors that can affect the cost of gas for businesses include the size of the building, the type of industry, and the number of employees.

UK average business gas cost by business size

A small UK business can expect to pay an average commercial gas cost of just over £170 a month. However, medium businesses could pay over £352 monthly.

A breakdown of the average cost of business gas for a micro, small, medium and large business

Large businesses can expect to pay over five-and-a-half times more on their gas bill than micro-businesses, at £5,663 and £1,013, respectively. Even the annual business gas bills of small businesses (£2,046) double that of micro companies.

Medium businesses pay almost a third (29%) less than large businesses, on average, when it comes to yearly gas bills.

Compare gas deals today to find out if you’re getting the best price for your business.

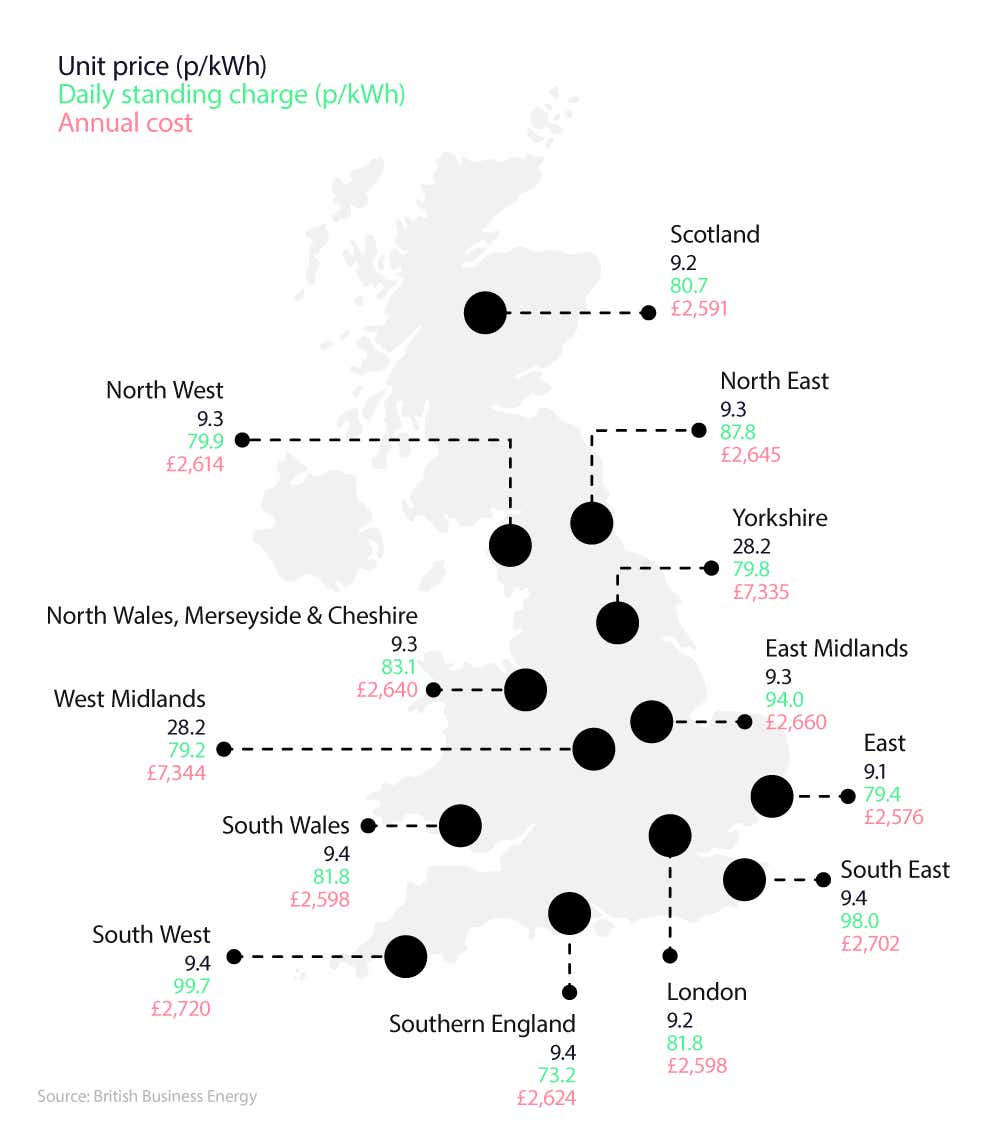

UK average business gas cost by region in 2024

The most expensive UK region for commercial gas is the South West, with businesses paying £2,720 annually on average. This compares to the lowest average cost in the West Midlands, at £2,564 per year – a 6% gap between the highest and lowest regions.

A breakdown of the UK average annual business gas cost, unit price, and daily standing charge by region

Like business electricity, the average standing charge for business gas can vary throughout the UK. They range from 27.8p/kWh in Yorkshire up to 99.7p/kWh in the most expensive South West territory. This represents a 112.8% difference.

The average business gas cost per kWh is between 9.1 and 9.4 throughout the UK, with the cheapest being in the East of England (9.1p/kWh).

Are business energy prices going up?

The cost of wholesale energy to suppliers will determine how much customers will pay. If wholesale prices go up, then business energy bills will also increase.

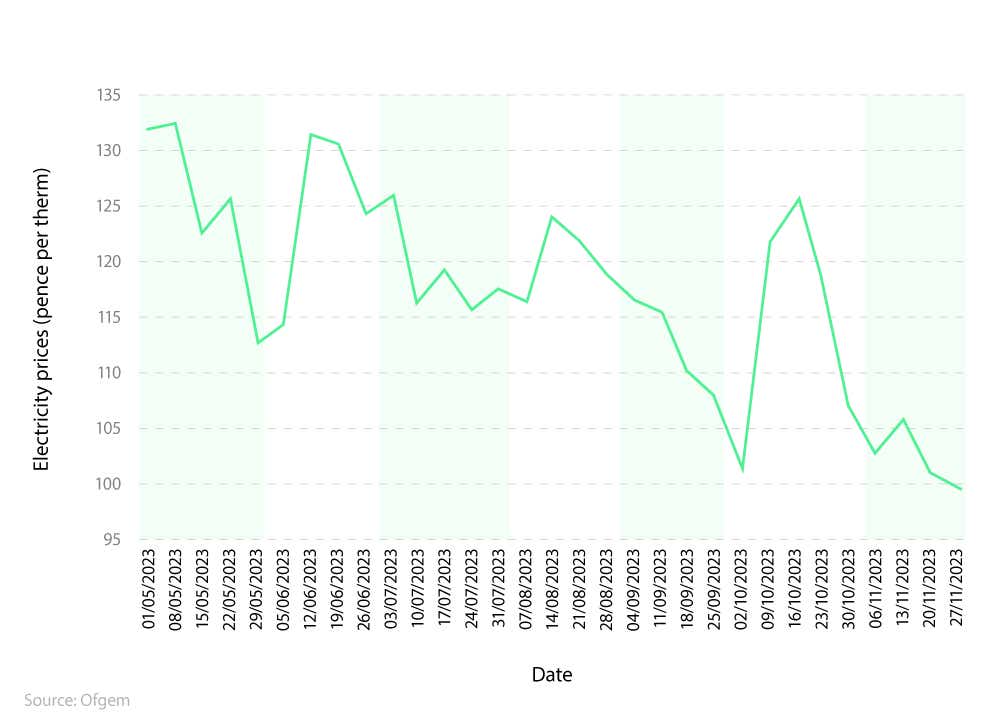

The changes in business energy wholesale prices in 2023

Business energy prices fluctuated throughout 2022 and 2023 following an increase in wholesale energy costs in December 2021. However, from December 2022 onward, there has been a trend of declining prices.

A breakdown of business electricity price rises and drops between May 2023 and November 2023

Wholesale electricity prices showed some volatility over the second half of 2023, with prices spiking up and down from week to week. The UK’s highest weekly average price throughout 2023 was £133.79 per MWh, recorded on 8 May. The lowest recorded price was £99.51 per MWh on 27 November – a decrease of more than a quarter (-25.6%).

July and August 2023 brought more changes, with prices fluctuating between £115-£125 per MWh week-to-week. September then saw another steady decline as prices dipped below £120, then £110 in late September.

A spike did occur in early October 2023 with energy prices rising back above £120 briefly. But that quickly reversed into a dramatic slide through November. The final weeks saw prices plunge to below £100 per MWh for the first time across the year.

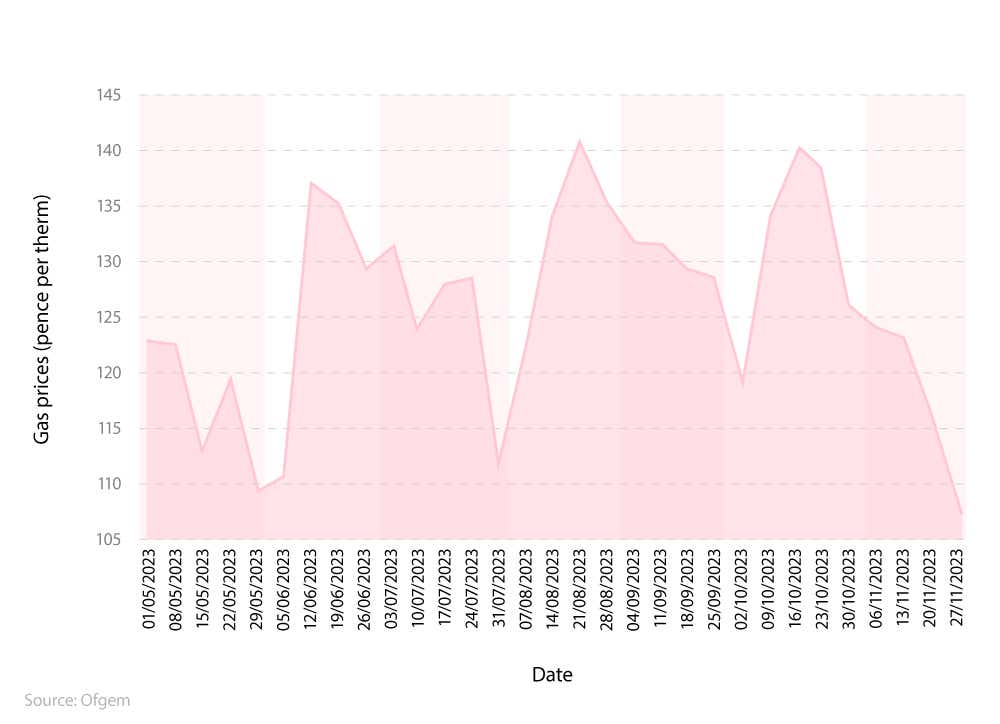

A breakdown of UK business gas price rises and drops between May 2023 and November 2023

Similar to electricity, average gas wholesale prices regularly fluctuated between May and November 2023. The highest weekly average price was £1.41 per therm (recorded on 21 August). The lowest price was £1.07 per therm on 27 November, representing a decrease of almost a quarter (-23.4%).

UK commercial gas prices in May 2023 started very high, hitting £1.23 per therm and remaining elevated above £1.15 for most of the month. Prices then dipped in June and early July, into the £1.20s and briefly dropping below £1.12 per therm by late July.

August 2023 brought a price spike as gas wholesale prices rose to £1.41 per therm by 21 August – the peak for the period.

Finally, November 2023 saw substantial declines as prices plunged below £1.10 per therm by mid-November down to a low of £1.07 per therm on 27 November.

Different UK business energy contract types

There are a range of business energy contract types out there, each with different conditions and rates.

Fixed

A fixed business electricity tariff allows you to pre-agree on electricity rates with your supplier for the duration of the contract. These rates tend to be competitive, but you should compare rates from other suppliers before signing anything to ensure you get the best deal.

Variable

With a variable rate electricity tariff, the rate you pay per kilowatt-hour (kWh) fluctuates based on market conditions. This means the rate per kWh that you are charged can go up or down at any time over the duration of your contract, depending on factors like wholesale energy costs.

Rolling

Some suppliers use rolling contracts, which automatically renew for another year at higher rates when your initial contract ends. You may be able to negotiate a new long-term contract at lower rates through a blend-and-extend deal. However, these new rates are usually not as low as those available from other suppliers. It's important to understand the terms of any contract and mark end dates in your calendar. Rolling contracts are less common now, but still a possibility.

Deemed rate

Deemed rates are similar to out-of-contract rates, but are applied when a business moves into new premises without choosing a new electricity contract. Like out-of-contract rates, deemed rates are typically higher than fixed tariffs. However, you can still switch by giving 28 days' notice.

Out-of-contract rate

If you let a fixed contract expire without arranging a new one, your supplier will move you to its out-of-contract rates. These are usually more expensive than fixed tariff rates, but you can switch suppliers at any time by providing 28 days' notice.

How business energy contracts differ from domestic energy contracts

Although the energy could come from the same suppliers and sources, there are key differences between domestic energy and business energy contracts.

They’re usually longer. Business energy contracts can last between one and five years. There is usually a switching window near the expiration date when you can leave the contract.

They don’t usually have a cooling period. Domestic energy contracts typically have a 14-day cooling-off period where you can cancel the contract if you change your mind or find a better deal. While most business energy contracts don’t offer this, it's still worth asking about flexibility before signing.

The energy sources won’t be combined. Business energy providers tend to offer separate contracts for electricity and gas, so it can be beneficial to get quotes from different suppliers (and pay separate bills for each).

Some include broker fees. If you choose to use a business energy broker to help find suppliers, the costs may be bundled into the overall rates you pay. Before agreeing to contract terms with a broker, clarify their fee structure in writing to fully understand the deal’s pricing.

UK average commercial EPC rating statistics

A commercial Energy Performance Certificate (EPC) is necessary for most business premises, and it assesses the energy efficiency of non-domestic buildings. The ratings range from A to G, where A represents the highest efficiency, and G indicates the least energy efficiency.

What EPC rating do most business premises have in the UK?

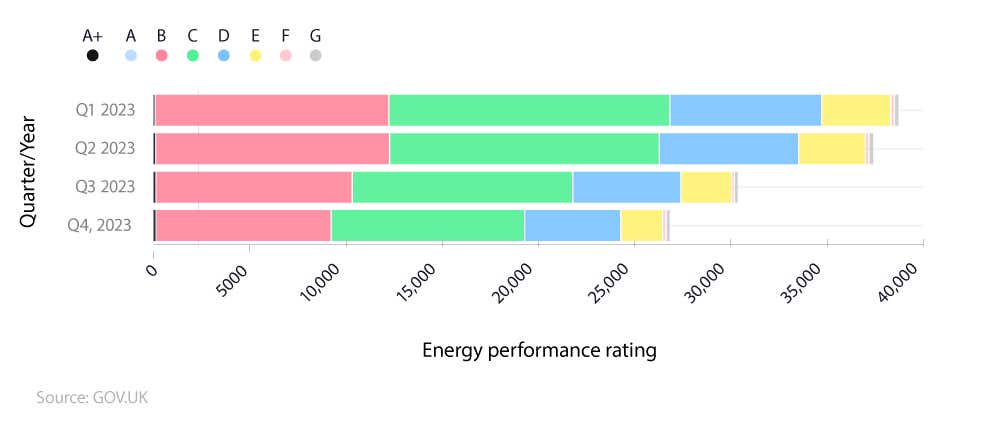

C ratings were held by the largest share of UK commercial buildings throughout 2023, with 14,605 in Q1 2023 alone That's over one in five more than the 12,142 buildings that had a B rating for the same quarter.

A breakdown of the number of businesses with each EPC rating in 2023

However, the number of C-rated buildings decreased by almost a third (-31.1%) as the year went on, from 14,605 in Q1 2023 to 10,061 by Q4 2023.

Top-level A+ ratings are the least common EPC ratings throughout the UK. At the start of the year, only 80 buildings held this rating in Q1 2023, which is four-fifths (80.1%) lower than the next least common rating of F in the same period (187).

The lowest EPC ratings of F and G stayed consistently low throughout 2023, representing less than 1,472 combined buildings across the year. This low number could be due to the tightening of the Minimum Energy Efficiency Standard (MEES) Regulations. Starting from 1 April 2023, it became against the law to continue renting any commercial property with an EPC rating of F or G (for leases granted before 1 April 2018) without a permitted exemption.

UK business EPC exemptions

An EPC is not necessary if the building falls into any of the following categories:

A detached building with a total floor space of under 50 square metres.

A temporary building with two years or less of intended use.

Listed or officially protected and meeting the minimum energy performance requirements would unacceptably alter it.

Used as a place of worship or for other religious activities.

Scheduled for demolition by the seller or landlord, with all the required planning and conservation consents in place.

An industrial site, workshop, or non-residential agricultural building with low energy usage.

Commercial EPC penalties in England and Wales

If a landlord opts to rent out the property without an EPC meeting the necessary requirements, and it does not fall under the above exemptions, they risk facing penalties. These penalties could involve fines and public exposure for failing to comply with MEES Regulations.

For commercial properties in breach for under three months, the financial penalty is £5,000, or 10% of the property's rateable value (maximum of £50,000), whichever is higher. If they’re in breach for over three months, the penalty is £10,000, or 20% of the rateable value (maximum of £150,000).

When do developers believe they will achieve net zero across their portfolio of commercial buildings?

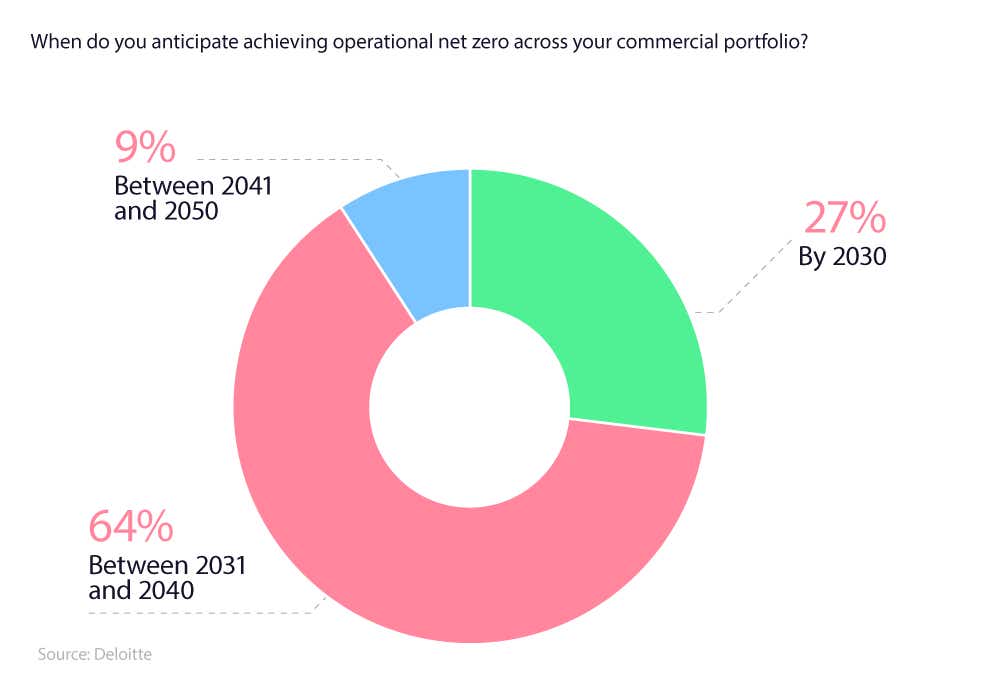

A 2023 survey by Deloitte shows that almost two-thirds of developers (64%) think they’ll achieve net zero emissions across all their commercial buildings between 2031 and 2040.

A breakdown of when UK commercial developers anticipate they will achieve operational net zero across their portfolio

Over a quarter (27%) of commercial developers anticipate they’ll be able to reach the goal of net zero sooner than 2031. Fewer than one in 10 (9%) expect it’ll take until 2041-50 before their whole portfolio of commercial buildings achieves net-zero targets.

A breakdown of the biggest difficulties for UK commercial developers in achieving operational net zero across their portfolio

The most significant barrier reported in achieving net zero targets by UK developers is the high cost of constructing net zero buildings, with an average difficulty score of 3.9 out of five – 0.3 higher than the second-most difficult barriers.

The issue of accessing sustainable supply chains and building materials was rated at 3.6 average difficulty. Commercial developers in this survey also scored the challenge of decarbonising current buildings in their portfolios at a 3.6 as well.

The cost of renewable business energy in the UK

Renewable business energy statistics from Bionic show the cheapest option for businesses looking to use renewable energy is to install small-scale wind turbines starting from £2,000. However, the time this equipment takes to make the money back is up to 15 years. Larger commercial turbines have a higher initial cost at £3.3 million, but recoup the investment faster within just one to five years.

A breakdown of the UK average cost for businesses switching to renewable energy and the payback period

| Type of renewable energy | Cost | How long it takes to make the money back |

|---|---|---|

| Wind power | Small turbines - £2,000 to £6,000 Large turbines - <£3.3 million | Small turbines - three to 15 years Large turbines - one to five years |

| Solar PV panels | Small systems - £6,000 to £11,000 Large systems - <£70,000 | Six to 11 years |

| Solar thermal energy | £3,000 to £5,000 | Five years |

| Biomass systems | Varies depending on boiler size and type of fuel | Five to 12 years |

| Anaerobic digestion | £8,750 per kWth | N/A |

| Geothermal and ground source heat pumps | £11,000 to £15,000 | 15 years |

| Combined heat and power | £32,500 | 10.5 years |

| Hydroelectric power | £4,000-£8,000 per kW of capacity installed. | Seven years (based on an 8kW hydroelectric power plant) |

| (Source: Bionic) |

Solar PV panel setups mirror the trend of a large cost range depending on scale. Small business PV installations cost £6,000 to £11,000 and take six to 11 years to pay off through electricity bill savings. But larger utility-sized solar arrays can surpass £70,000, yet recover costs quicker thanks to high output – within five years or less.

Solar energy is a popular choice by UK businesses and residential properties, with renewable energy statistics showing that it made up 11% of the UK’s renewable energy production in 2023.

Other solutions like solar thermal (£3,000-£5,000) and hydroelectric power (£4,000-£8,000 per kW) offer reasonable small business installation costs with average payback periods of around five to seven years.

Are you interested in renewable energy for your business? Compare green energy deals now.

Business energy FAQs

How much is business electricity per kWh?

The price of business electricity can vary depending on where a business is located, but the average price throughout the UK is 28.6 pence per kWh in 2024.

What is the business energy cap?

Unlike domestic energy, there is no price cap for business energy. This is because the variation in energy usage among businesses makes implementing a cap on business energy rates challenging.

What is the VAT rate on business electricity bills?

VAT on business energy bills is applied at a rate of 20%. However, there are exceptions, allowing for a reduced rate of 5% VAT. These include:

Charitable organisations engaged in non-business activities

Any businesses that record a low usage – under 33-kilowatt hours per day or 1,000 kilowatt hours per month.

How can I reduce energy consumption in a business?

There are several ways, either free or requiring initial payment, that can help to reduce business energy consumption. These include:

Only use what you need – turn off lights in rooms no one is working in, turn off machines or appliances when they are not in use, and only use air conditioning or heating when employees are in the building.

Replace old boilers or fitting the premises with double glazing.

Update office equipment to energy-efficient devices.

Run a business energy comparison to see if you can find a better price for your gas and electricity.

Will business energy prices go down?

While business energy prices fell on average in 2023, it’s difficult to predict if they will go down in 2024 due to the fluctuating nature of wholesale prices. However, with the Energy Bills Discount Scheme ending in March 2024, it’s possible that business energy bills may go up.

Why is business energy so expensive?

One reason business energy is expensive, at least more expensive than domestic energy, is the absence of price caps. This means there isn’t a maximum amount energy providers can charge businesses for their gas and electricity.

As well as this, businesses pay 20% VAT for energy, whereas domestic dwellings pay 5%.

What help is there for business energy bills?

The UK government launched the Energy Bill Discount Scheme running from 1 April 2023 to 31 March 2024. This replaced the Energy Bill Relief Scheme.

With this, you can get the following discounts:

Qualifying non-domestic gas contracts for a maximum discount of 0.7p per kWh.

Qualifying non-domestic electricity contracts with a maximum discount of 2.0p per kWh.

How much does electricity cost for a small business?

The average electricity cost for a small business in the UK is £2,895 a year. However, this can be more or less depending on factors such as building size, type of industry, and location.

Business energy glossary

Energy Performance Certificate (EPC)

An EPC provides information on the energy efficiency of a property in the UK and is required when buildings are constructed, sold, or rented out.

Kilowatt-hour (kWh)

A unit of energy representing 1,000 watts of power sustained for one hour.

Large business

A business with over 250 employees and a balance sheet of more than £43 million.

Medium business

A business with 50-250 employees and a balance sheet of less than £43 million.

Megawatt hour (MWh)

A unit of energy representing 1,000,000 watts of power sustained for one hour. Used to measure large amounts of electricity usage.

Micro business

A very small business, typically with fewer than 10 employees and a balance sheet of less than £1.7 million.

Small business

A business with fewer than 50 employees and a balance sheet of less than £8.5 million.

Sources and methodology

https://www.statista.com/statistics/546959/average-selling-value-electricity-commercial-sector-uk/

https://www.gov.uk/government/statistics/energy-consumption-in-the-uk-2023

https://bionic.co.uk/business-energy/guides/average-energy-usage-for-businesses/

https://britishbusinessenergy.co.uk/business-electricity/

https://britishbusinessenergy.co.uk/business-gas/

https://bionic.co.uk/blog/noticed-energy-prices-have-fallen-over-past-few-months/

https://www.ofgem.gov.uk/energy-data-and-research/data-portal/wholesale-market-indicators

https://www2.deloitte.com/uk/en/pages/real-estate/articles/crane-survey.html

https://bionic.co.uk/business-energy/guides/guide-to-renewable-energy-for-small-businesses/

https://www.gov.uk/energy-performance-certificate-commercial-property

https://www.sefe-energy.co.uk/help-support/bills-payments/vat/